As global markets navigate a complex landscape marked by interest rate cuts from the ECB and anticipated actions by the Fed, Hong Kong's market has shown resilience, with its benchmark Hang Seng Index recently giving up only 0.43%. Amid this backdrop, small-cap stocks in Hong Kong present intriguing opportunities for investors seeking growth potential in a volatile environment. When considering stocks to watch this September 2024, it's crucial to focus on companies that demonstrate strong fundamentals and are well-positioned to capitalize on current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Xin Yuan Enterprises Group (SEHK:1748)

Simply Wall St Value Rating: ★★★★★★

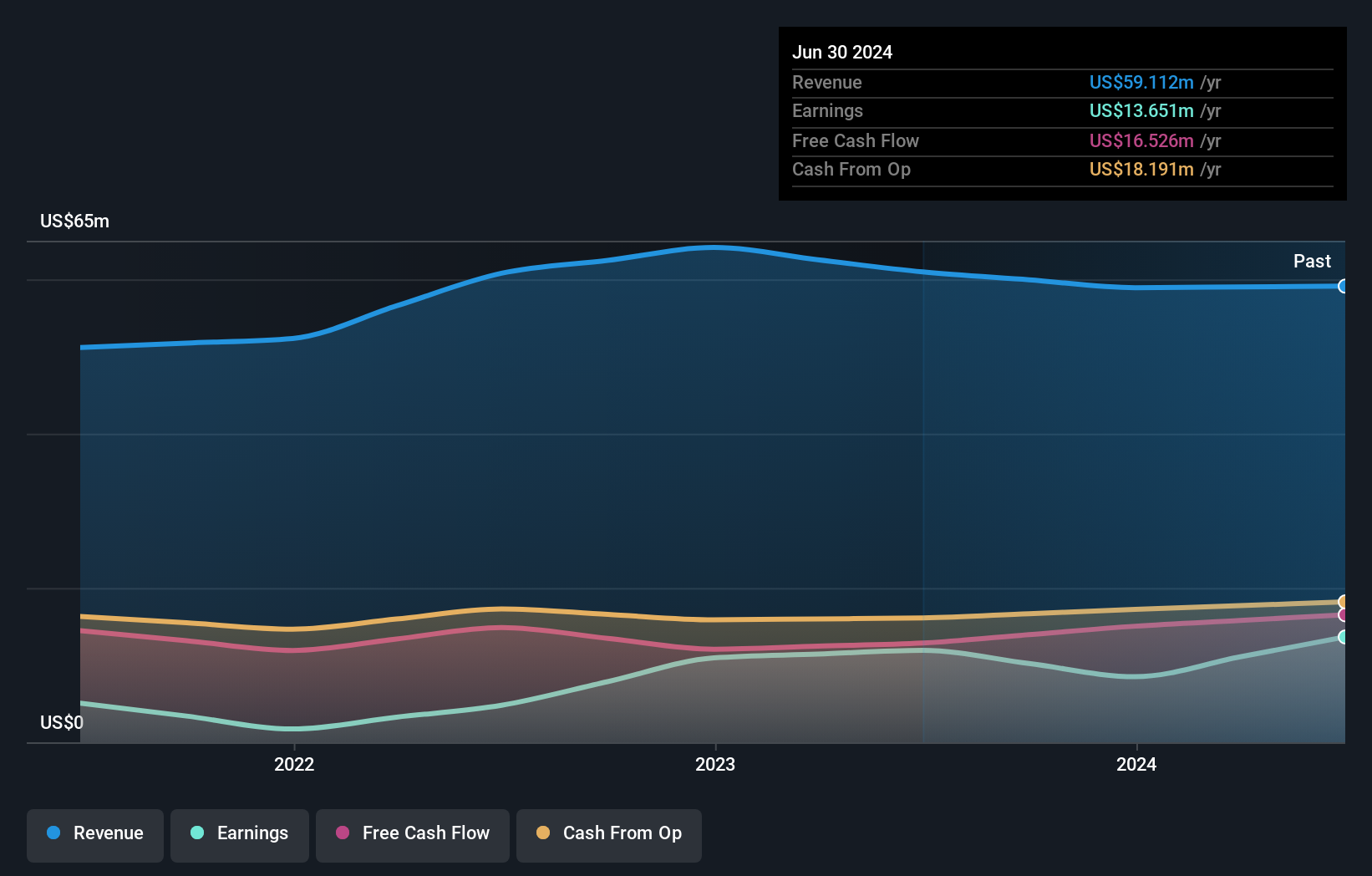

Overview: Xin Yuan Enterprises Group Limited, an investment holding company, provides asphalt tanker and bulk carrier chartering services in the People’s Republic of China, Hong Kong, and Singapore with a market cap of HK$2.55 billion.

Operations: The company generates revenue primarily from asphalt tanker chartering services ($55.49 million) and bulk carrier chartering services ($3.63 million).

Xin Yuan Enterprises Group has shown notable financial performance recently, with net income for the half-year ending June 2024 at US$10.69 million, up from US$5.53 million year-on-year. Earnings per share doubled to US$0.0243 from US$0.0126 a year ago, driven by a net realized gain of approximately US$3.6 million from vessel disposal and increased revenue from asphalt tanker charters. Additionally, their debt-to-equity ratio improved to 31.3% over five years, reflecting better financial health and strategic management decisions.

Easou Technology Holdings (SEHK:2550)

Simply Wall St Value Rating: ★★★★☆☆

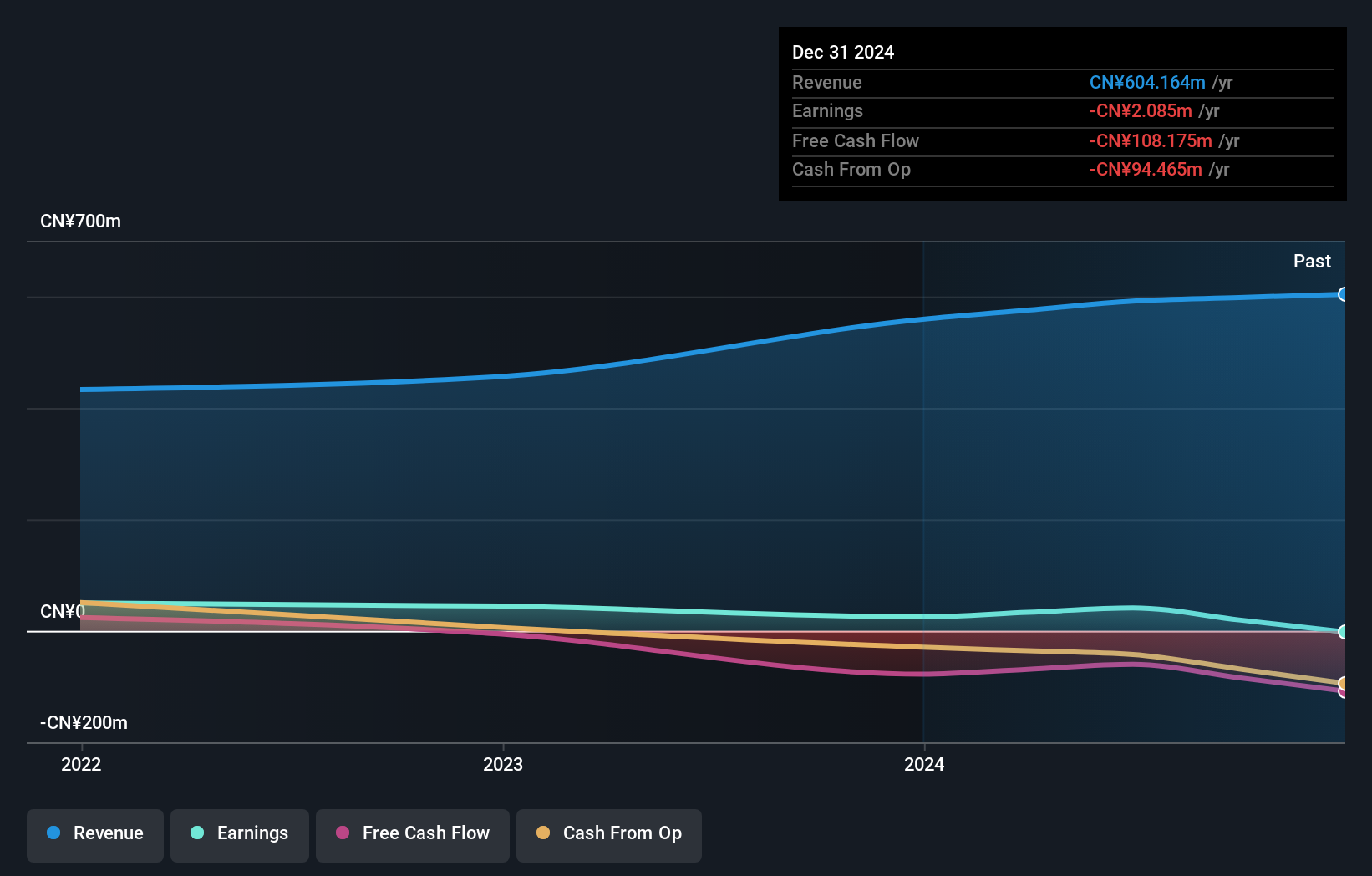

Overview: Easou Technology Holdings Limited operates a digital marketing online reading platform, publishes online games, and offers other digital content recommendation services in China, with a market cap of HK$5.72 billion.

Operations: Easou Technology Holdings generates revenue primarily from its digital marketing online reading platform and online games publishing. The company's cost structure includes expenses related to content acquisition, platform maintenance, and marketing efforts. Notably, the net profit margin stands at 15.32%.

Easou Technology Holdings, a small player in the tech space, reported sales of CNY 277.84 million for the first half of 2024, up from CNY 245.08 million last year. Net income reached CNY 3.39 million compared to a net loss of CNY 12.86 million previously. Basic earnings per share improved to CNY 0.0107 from a loss per share of CNY 0.0495 last year, indicating solid progress in profitability and operational efficiency despite recent volatility in its stock price.

- Navigate through the intricacies of Easou Technology Holdings with our comprehensive health report here.

Gain insights into Easou Technology Holdings' past trends and performance with our Past report.

Dida (SEHK:2559)

Simply Wall St Value Rating: ★★★★★★

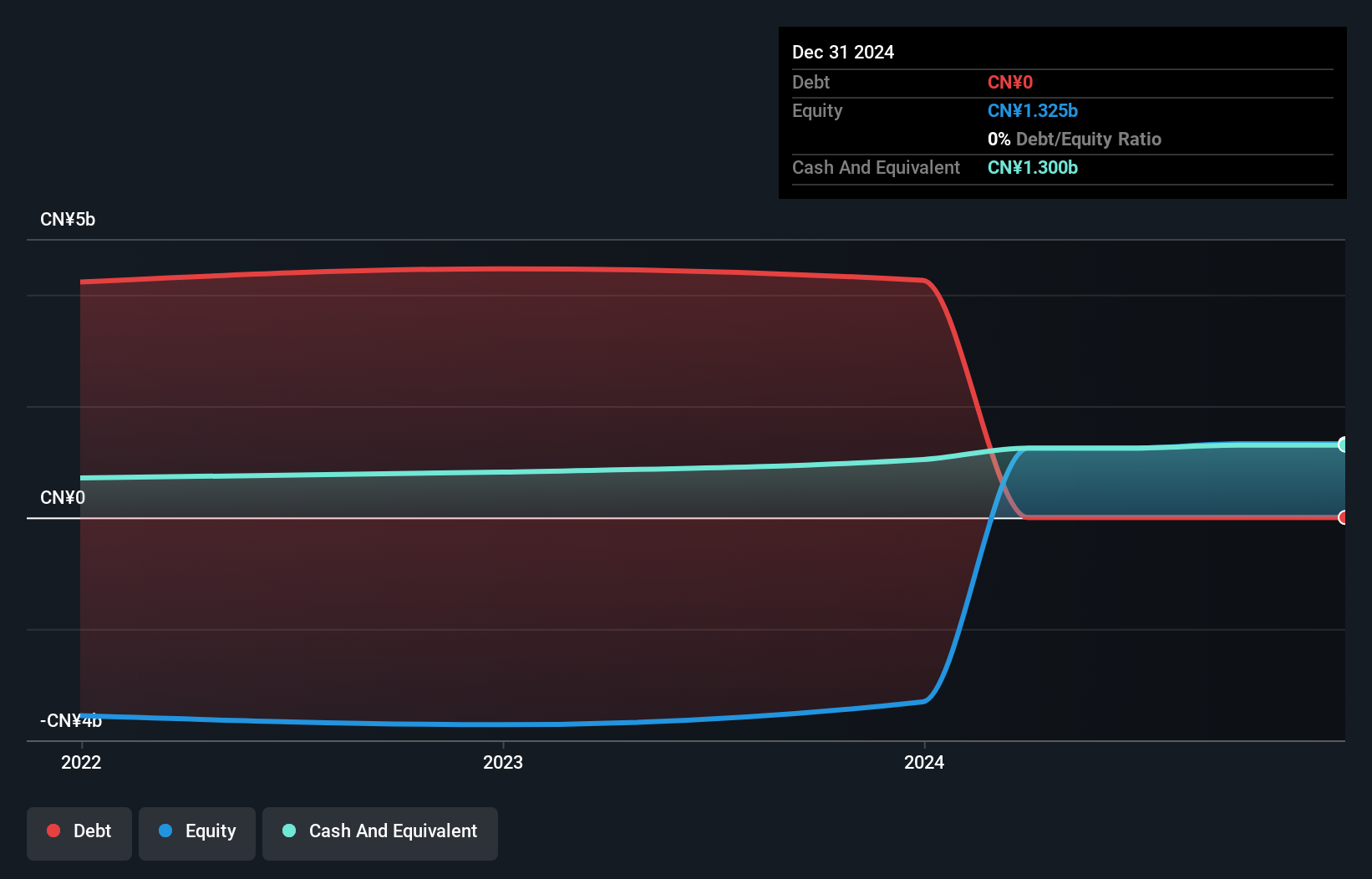

Overview: Dida Inc. is a technology-driven platform offering carpooling marketplace and smart taxi services, with a market cap of HK$2.07 billion.

Operations: Dida Inc. generates revenue primarily from its carpooling marketplace services (CN¥789.27 million), taxi-related services (CN¥7.25 million), and advertising and related services (CN¥26.51 million).

Dida has shown impressive financial performance, with earnings growth of 2600.8% over the past year, far outpacing the Transportation industry’s -10.3%. The company reported net income of CNY 947.88 million for the first half of 2024, a significant turnaround from a net loss of CNY 220.17 million in the same period last year. Additionally, Dida completed an IPO raising HKD 269.73 million and trades at nearly 35% below its estimated fair value, highlighting its potential as an undervalued stock in Hong Kong's market.

- Delve into the full analysis health report here for a deeper understanding of Dida.

Evaluate Dida's historical performance by accessing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 170 SEHK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com