As global markets show signs of recovery and investors navigate through economic fluctuations, the Hong Kong market presents a unique landscape ripe for exploration. With small-cap stocks often overlooked in favor of larger counterparts, this article aims to uncover three undiscovered gems that boast strong potential amidst current market dynamics. In today's environment, identifying promising stocks involves looking at companies with solid fundamentals, innovative business models, and resilience to market volatility. These characteristics are particularly crucial given the recent economic indicators and broader sentiment impacting small-cap stocks globally.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, an investment holding company with a market cap of HK$10.20 billion, engages in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company reported a gross profit margin of 35% for the latest fiscal year.

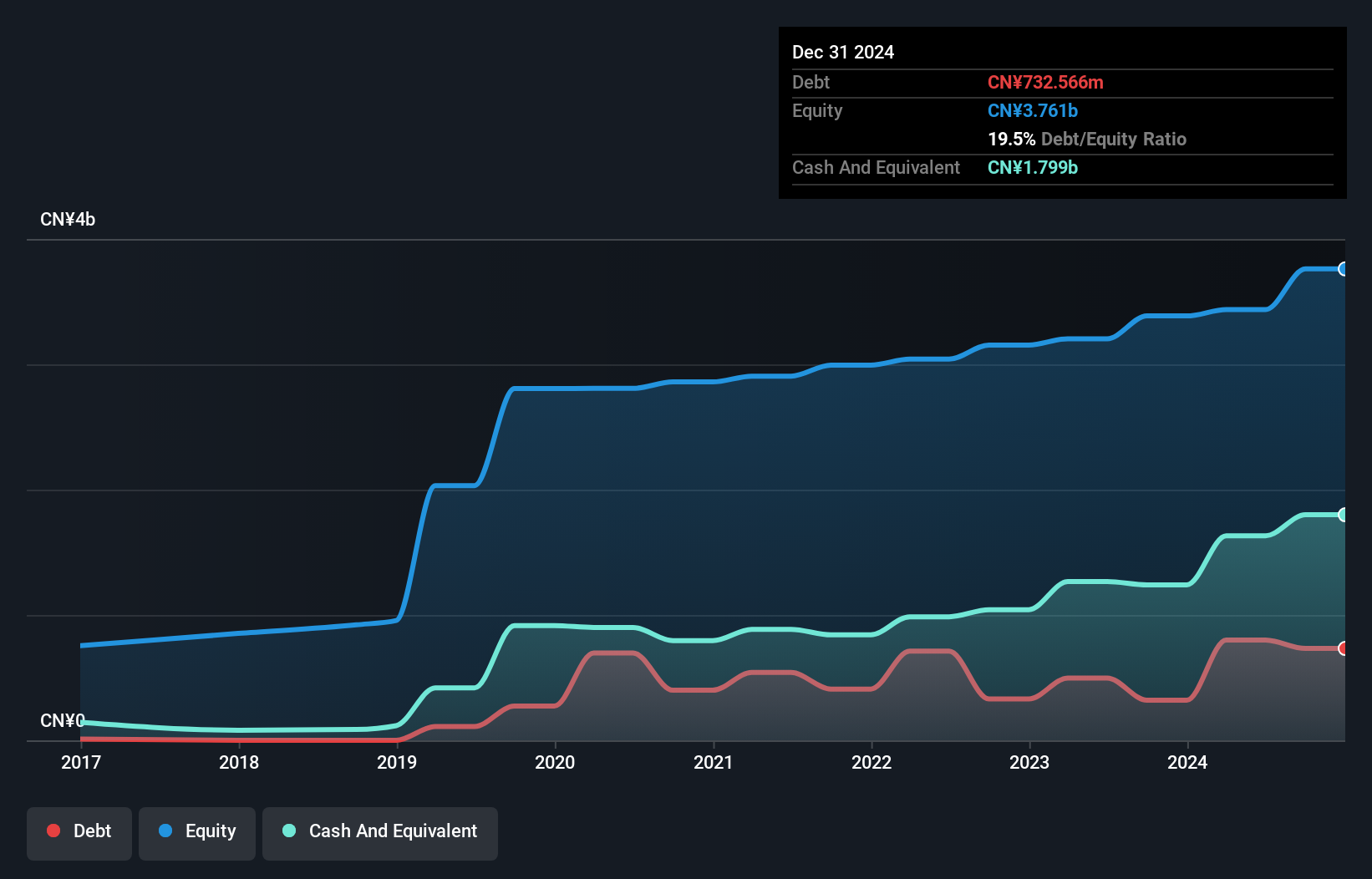

Kinetic Development Group, a small-cap entity, reported impressive earnings for the half year ending June 2024, with sales of CNY 2.53 billion compared to CNY 1.49 billion a year ago and net income rising to CNY 1.10 billion from CNY 570 million. The company declared an interim dividend of HKD 0.04 per share and announced a special dividend of HKD 0.04 per share in August 2024. Its net debt to equity ratio is satisfactory at 4.7%, with interest payments well covered by EBIT (163x).

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally, with a market cap of approximately HK$2.88 billion.

Operations: Revenue streams for IVD Medical Holding Limited include after-sales services (CN¥196.47 million), distribution business (CN¥2.86 billion), and self-branded products business (CN¥9.05 million). The distribution business is the largest contributor to revenue, significantly overshadowing other segments.

IVD Medical Holding reported half-year sales of CNY 1.35 billion, slightly down from last year's CNY 1.38 billion, but net income rose to CNY 125.29 million from CNY 103.01 million. Earnings per share improved to CNY 0.0927 from CNY 0.0762 a year ago, reflecting stronger profitability despite revenue fluctuations. The company’s debt-to-equity ratio increased to 23.3% over five years, yet it trades at a significant discount—66% below estimated fair value—suggesting potential undervaluation in the market.

AGTech Holdings (SEHK:8279)

Simply Wall St Value Rating: ★★★★★★

Overview: AGTech Holdings Limited is an integrated technology and services company operating in the People's Republic of China and Macau, with a market cap of HK$2.57 billion.

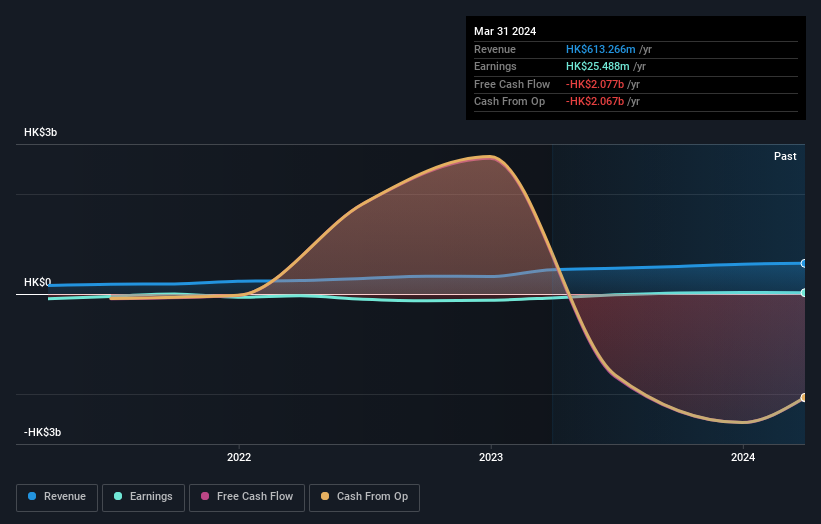

Operations: AGTech Holdings generates revenue primarily from its Lottery Operation (HK$248.76 million) and Electronic Payment and Related Services (HK$364.50 million).

AGTech Holdings, a small cap player in Hong Kong, reported sales of HK$766.58 million for the fifteen months ending March 2024 and net income of HK$31.86 million. The company became profitable this year, marking a significant turnaround from its past performance. AGTech has no debt now compared to five years ago when its debt to equity ratio was 13.8%. Despite high volatility in share price recently, it offers high-quality earnings and a stable financial outlook with no concerns over cash runway or interest payments due to being debt-free.

- Delve into the full analysis health report here for a deeper understanding of AGTech Holdings.

Understand AGTech Holdings' track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 171 SEHK Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com