As global markets continue to navigate economic uncertainties, the Hong Kong market has shown resilience, with the Hang Seng Index experiencing only a slight decline amid weak inflation data and ongoing concerns about China's longer-term growth. Despite these challenges, small-cap stocks remain an attractive segment for investors seeking untapped potential. In this article, we explore three lesser-known small-cap stocks in Hong Kong that exhibit promising fundamentals and growth potential in today's dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, with a market cap of HK$10.20 billion, is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group generates revenue primarily through the extraction and sale of coal products in the People’s Republic of China. The company's net profit margin stands at 12.5%.

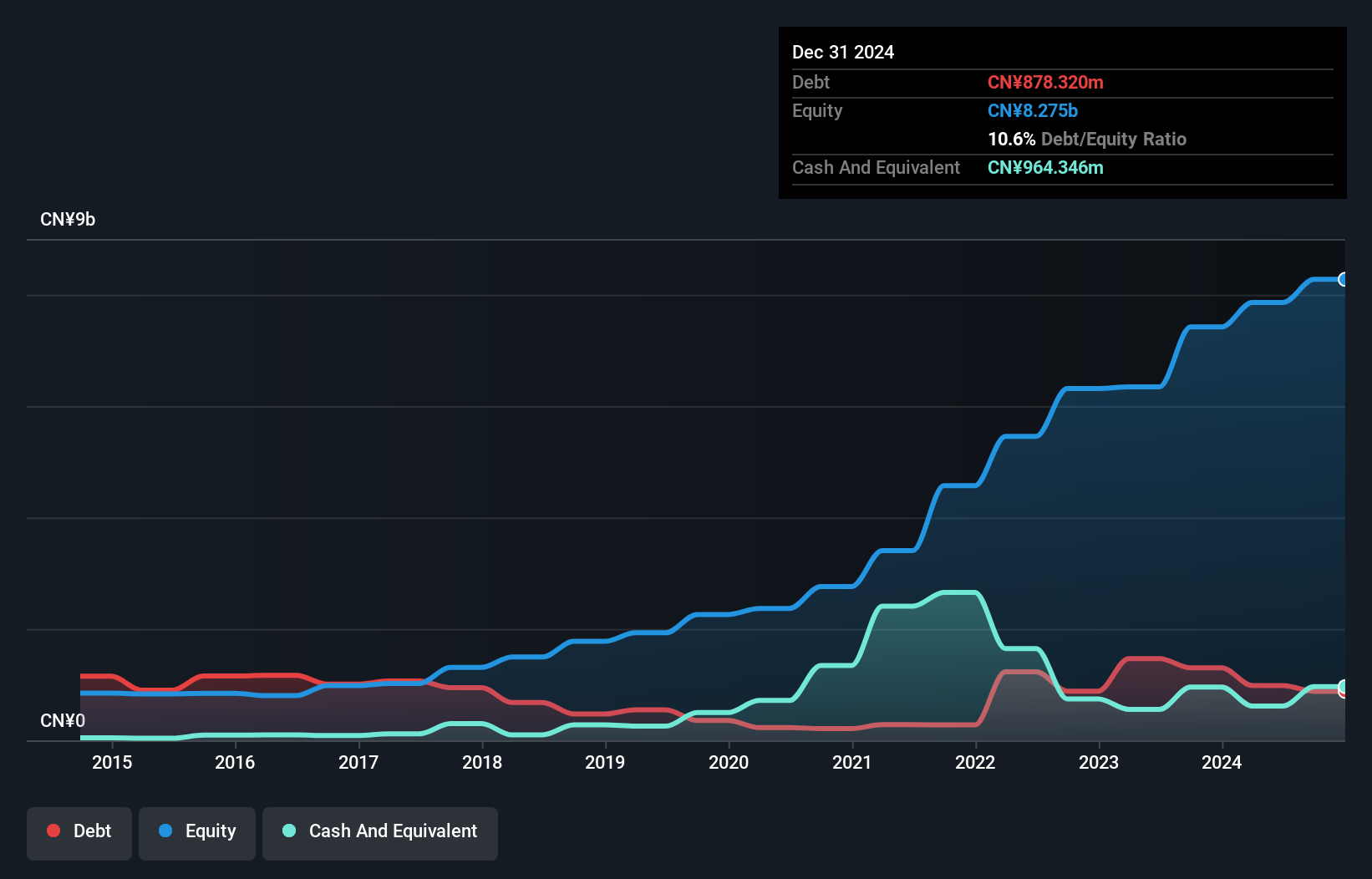

Kinetic Development Group's recent performance highlights its impressive earnings growth of 39.2% over the past year, significantly outpacing the Oil and Gas industry's 4.6%. The company reported half-year sales of CNY 2.53 billion, up from CNY 1.49 billion a year ago, with net income rising to CNY 1.10 billion from CNY 570 million previously. Additionally, Kinetic declared an interim dividend of HKD 0.04 per share and a special dividend of HKD 0.04 per share for shareholders in August and September respectively, reflecting strong financial health and shareholder returns.

- Dive into the specifics of Kinetic Development Group here with our thorough health report.

Understand Kinetic Development Group's track record by examining our Past report.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVD Medical Holding Limited, with a market cap of HK$2.88 billion, is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally.

Operations: IVD Medical Holding generates revenue primarily from its distribution business (CN¥2.86 billion), followed by after-sales services (CN¥196.47 million) and self-branded products (CN¥9.05 million).

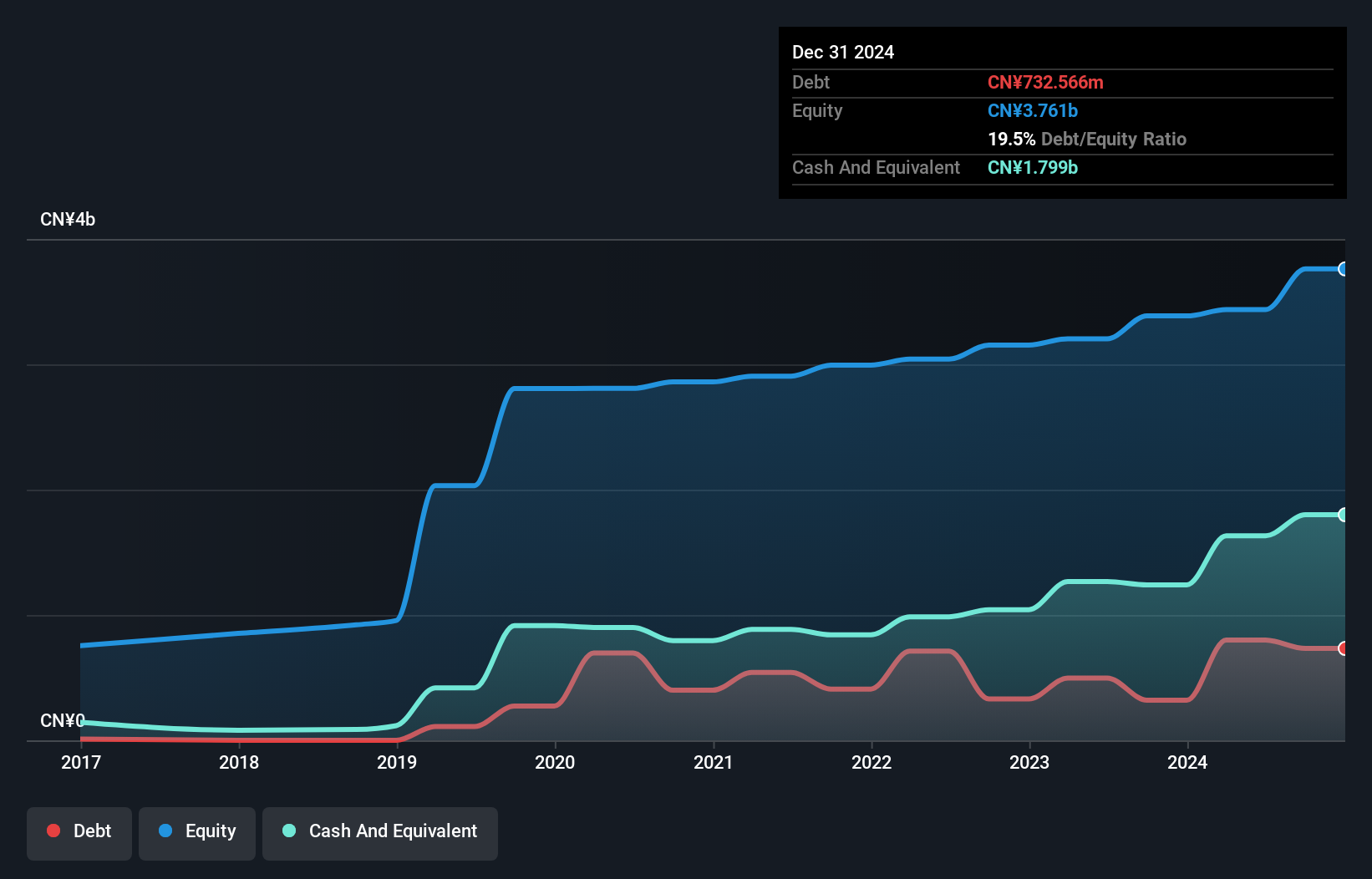

IVD Medical Holding, a small cap in Hong Kong, reported half-year sales of CNY 1.35 billion, slightly down from CNY 1.38 billion last year. Net income rose to CNY 125 million from CNY 103 million, with basic earnings per share increasing to CNY 0.0927 from CNY 0.0762. The company repurchased shares worth HKD 189 million recently and has seen a debt-to-equity ratio rise to 23% over five years while maintaining more cash than total debt.

AGTech Holdings (SEHK:8279)

Simply Wall St Value Rating: ★★★★★★

Overview: AGTech Holdings Limited operates as an integrated technology and services company in the People’s Republic of China and Macau, with a market cap of HK$2.57 billion.

Operations: AGTech Holdings Limited generates revenue primarily from Lottery Operations (HK$248.76 million) and Electronic Payment and Related Services (HK$364.50 million).

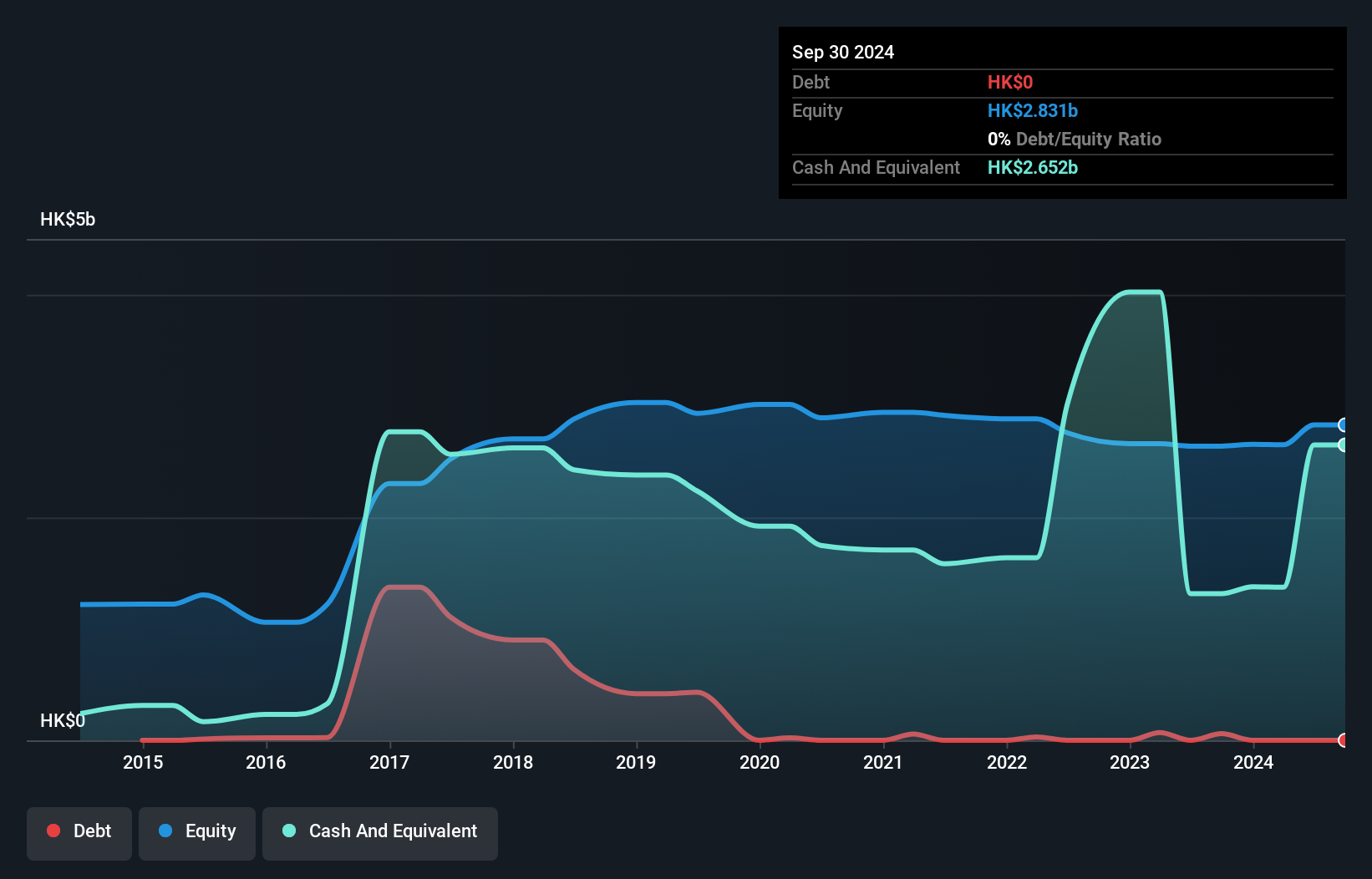

AGTech Holdings has shown significant improvement, becoming profitable this year with net income of HK$31.86 million for the fifteen months ended March 31, 2024. The company is debt-free now compared to a debt to equity ratio of 13.8% five years ago, indicating strong financial health. Recent executive changes include Mr. Zou Liang not standing for re-election at the AGM due to other commitments. Despite high volatility in its share price over the past three months, AGTech's earnings quality remains robust and it reported basic earnings per share from continuing operations at HK$0.00279.

- Click to explore a detailed breakdown of our findings in AGTech Holdings' health report.

Evaluate AGTech Holdings' historical performance by accessing our past performance report.

Make It Happen

- Click here to access our complete index of 171 SEHK Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com