The InnoCare Pharma Limited (HKG:9969) share price has done very well over the last month, posting an excellent gain of 29%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.3% over the last year.

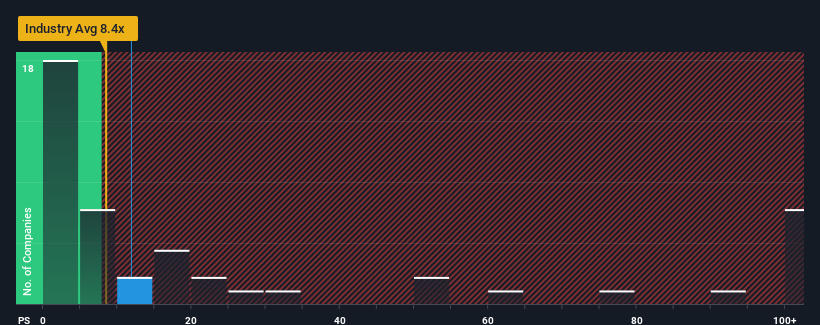

Following the firm bounce in price, InnoCare Pharma may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 11.9x, since almost half of all companies in the Biotechs in Hong Kong have P/S ratios under 8.4x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for InnoCare Pharma

How Has InnoCare Pharma Performed Recently?

InnoCare Pharma could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on InnoCare Pharma will help you uncover what's on the horizon.How Is InnoCare Pharma's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as InnoCare Pharma's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.1% last year. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 40% per annum over the next three years. That's shaping up to be materially lower than the 51% each year growth forecast for the broader industry.

In light of this, it's alarming that InnoCare Pharma's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

InnoCare Pharma shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for InnoCare Pharma, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 1 warning sign for InnoCare Pharma you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.