Key Insights

- Honma Golf's Annual General Meeting to take place on 20th of September

- Salary of JP¥34.1m is part of CEO Jianguo Liu's total remuneration

- The total compensation is similar to the average for the industry

- Honma Golf's total shareholder return over the past three years was 4.9% while its EPS grew by 37% over the past three years

Performance at Honma Golf Limited (HKG:6858) has been reasonably good and CEO Jianguo Liu has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 20th of September. We present our case of why we think CEO compensation looks fair.

View our latest analysis for Honma Golf

How Does Total Compensation For Jianguo Liu Compare With Other Companies In The Industry?

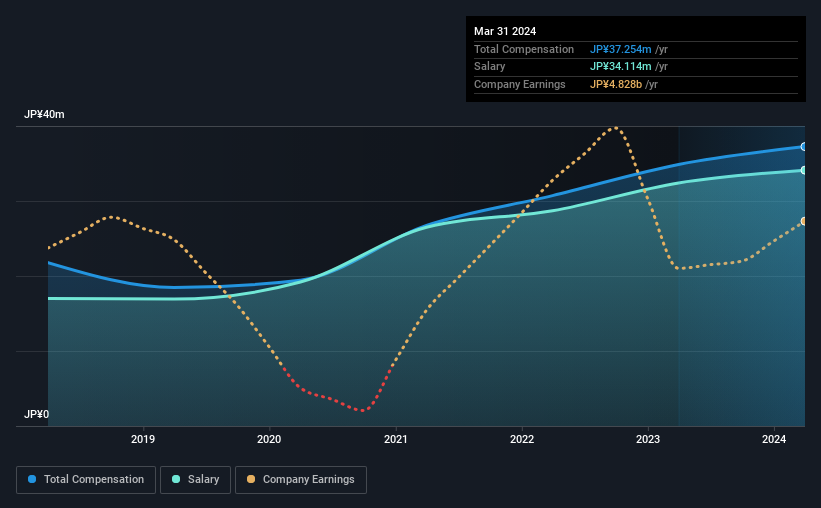

Our data indicates that Honma Golf Limited has a market capitalization of HK$2.0b, and total annual CEO compensation was reported as JP¥37m for the year to March 2024. That's a modest increase of 6.8% on the prior year. We note that the salary portion, which stands at JP¥34.1m constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the Hong Kong Leisure industry with market caps ranging from HK$780m to HK$3.1b, we found that the median CEO total compensation was JP¥30m. From this we gather that Jianguo Liu is paid around the median for CEOs in the industry. Furthermore, Jianguo Liu directly owns HK$780m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | JP¥34m | JP¥32m | 92% |

| Other | JP¥3.1m | JP¥2.5m | 8% |

| Total Compensation | JP¥37m | JP¥35m | 100% |

On an industry level, around 92% of total compensation represents salary and 8% is other remuneration. Our data reveals that Honma Golf allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Honma Golf Limited's Growth Numbers

Over the past three years, Honma Golf Limited has seen its earnings per share (EPS) grow by 37% per year. It saw its revenue drop 11% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Honma Golf Limited Been A Good Investment?

Honma Golf Limited has generated a total shareholder return of 4.9% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Honma Golf that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.