In September 2024, the Hong Kong market has experienced notable fluctuations, with the Hang Seng Index retreating by 3.03% amid weak corporate earnings and economic data. This backdrop of volatility presents a unique opportunity to explore undervalued small-cap stocks that have shown insider action. Identifying a good stock in such conditions often involves looking for companies with strong fundamentals and insider buying activity, which can signal confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shenzhen International Holdings | 5.8x | 0.7x | 25.44% | ★★★★★★ |

| IGG | 5.3x | 0.7x | 11.17% | ★★★★★☆ |

| Lion Rock Group | 5.5x | 0.4x | 49.46% | ★★★★☆☆ |

| EEKA Fashion Holdings | 8.4x | 0.8x | 18.55% | ★★★☆☆☆ |

| Meilleure Health International Industry Group | 23.5x | 8.7x | 28.48% | ★★★☆☆☆ |

| Giordano International | 9.1x | 0.7x | 27.49% | ★★★☆☆☆ |

| Analogue Holdings | 13.2x | 0.2x | 42.21% | ★★★☆☆☆ |

| Skyworth Group | 4.8x | 0.1x | -144.71% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 6.0x | 0.4x | -22.32% | ★★★☆☆☆ |

| CN Logistics International Holdings | 18.7x | 0.4x | 27.65% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

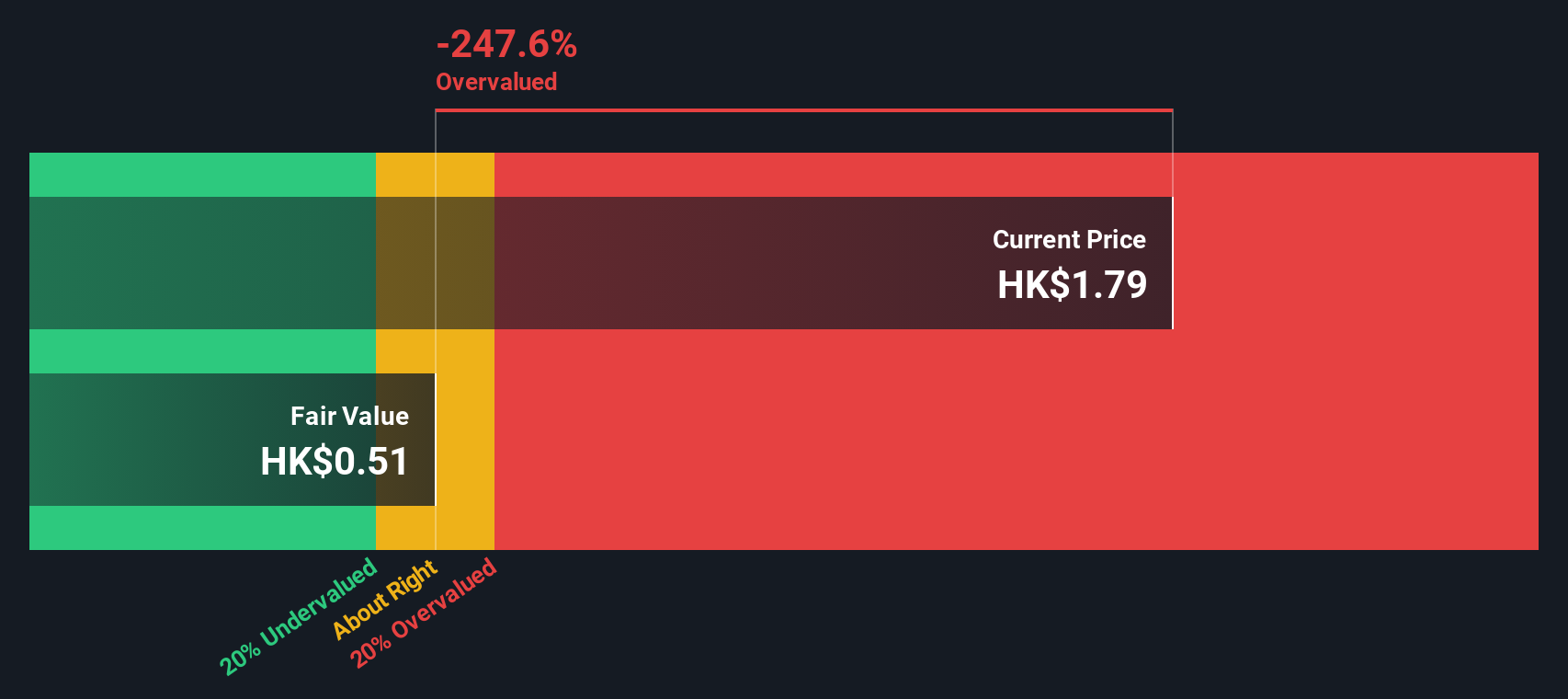

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, as well as operator telecommunication services, with a market cap of approximately HK$1.76 billion.

Operations: The company generates revenue primarily from Operator Telecommunication Services and Wireless Telecommunications Network System Equipment and Services. For the period ending 2023-09-30, it reported a gross profit of HK$1.77 billion with a gross profit margin of 28.23%. Operating expenses for the same period were HK$1.72 billion, leading to a net income margin of 1.75%.

PE: -11.9x

Comba Telecom Systems Holdings, a small cap in Hong Kong, has seen earnings decline by 1.7% annually over the past five years and experienced high share price volatility recently. The company’s funding is entirely from external borrowing, posing higher risks. Insider confidence is evident with recent purchases between June and August 2024. However, they forecast a loss of up to HK$160 million for H1 2024 due to delayed telecom projects and decreased other income compared to a HK$112 million profit in H1 2023.

- Take a closer look at Comba Telecom Systems Holdings' potential here in our valuation report.

Understand Comba Telecom Systems Holdings' track record by examining our Past report.

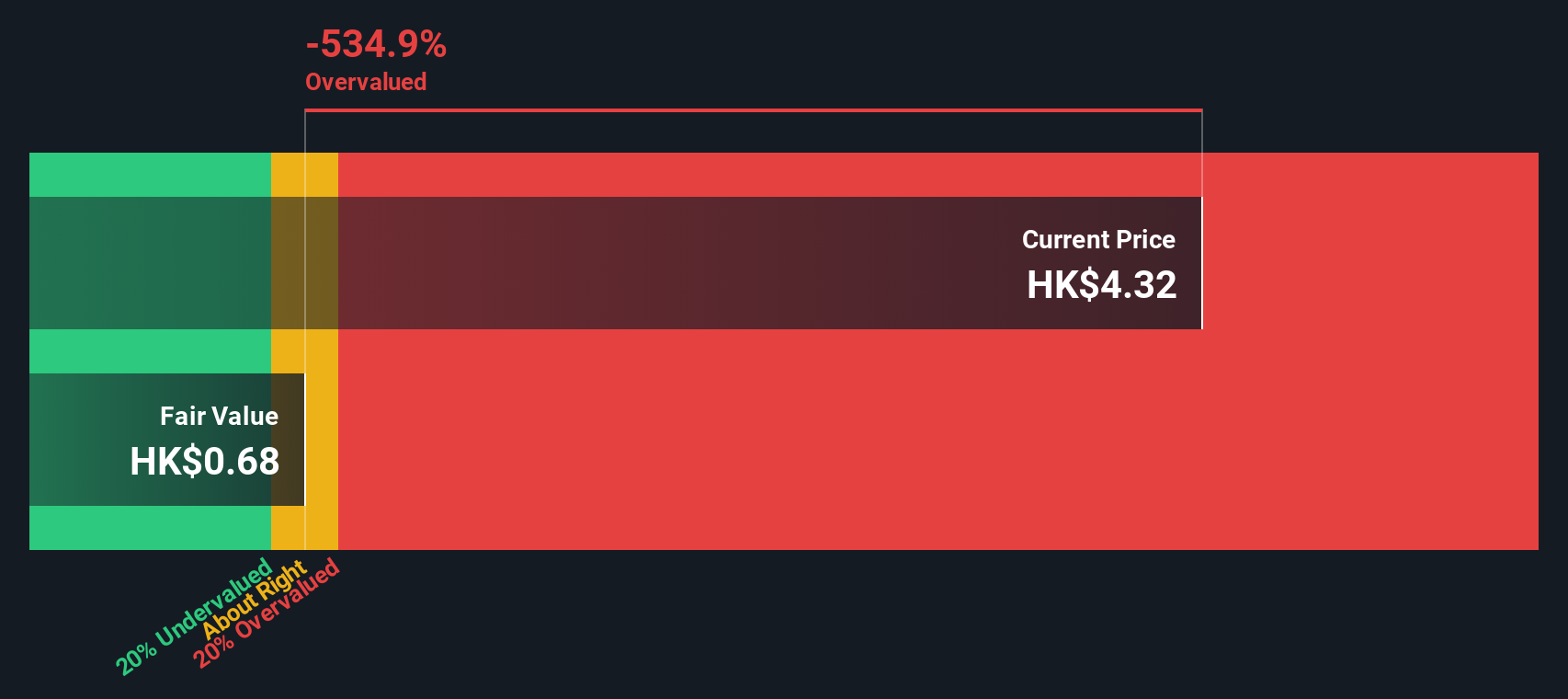

EEKA Fashion Holdings (SEHK:3709)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: EEKA Fashion Holdings is engaged in the retailing and wholesaling of ladies' wear with a market cap of CN¥7.88 billion.

Operations: The company's revenue primarily stems from retailing and wholesaling of ladies' wear, with a gross profit margin of 75.80%. Operating expenses are significant, dominated by sales and marketing costs at CN¥3.16 billion, followed by general and administrative expenses at CN¥1.42 billion.

PE: 8.4x

EEKA Fashion Holdings recently reported half-year sales of CNY 3,306.37 million, a slight dip from CNY 3,340.9 million the previous year. Net income also dropped to CNY 278.66 million from CNY 445.23 million. Despite these declines, insider confidence is evident with Ming Jin purchasing 600,000 shares for approximately CNY 5.19 million in August 2024, reflecting a significant vote of confidence in the company's potential growth and value recovery prospects within the fashion sector in Hong Kong's small-cap market segment.

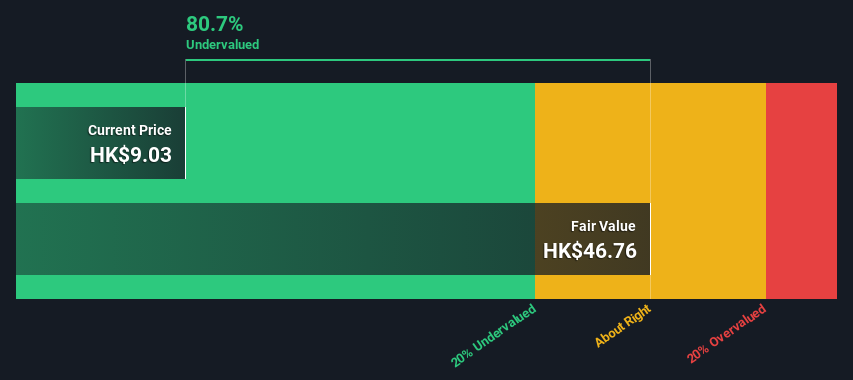

IGG (SEHK:799)

Simply Wall St Value Rating: ★★★★★☆

Overview: IGG is a company specializing in the development and operation of online games, with a market cap of approximately HK$6.05 billion.

Operations: The company generates revenue primarily from the development and operation of online games, with a recent gross profit margin of 77.58%. The cost of goods sold (COGS) was HK$1.23 billion, while operating expenses totaled HK$3.52 billion, including significant investments in sales & marketing (HK$2.37 billion) and research & development (HK$828.94 million).

PE: 5.3x

IGG Inc, a smaller firm in Hong Kong, has attracted attention due to insider confidence. CFO Jessie Shen purchased 549,000 shares for HK$1.77 million recently, indicating faith in the company’s future. The company reported a turnaround with H1 2024 net income of HK$330.95 million compared to a loss last year and announced an interim dividend of HK$0.085 per share payable on September 27, 2024. Additionally, IGG commenced share repurchases on September 10 under a mandate allowing up to 118 million shares buyback.

- Click here and access our complete valuation analysis report to understand the dynamics of IGG.

Examine IGG's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Click here to access our complete index of 15 Undervalued SEHK Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com