Key Insights

- Rykadan Capital's Annual General Meeting to take place on 16th of September

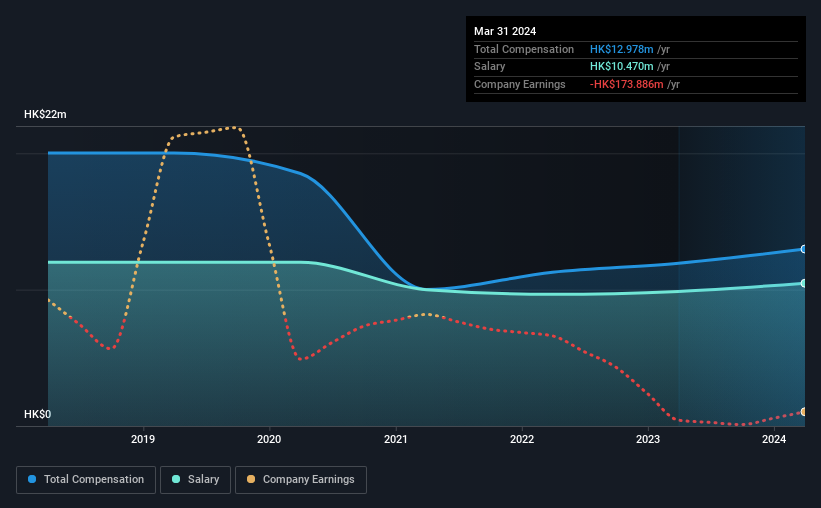

- CEO William Chan's total compensation includes salary of HK$10.5m

- The total compensation is 543% higher than the average for the industry

- Rykadan Capital's three-year loss to shareholders was 86% while its EPS was down 76% over the past three years

In the past three years, the share price of Rykadan Capital Limited (HKG:2288) has struggled to grow and now shareholders are sitting on a loss. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. Shareholders will have a chance to take their concerns to the board at the next AGM on 16th of September and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

View our latest analysis for Rykadan Capital

How Does Total Compensation For William Chan Compare With Other Companies In The Industry?

At the time of writing, our data shows that Rykadan Capital Limited has a market capitalization of HK$38m, and reported total annual CEO compensation of HK$13m for the year to March 2024. We note that's an increase of 8.7% above last year. Notably, the salary which is HK$10.5m, represents most of the total compensation being paid.

In comparison with other companies in the Hong Kong Real Estate industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.0m. This suggests that William Chan is paid more than the median for the industry. Furthermore, William Chan directly owns HK$13m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$10m | HK$9.9m | 81% |

| Other | HK$2.5m | HK$2.1m | 19% |

| Total Compensation | HK$13m | HK$12m | 100% |

On an industry level, around 76% of total compensation represents salary and 24% is other remuneration. There isn't a significant difference between Rykadan Capital and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Rykadan Capital Limited's Growth

Rykadan Capital Limited has reduced its earnings per share by 76% a year over the last three years. In the last year, its revenue is up 19%.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Rykadan Capital Limited Been A Good Investment?

The return of -86% over three years would not have pleased Rykadan Capital Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 3 warning signs for Rykadan Capital that investors should be aware of in a dynamic business environment.

Switching gears from Rykadan Capital, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.