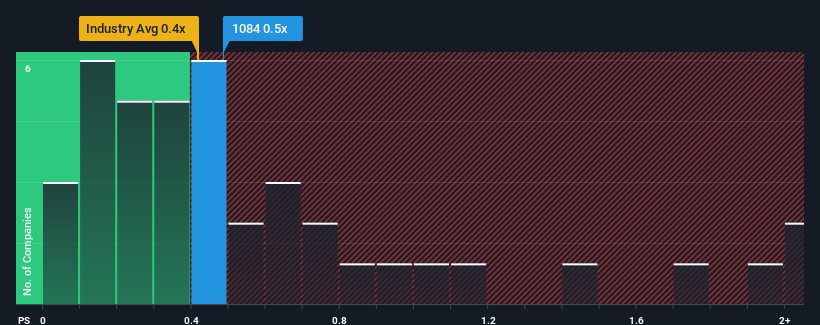

There wouldn't be many who think Green Future Food Hydrocolloid Marine Science Company Limited's (HKG:1084) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Chemicals industry in Hong Kong is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Green Future Food Hydrocolloid Marine Science

What Does Green Future Food Hydrocolloid Marine Science's Recent Performance Look Like?

For instance, Green Future Food Hydrocolloid Marine Science's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Green Future Food Hydrocolloid Marine Science's earnings, revenue and cash flow.How Is Green Future Food Hydrocolloid Marine Science's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Green Future Food Hydrocolloid Marine Science's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. Still, the latest three year period has seen an excellent 34% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.5% shows it's noticeably more attractive.

In light of this, it's curious that Green Future Food Hydrocolloid Marine Science's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Green Future Food Hydrocolloid Marine Science's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Green Future Food Hydrocolloid Marine Science's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Green Future Food Hydrocolloid Marine Science (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.