As global markets navigate a mixed performance and economic indicators show varied resilience, the Hong Kong market has seen its benchmark Hang Seng Index gain 2.14%, reflecting investor optimism despite broader uncertainties. Against this backdrop, identifying promising stocks becomes crucial, particularly those with strong fundamentals and growth potential in an evolving economic landscape. In this article, we will explore three lesser-known stocks in Hong Kong that have shown promise and could be worth watching this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Xin Yuan Enterprises Group (SEHK:1748)

Simply Wall St Value Rating: ★★★★★★

Overview: Xin Yuan Enterprises Group Limited, an investment holding company, provides asphalt tanker and bulk carrier chartering services in the People’s Republic of China, Hong Kong, and Singapore with a market cap of HK$2.60 billion.

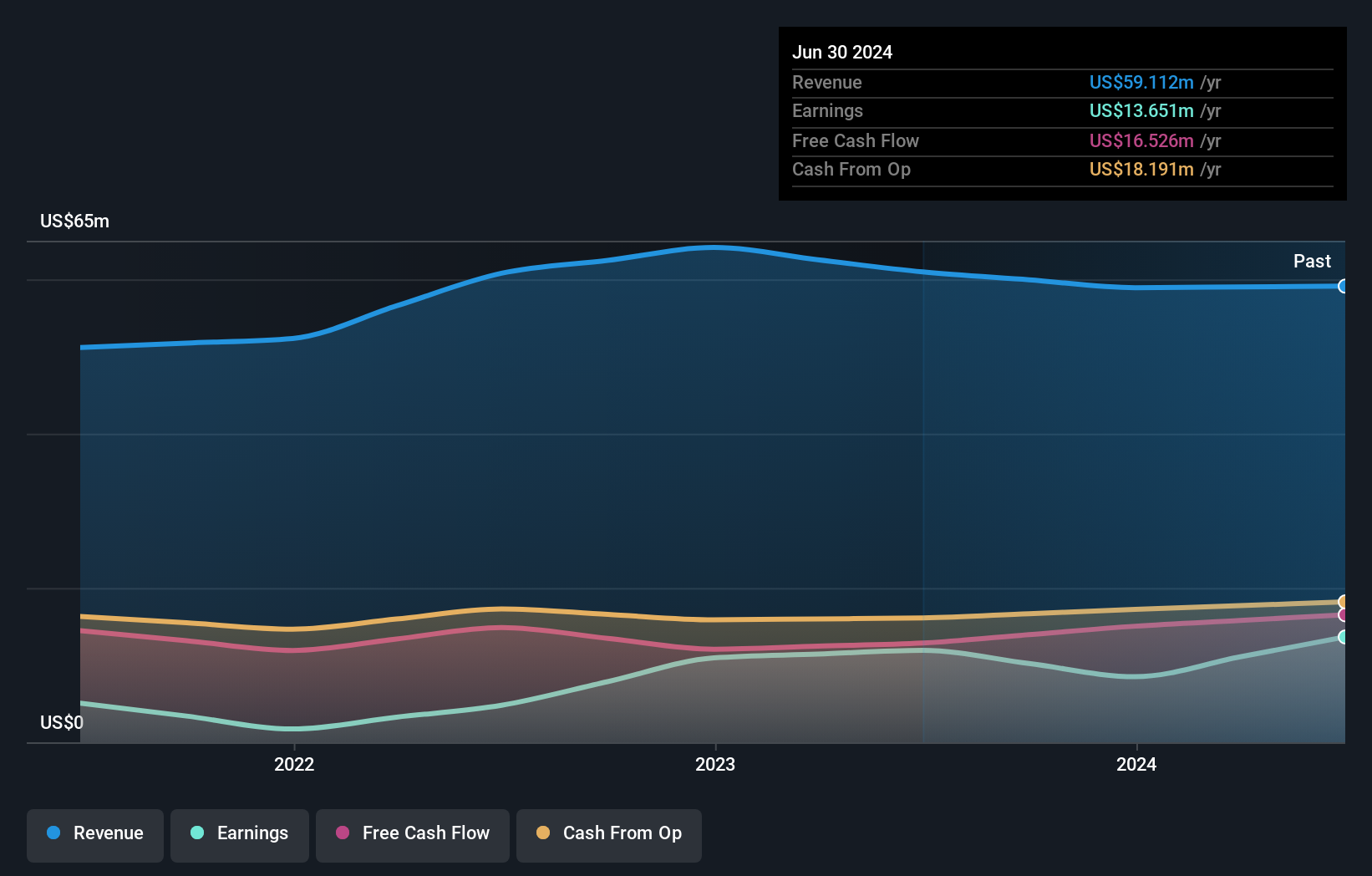

Operations: Xin Yuan Enterprises Group generates revenue primarily from asphalt tanker chartering services (HK$55.49 million) and bulk carrier chartering services (HK$3.63 million).

Xin Yuan Enterprises Group reported half-year sales of US$30.26M, up slightly from US$30.06M last year, with net income doubling to US$10.69M due to a one-off gain of US$4.5M and increased revenue from asphalt tanker charters. The company’s debt-to-equity ratio improved over five years from 35.3% to 31.3%, and its EBIT covers interest payments 3.3 times over, indicating strong financial health despite recent share price volatility.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Banking Group Limited is an investment holding company that provides banking, financial, and related services in Hong Kong, Macau, and the People’s Republic of China with a market cap of HK$9.77 billion.

Operations: Dah Sing Banking Group generates revenue primarily from Personal Banking (HK$2.68 billion), Corporate Banking (HK$853.60 million), and Treasury and Global Markets (HK$1.34 billion). Mainland China and Macau Banking contribute HK$176.27 million to the total revenue.

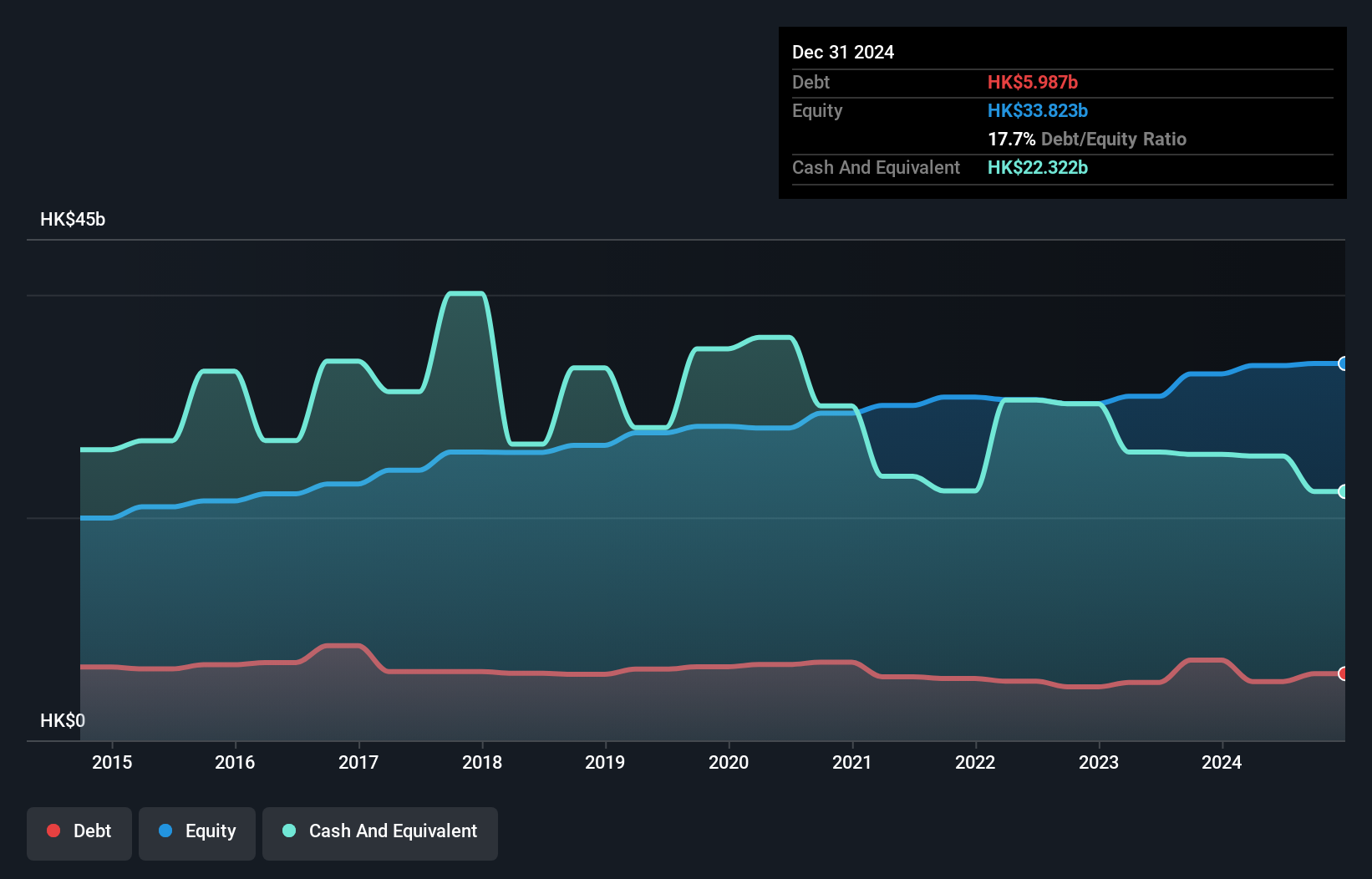

Dah Sing Banking Group, with total assets of HK$262.4B and equity of HK$33.6B, has been showing strong performance. Deposits stand at HK$214.6B while loans are at HK$141.9B, yielding a net interest margin of 2%. The company reported earnings growth of 32.3% over the past year, surpassing the industry average of 3.2%. Trading at 46.4% below estimated fair value and maintaining an appropriate bad loans ratio at 1.9%, it seems poised for steady progress.

- Get an in-depth perspective on Dah Sing Banking Group's performance by reading our health report here.

Evaluate Dah Sing Banking Group's historical performance by accessing our past performance report.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Financial Holdings Limited is an investment holding company that offers banking, insurance, financial, and related services in Hong Kong, Macau, and the People’s Republic of China with a market cap of HK$7.57 billion.

Operations: Dah Sing Financial Holdings generates revenue primarily from Personal Banking (HK$2.68 billion), Treasury and Global Markets (HK$1.34 billion), and Corporate Banking (HK$853.60 million). The company also earns from its Insurance Business segment, contributing HK$246.25 million, and Mainland China and Macau Banking, adding HK$176.27 million to the total revenue stream.

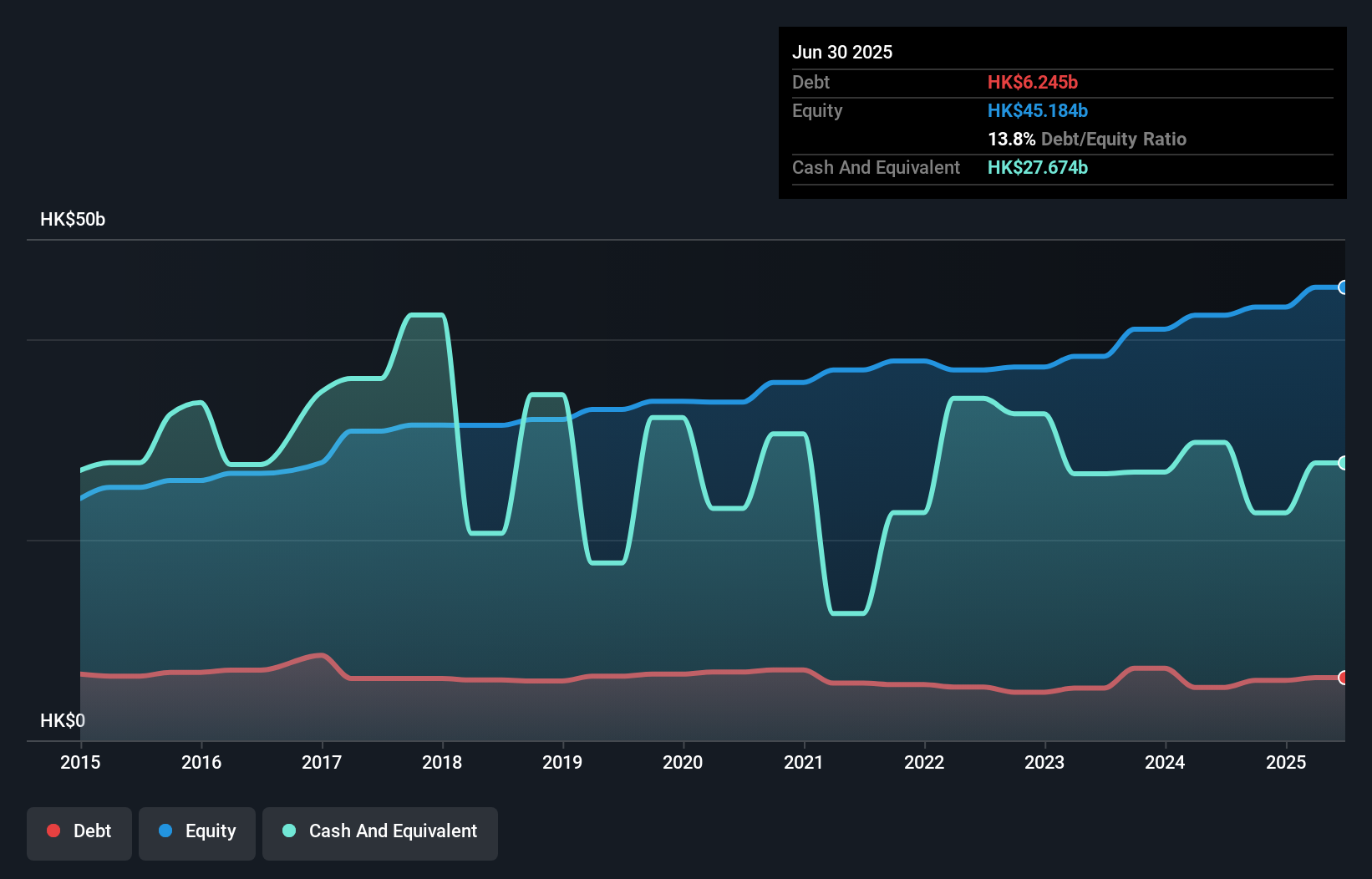

Dah Sing Financial Holdings, with total assets of HK$272.4B and equity of HK$42.4B, recently reported net income of HK$1.11B for the half year ending June 2024, up from HK$921.86M a year ago. The company has an appropriate level of bad loans at 1.9% and trades at 42% below its estimated fair value. Total deposits stand at HK$214.2B against total loans of HK$141.9B, reflecting strong financial health bolstered by low-risk funding sources (93%).

- Click here and access our complete health analysis report to understand the dynamics of Dah Sing Financial Holdings.

Learn about Dah Sing Financial Holdings' historical performance.

Next Steps

- Navigate through the entire inventory of 173 SEHK Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com