Last week, you might have seen that Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited (HKG:874) released its second-quarter result to the market. The early response was not positive, with shares down 6.6% to HK$17.94 in the past week. Results look mixed - while revenue fell marginally short of analyst estimates at CN¥18b, statutory earnings were in line with expectations, at CN¥2.50 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Guangzhou Baiyunshan Pharmaceutical Holdings

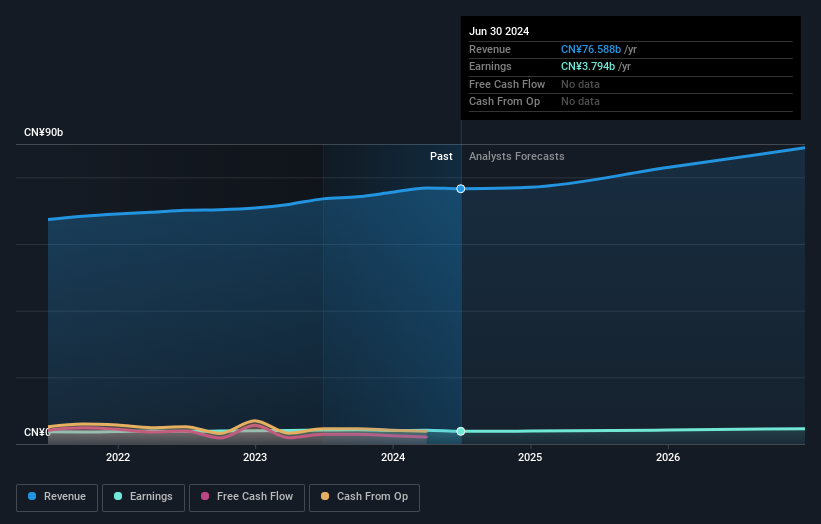

Following last week's earnings report, Guangzhou Baiyunshan Pharmaceutical Holdings' six analysts are forecasting 2024 revenues to be CN¥77.0b, approximately in line with the last 12 months. Statutory per share are forecast to be CN¥2.38, approximately in line with the last 12 months. In the lead-up to this report, the analysts had been modelling revenues of CN¥80.1b and earnings per share (EPS) of CN¥2.58 in 2024. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a minor downgrade to earnings per share estimates.

The consensus price target fell 6.8% to HK$24.36, with the weaker earnings outlook clearly leading valuation estimates. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Guangzhou Baiyunshan Pharmaceutical Holdings at HK$31.57 per share, while the most bearish prices it at HK$17.01. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that Guangzhou Baiyunshan Pharmaceutical Holdings' revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 1.2% growth on an annualised basis. This is compared to a historical growth rate of 4.7% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 10% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Guangzhou Baiyunshan Pharmaceutical Holdings.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Guangzhou Baiyunshan Pharmaceutical Holdings. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Guangzhou Baiyunshan Pharmaceutical Holdings analysts - going out to 2026, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Guangzhou Baiyunshan Pharmaceutical Holdings that you should be aware of.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.