Key Insights

- Vico International Holdings to hold its Annual General Meeting on 11th of September

- CEO Eric Hui's total compensation includes salary of HK$975.0k

- Total compensation is 33% below industry average

- Vico International Holdings' three-year loss to shareholders was 47% while its EPS was down 2.6% over the past three years

Performance at Vico International Holdings Limited (HKG:1621) has been rather uninspiring recently and shareholders may be wondering how CEO Eric Hui plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 11th of September. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Vico International Holdings

Comparing Vico International Holdings Limited's CEO Compensation With The Industry

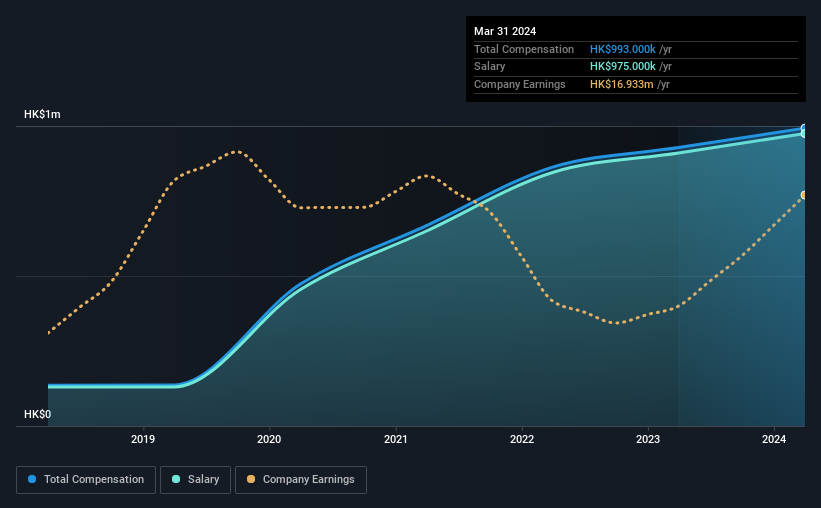

Our data indicates that Vico International Holdings Limited has a market capitalization of HK$65m, and total annual CEO compensation was reported as HK$993k for the year to March 2024. That's a fairly small increase of 7.0% over the previous year. We note that the salary portion, which stands at HK$975.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong Oil and Gas industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.5m. This suggests that Eric Hui is paid below the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$975k | HK$910k | 98% |

| Other | HK$18k | HK$18k | 2% |

| Total Compensation | HK$993k | HK$928k | 100% |

On an industry level, around 93% of total compensation represents salary and 7% is other remuneration. Vico International Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Vico International Holdings Limited's Growth

Over the last three years, Vico International Holdings Limited has shrunk its earnings per share by 2.6% per year. Its revenue is up 57% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Vico International Holdings Limited Been A Good Investment?

The return of -47% over three years would not have pleased Vico International Holdings Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Vico International Holdings pays its CEO a majority of compensation through a salary. The fact that shareholders have earned a negative share price return is certainly disconcerting. The downward trend in share price performance may be attributable to the the fact that earnings growth has gone backwards. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Vico International Holdings that investors should be aware of in a dynamic business environment.

Switching gears from Vico International Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.