As the Hong Kong market navigates a period of mixed economic signals and cautious investor sentiment, small-cap stocks have shown resilience amid broader market fluctuations. With the Hang Seng Index gaining 2.14% recently, it's an opportune moment to explore lesser-known companies that could offer unique growth potential in this dynamic environment. A good stock in such conditions often combines strong fundamentals with promising sectoral trends, making it well-positioned to capitalize on emerging opportunities despite broader uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Xin Yuan Enterprises Group (SEHK:1748)

Simply Wall St Value Rating: ★★★★★★

Overview: Xin Yuan Enterprises Group Limited, an investment holding company, provides asphalt tanker and bulk carrier chartering services in the People’s Republic of China, Hong Kong, and Singapore with a market cap of HK$6.60 billion.

Operations: Xin Yuan Enterprises Group derives its revenue primarily from asphalt tanker chartering services ($55.49 million) and bulk carrier chartering services ($3.63 million). The company’s financial performance is significantly influenced by the higher contribution of the asphalt tanker segment.

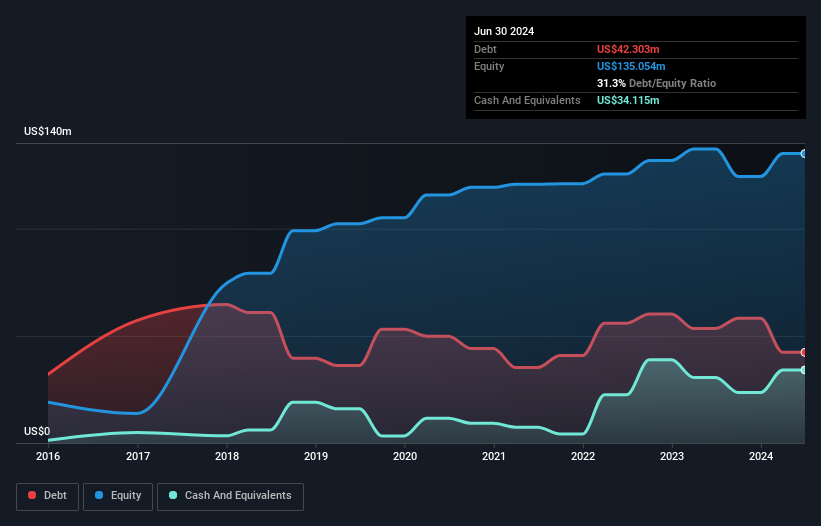

Xin Yuan Enterprises Group has shown promising growth, with earnings increasing by 14.6% over the past year, significantly outpacing the shipping industry's -29.9%. The company reported a net income of US$10.69 million for the half-year ended June 30, 2024, up from US$5.53 million a year ago. Their debt to equity ratio improved from 35.3% to 31.3% over five years, and interest payments are well covered by EBIT at 3.3x coverage.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Banking Group Limited is an investment holding company offering banking, financial, and related services in Hong Kong, Macau, and the People’s Republic of China with a market cap of HK$9.78 billion.

Operations: The company's revenue streams include Personal Banking (HK$2.68 billion), Corporate Banking (HK$0.85 billion), Treasury and Global Markets (HK$1.34 billion), and Mainland China and Macau Banking (HK$0.18 billion).

Dah Sing Banking Group appears undervalued, trading at 46.3% below its estimated fair value. With total assets of HK$262.4B and equity of HK$33.6B, the bank's deposits stand at HK$214.6B while loans total HK$141.9B with a net interest margin of 2%. Despite an appropriate level of bad loans at 1.9%, its allowance for bad loans is low (43%). Earnings grew by 32.3% last year, outpacing the industry’s 2.8%.

- Take a closer look at Dah Sing Banking Group's potential here in our health report.

Explore historical data to track Dah Sing Banking Group's performance over time in our Past section.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Financial Holdings Limited is an investment holding company that offers banking, insurance, financial, and related services in Hong Kong, Macau, and the People’s Republic of China with a market cap of HK$7.61 billion.

Operations: Dah Sing Financial Holdings generates revenue primarily from Personal Banking (HK$2.68 billion), Treasury and Global Markets (HK$1.34 billion), and Corporate Banking (HK$853.60 million). The company also derives income from its Insurance Business (HK$246.25 million) and Mainland China and Macau Banking operations (HK$176.27 million).

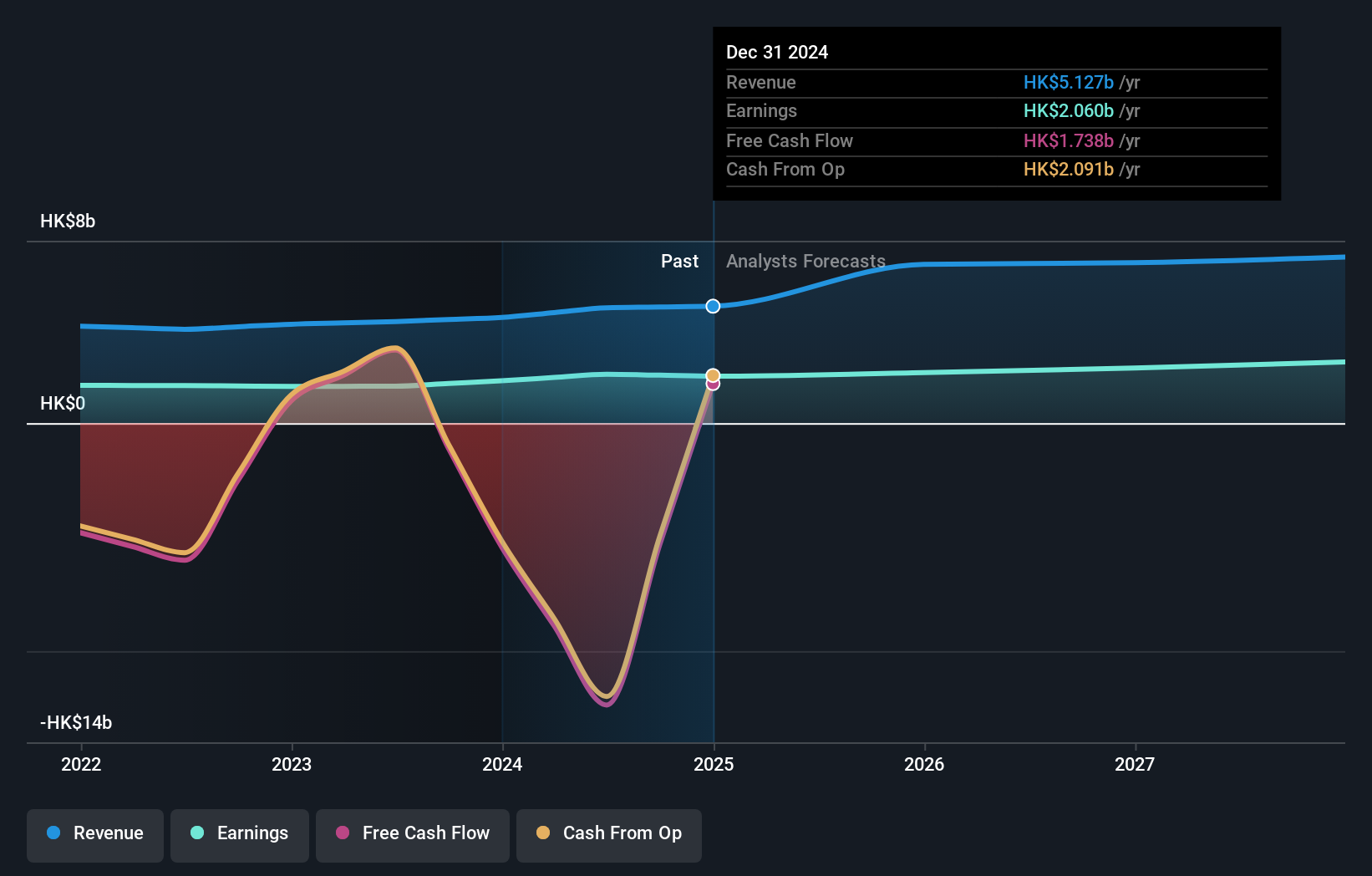

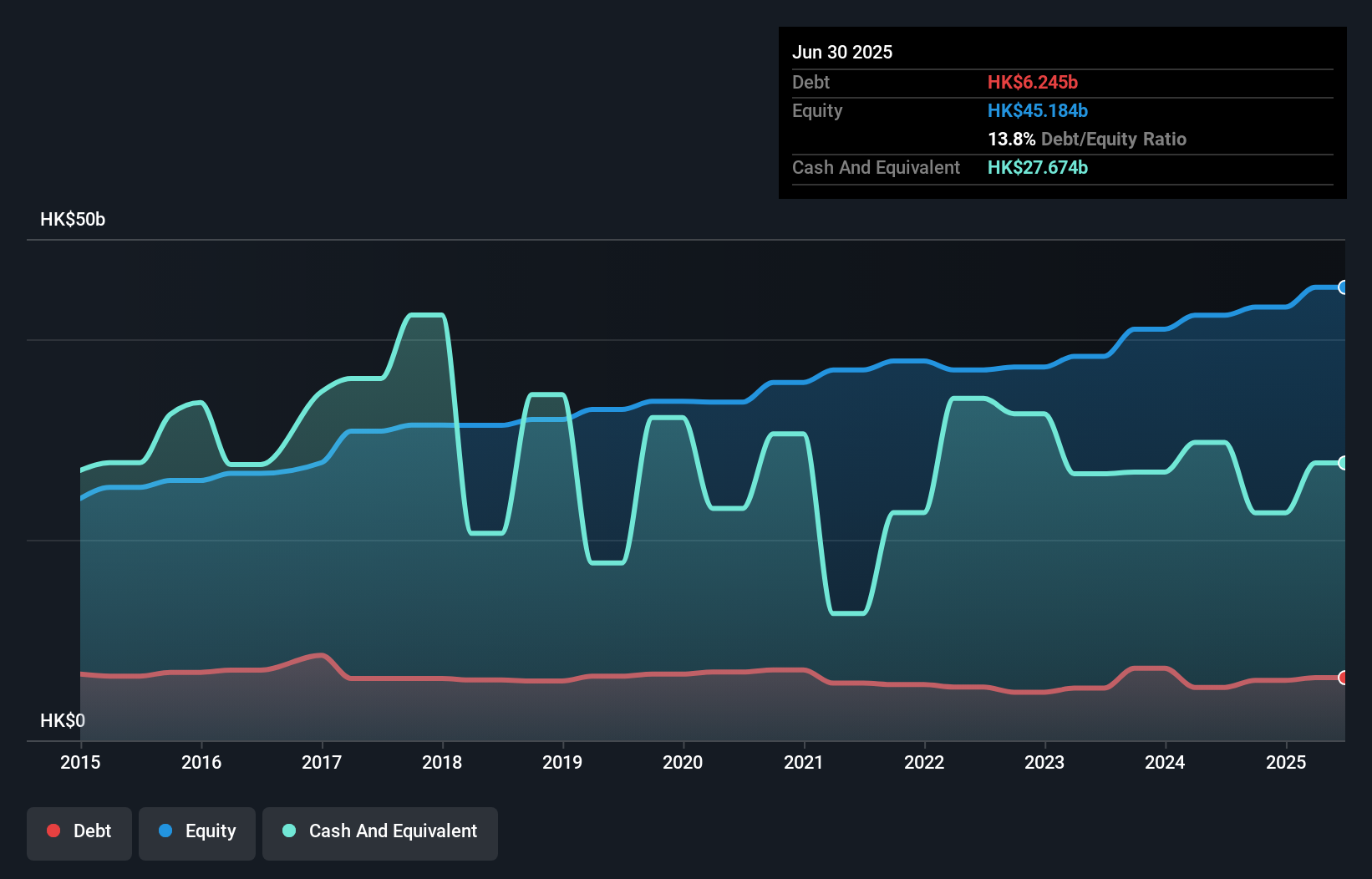

Dah Sing Financial Holdings, with total assets of HK$272.4B and equity of HK$42.4B, reported net income of HK$1.11B for the first half of 2024, up from HK$921.86M a year ago. Total deposits are at HK$214.2B while loans stand at HK$141.9B, reflecting robust banking operations with low-risk funding sources (93% customer deposits). The company also announced an interim dividend of HKD 0.92 per share for the six months ended June 2024.

Summing It All Up

- Explore the 174 names from our SEHK Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com