The Xin Yuan Enterprises Group Limited (HKG:1748) share price has done very well over the last month, posting an excellent gain of 376%. The last 30 days were the cherry on top of the stock's 733% gain in the last year, which is nothing short of spectacular.

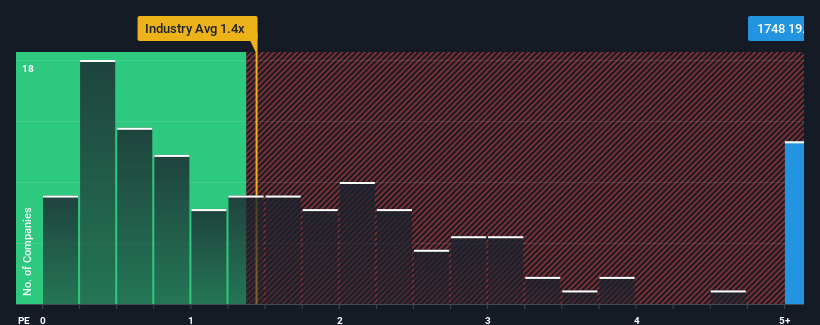

Following the firm bounce in price, when almost half of the companies in Hong Kong's Shipping industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Xin Yuan Enterprises Group as a stock not worth researching with its 19.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Xin Yuan Enterprises Group

What Does Xin Yuan Enterprises Group's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Xin Yuan Enterprises Group over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xin Yuan Enterprises Group's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Xin Yuan Enterprises Group's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.0%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 16% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 8.2% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Xin Yuan Enterprises Group's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Xin Yuan Enterprises Group's P/S Mean For Investors?

Xin Yuan Enterprises Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Xin Yuan Enterprises Group revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Plus, you should also learn about these 2 warning signs we've spotted with Xin Yuan Enterprises Group (including 1 which can't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.