As global markets react to anticipated interest rate cuts and small-cap stocks outperform their larger counterparts, the Hong Kong market has shown resilience despite broader economic uncertainties. Investors are increasingly looking for promising opportunities within this dynamic landscape, particularly among emerging stocks that exhibit strong fundamentals and growth potential. Identifying a good stock in this environment often means focusing on companies with solid financial health, innovative business models, and the ability to capitalize on current market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.50% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Xin Point Holdings (SEHK:1571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xin Point Holdings Limited, an investment holding company, manufactures and sells automotive and electronic components in China, North America, Europe, and internationally with a market cap of HK$3.39 billion.

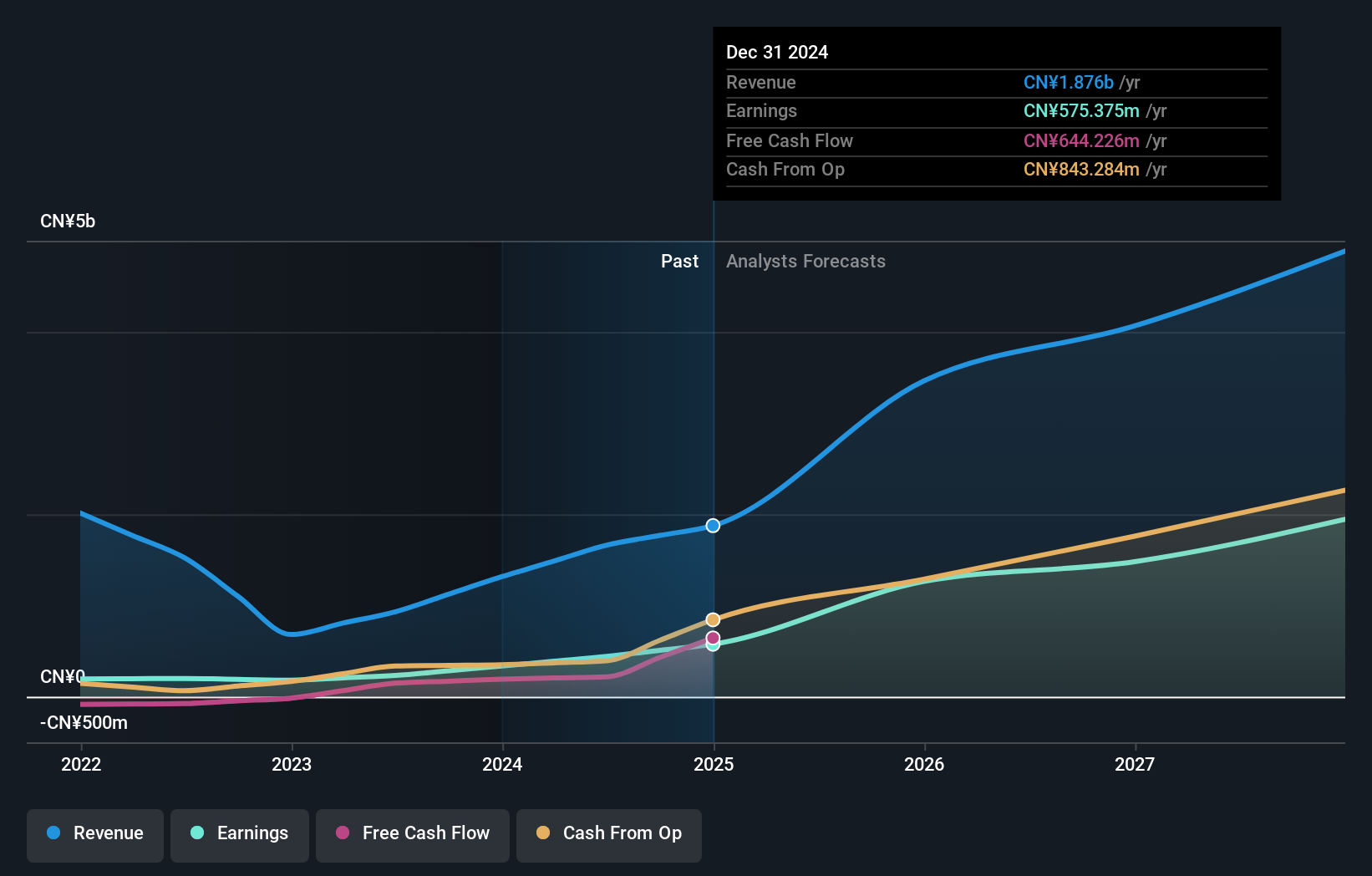

Operations: Xin Point Holdings generates revenue primarily from the manufacture and sale of automotive and electronic components, totaling CN¥3.23 billion. The company's net profit margin is a key metric to consider for evaluating its financial performance.

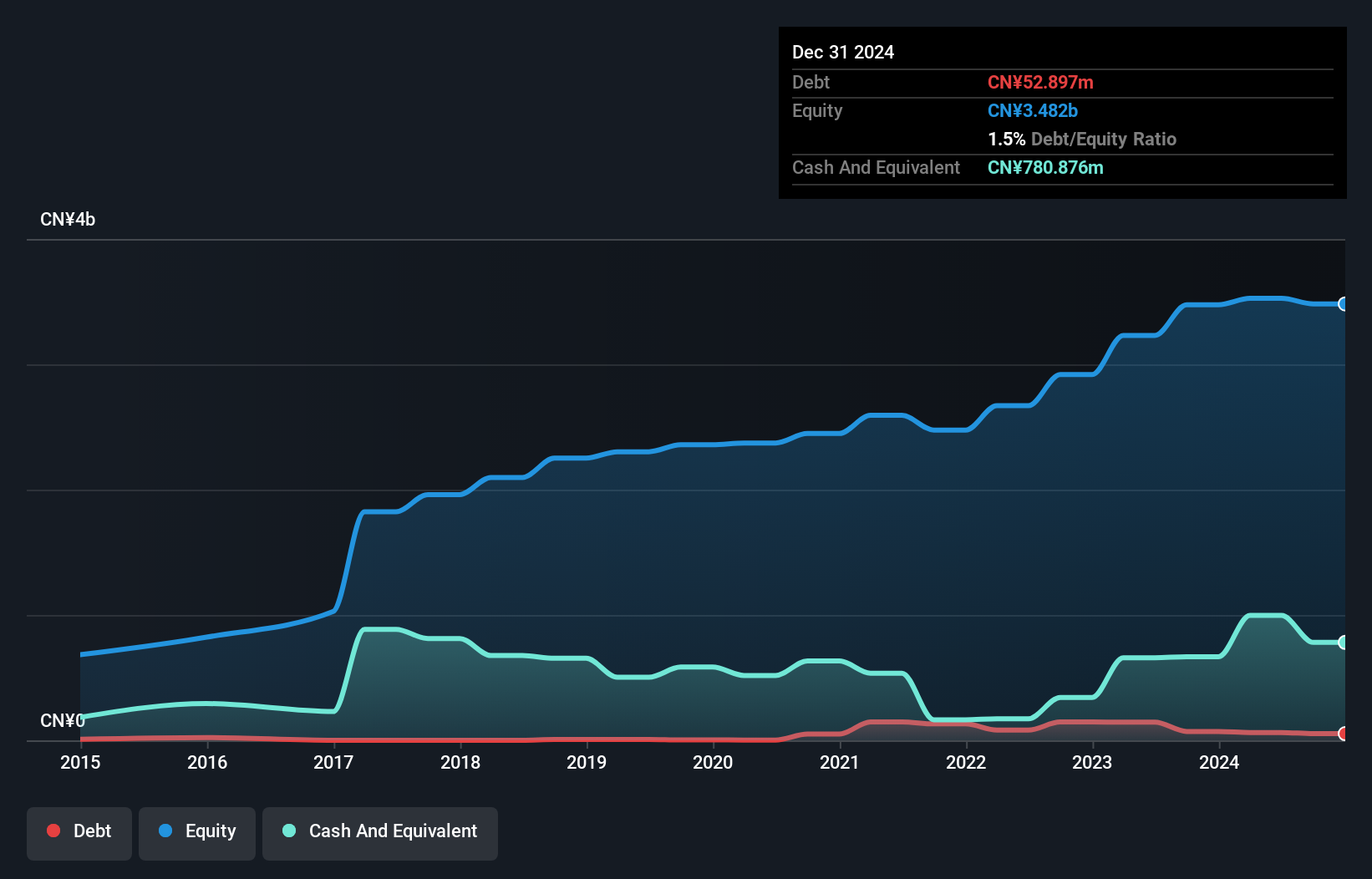

Xin Point Holdings, a promising player in the auto components sector, reported earnings growth of 27.4% over the past year, significantly outpacing the industry's -16.7%. The company's net income for H1 2024 was CNY 322.16 million, up from CNY 263.67 million last year, with basic EPS rising to CNY 0.321 from CNY 0.2635. Its debt-to-equity ratio has increased from 0.3 to 1.8 over five years but remains manageable given its strong cash position and high-quality earnings profile.

- Navigate through the intricacies of Xin Point Holdings with our comprehensive health report here.

Understand Xin Point Holdings' track record by examining our Past report.

Wanguo International Mining Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo International Mining Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in the People’s Republic of China and Solomon Islands, with a market cap of HK$7.09 billion.

Operations: Wanguo International Mining Group Limited generates revenue primarily from its Yifeng Project (CN¥749.25 million) and Solomon Project (CN¥912.63 million).

Wanguo Gold Group Limited, formerly Wanguo International Mining Group, has shown strong performance with earnings growth of 89.9% over the past year, outpacing the Metals and Mining industry’s 21.7%. The company reported half-year sales of CNY 927.86 million and a net income of CNY 254.27 million for June 2024, compared to CNY 581.19 million and CNY 147.11 million last year respectively. Additionally, Wanguo announced an interim dividend of HKD0.12 per share for the first half of the year ending June 2024.

COSCO SHIPPING International (Hong Kong) (SEHK:517)

Simply Wall St Value Rating: ★★★★★★

Overview: COSCO SHIPPING International (Hong Kong) Co., Ltd., an investment holding company, provides shipping services in the People’s Republic of China and internationally with a market cap of HK$6.39 billion.

Operations: COSCO SHIPPING International (Hong Kong) generates revenue mainly from shipping services, with Marine Equipment and Spare Parts contributing HK$1.73 billion and Coatings adding HK$992.94 million. The company also earns from General Trading (HK$478.19 million), Insurance Brokerage (HK$175.51 million), and Ship Trading Agency (HK$99.97 million).

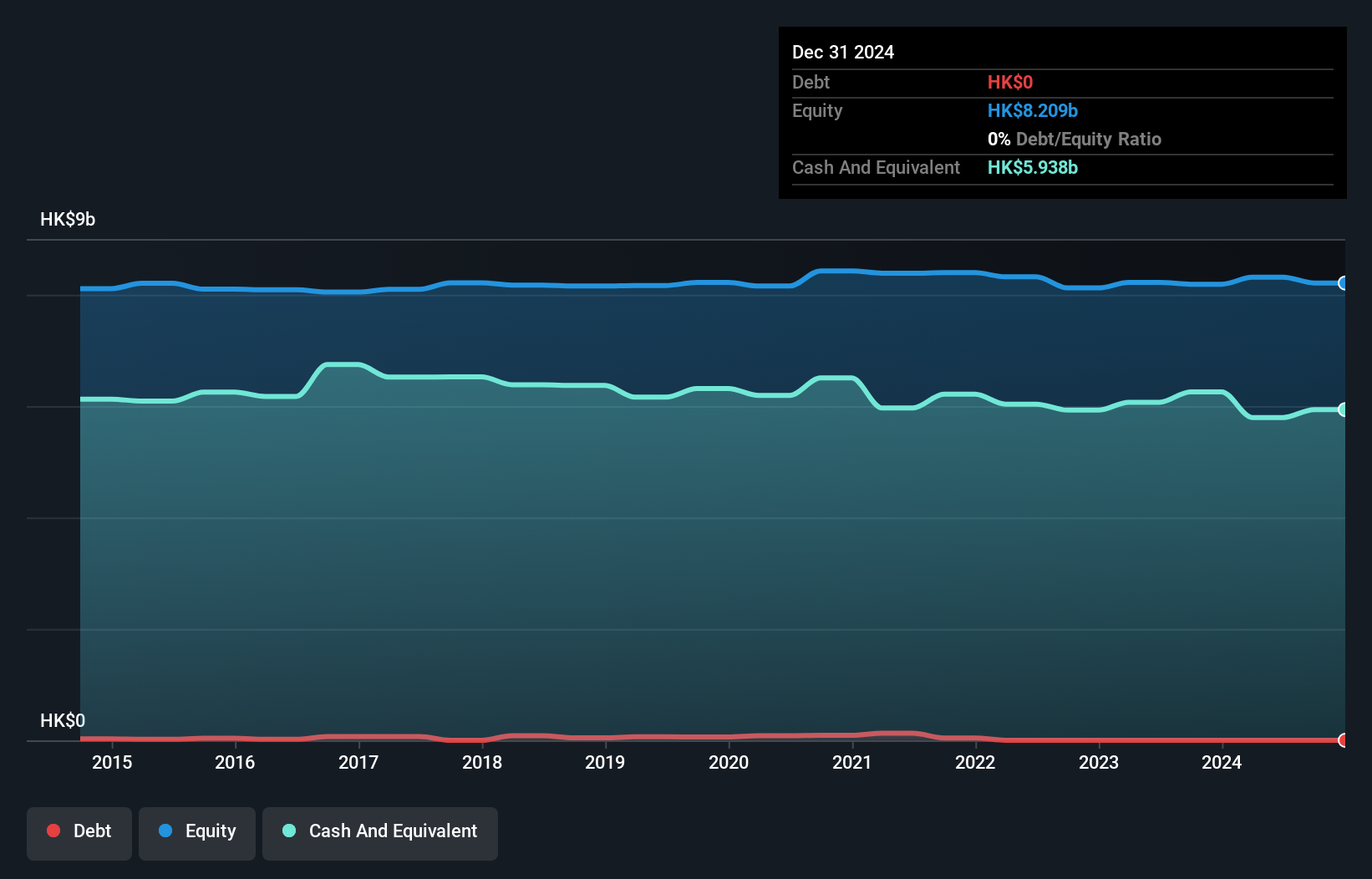

COSCO SHIPPING International (Hong Kong) is trading at 30% below our fair value estimate, making it an intriguing option. The company reported HK$1.75 billion in sales for the first half of 2024, up from HK$1.62 billion last year. Net income increased to HK$388 million compared to HK$336 million previously, reflecting strong performance with earnings per share rising to HKD 0.2647 from HKD 0.2269 a year ago. Additionally, COSCO has no debt and its earnings growth of 24.8% outpaced the infrastructure industry’s 9.3%.

Where To Now?

- Click through to start exploring the rest of the 166 SEHK Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com