As global markets react to anticipated interest rate cuts and small-cap stocks outperform their larger counterparts, the Hong Kong market presents unique opportunities for discerning investors. In this dynamic environment, identifying stocks with strong fundamentals and growth potential becomes crucial for navigating the evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Wanguo International Mining Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo International Mining Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market cap of HK$6.54 billion.

Operations: The company generates revenue primarily from its Yifeng Project (CN¥749.25 million) and Solomon Project (CN¥912.63 million).

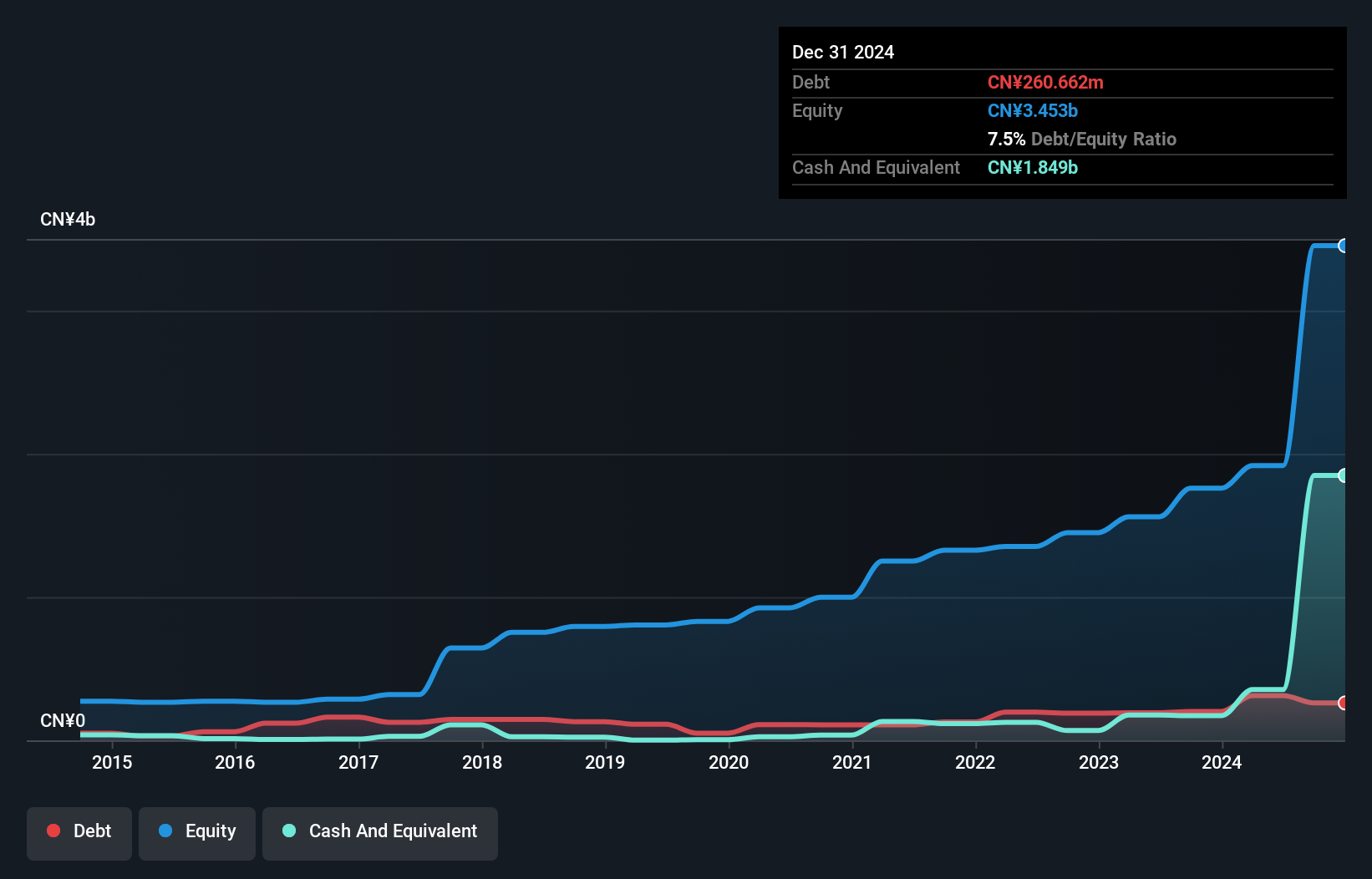

Wanguo International Mining Group, now Wanguo Gold Group, has shown impressive growth with earnings surging 89.9% in the past year, outpacing the industry average of 14.8%. Recent half-year results highlight a net income jump to CNY 254.27 million from CNY 147.11 million last year and sales rising to CNY 927.86 million from CNY 581.19 million previously reported. The company declared an interim dividend of HKD 0.12 per share and maintains a strong cash position relative to its debt levels.

COSCO SHIPPING International (Hong Kong) (SEHK:517)

Simply Wall St Value Rating: ★★★★★★

Overview: COSCO SHIPPING International (Hong Kong) Co., Ltd. is an investment holding company that offers a range of shipping services both in China and globally, with a market cap of HK$6.44 billion.

Operations: COSCO SHIPPING International (Hong Kong) generates revenue from various segments including General Trading (HK$478.19 million), Coatings (HK$992.94 million), Insurance Brokerage (HK$175.51 million), Ship Trading Agency (HK$99.97 million), and Marine Equipment and Spare Parts (HK$1.73 billion).

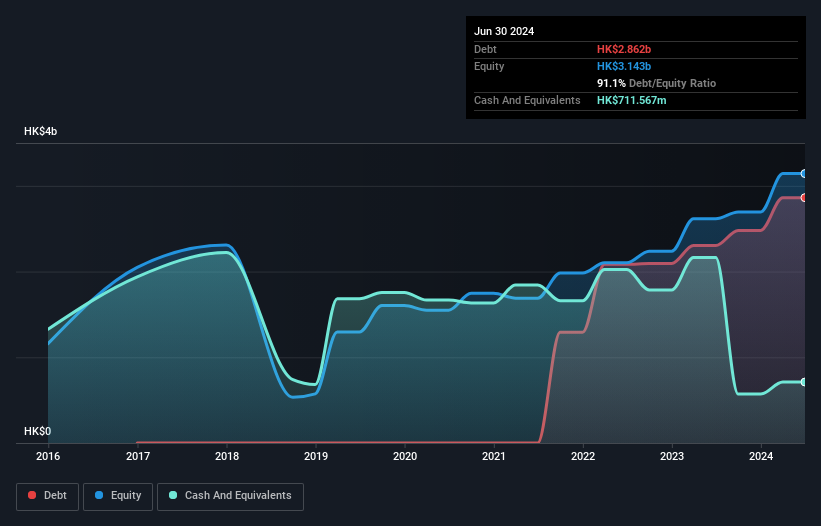

COSCO SHIPPING International (Hong Kong) has shown strong performance with a 24.8% earnings growth over the past year, surpassing the Infrastructure industry’s 9.3%. The company is debt-free, contrasting its debt to equity ratio of 0.8 five years ago. Recently, it announced an interim dividend of HKD 0.265 per share for the first half of 2024 and reported sales of HKD1.75 billion and net income of HKD388 million for the same period, indicating solid financial health and shareholder returns.

- Unlock comprehensive insights into our analysis of COSCO SHIPPING International (Hong Kong) stock in this health report.

Understand COSCO SHIPPING International (Hong Kong)'s track record by examining our Past report.

China Tobacco International (HK) (SEHK:6055)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Tobacco International (HK) Company Limited engages in the tobacco business with a market cap of HK$10.87 billion.

Operations: The company generates revenue from five primary segments: Brazil Operation Business (HK$766.28 million), Cigarettes Export Business (HK$1.21 billion), New Tobacco Products Export Business (HK$129.98 million), Tobacco Leaf Products Export Business (HK$1.65 billion), and Tobacco Leaf Products Import Business (HK$8.08 billion).

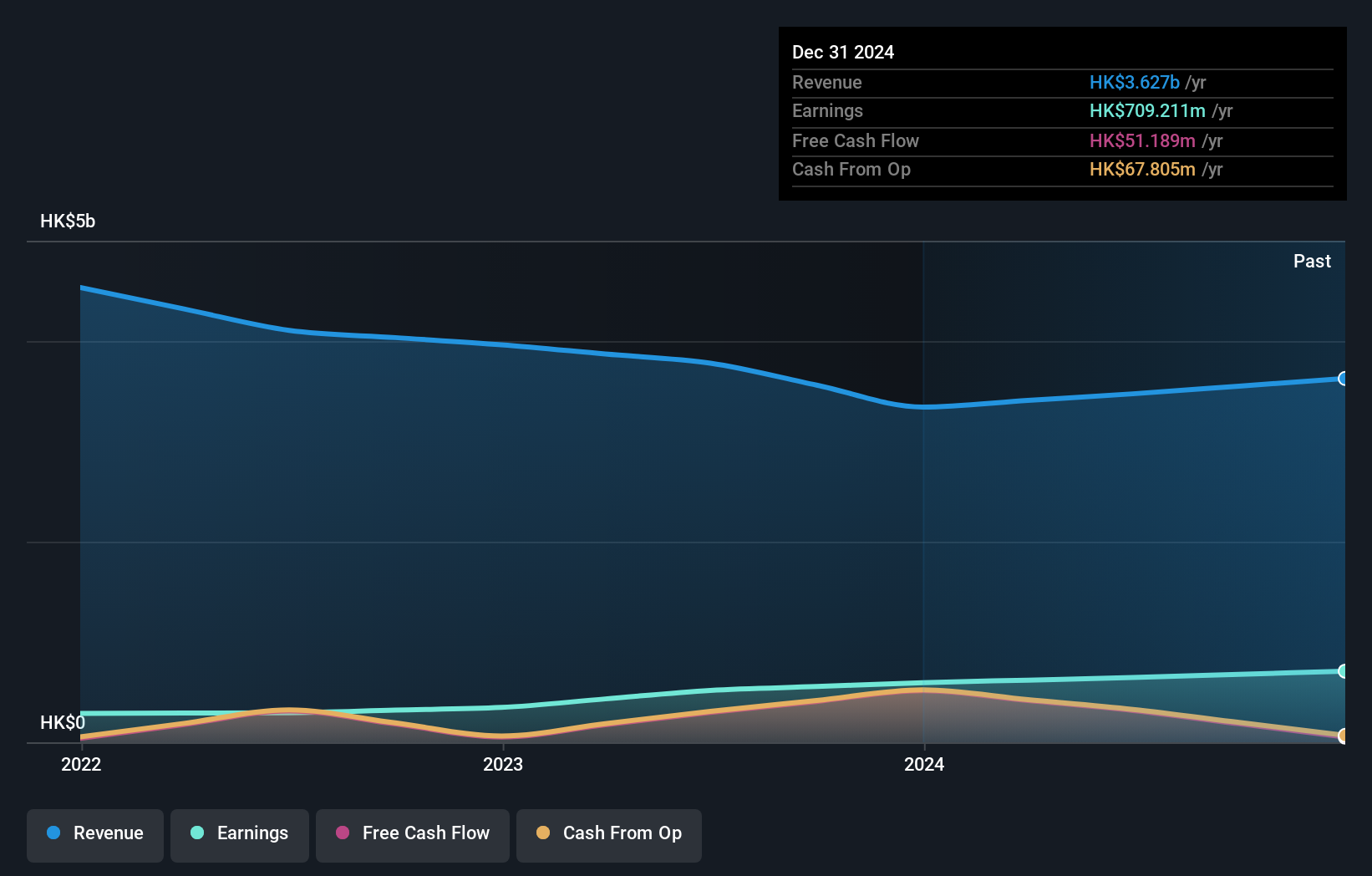

China Tobacco International (HK) has shown impressive growth, with earnings increasing by 59.7% over the past year to HK$643.34 million from HK$456.95 million a year ago. Sales for the first half of 2024 reached HK$8.70 billion, up from HK$7.74 billion in the same period last year, reflecting strong performance in both cigarette and tobacco leaf product segments. The company also declared an interim dividend of HKD 0.15 per share, reinforcing investor confidence amid robust revenue and profit increases driven by strategic optimization and favorable market conditions post-pandemic recovery.

Next Steps

- Dive into all 178 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com