As global markets react to anticipated interest rate cuts and small-cap stocks outperform their larger counterparts, the Hong Kong market presents a unique landscape for discovering hidden opportunities. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to capitalize on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Xin Point Holdings (SEHK:1571)

Simply Wall St Value Rating: ★★★★★☆

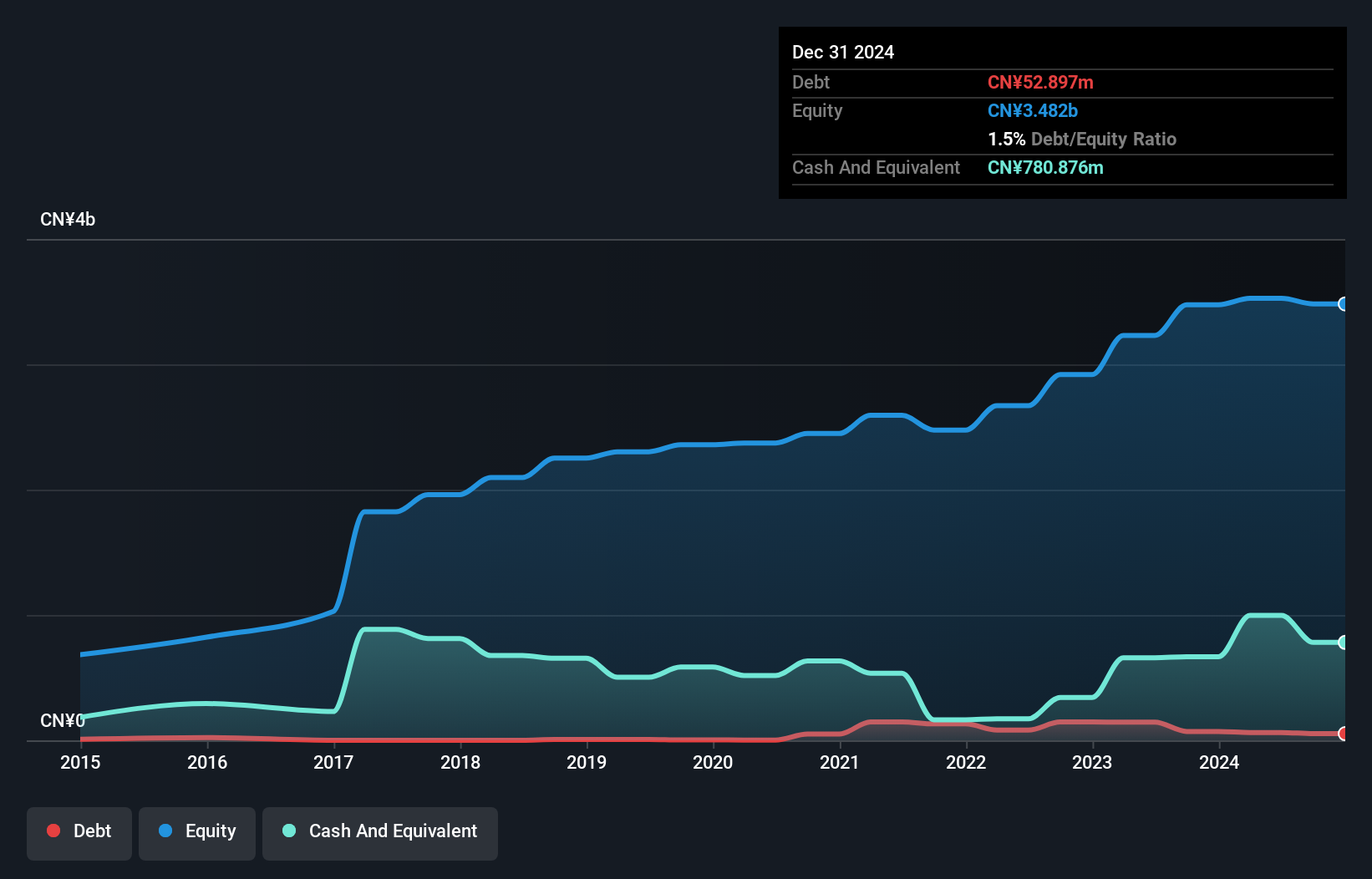

Overview: Xin Point Holdings Limited is an investment holding company that manufactures and sells automotive and electronic components in China, North America, Europe, and internationally with a market cap of HK$3.34 billion.

Operations: Xin Point Holdings generates revenue primarily from the manufacture and sale of automotive and electronic components, amounting to CN¥3.23 billion.

Xin Point Holdings reported half-year sales of CNY 1.65 billion, up from CNY 1.52 billion last year, with net income rising to CNY 322.16 million from CNY 263.67 million. The company approved a final dividend of HKD 0.25 per share for the year ended December 2023 and announced an interim dividend of HKD 0.2 per share for June 2024, payable in October. Earnings growth over the past year was robust at 27%, significantly outpacing the Auto Components industry's -16%.

Bank of Tianjin (SEHK:1578)

Simply Wall St Value Rating: ★★★★★★

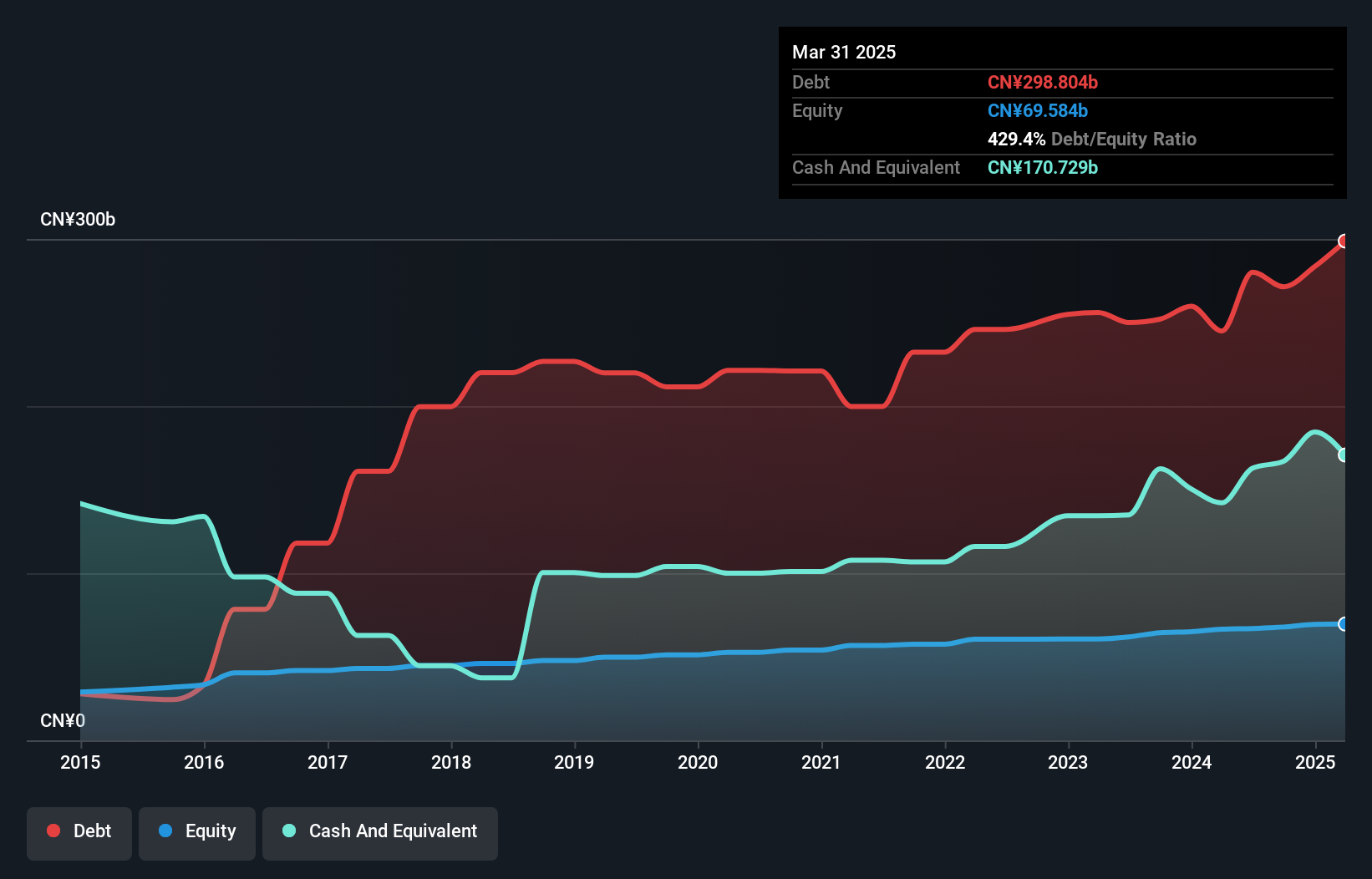

Overview: Bank of Tianjin Co., Ltd. offers a variety of banking and financial services mainly within the People’s Republic of China, with a market cap of approximately HK$10.62 billion.

Operations: Bank of Tianjin Co., Ltd. generates revenue primarily through its diverse banking and financial services within China. The company’s financial performance includes net profit margins that fluctuate, reflecting changes in operational efficiency and market conditions.

Boasting total assets of CN¥871.1B and equity of CN¥66.5B, Bank of Tianjin stands out with deposits amounting to CN¥551.8B and loans at CN¥463.2B. The bank's net interest margin is 1.7%, while its allowance for bad loans is sufficient at 1.7% of total loans, reflecting prudent risk management practices. Over the past year, earnings surged by 22.5%, outpacing the industry average growth rate significantly, showcasing robust performance in a competitive market environment.

- Click here and access our complete health analysis report to understand the dynamics of Bank of Tianjin.

Explore historical data to track Bank of Tianjin's performance over time in our Past section.

COSCO SHIPPING International (Hong Kong) (SEHK:517)

Simply Wall St Value Rating: ★★★★★★

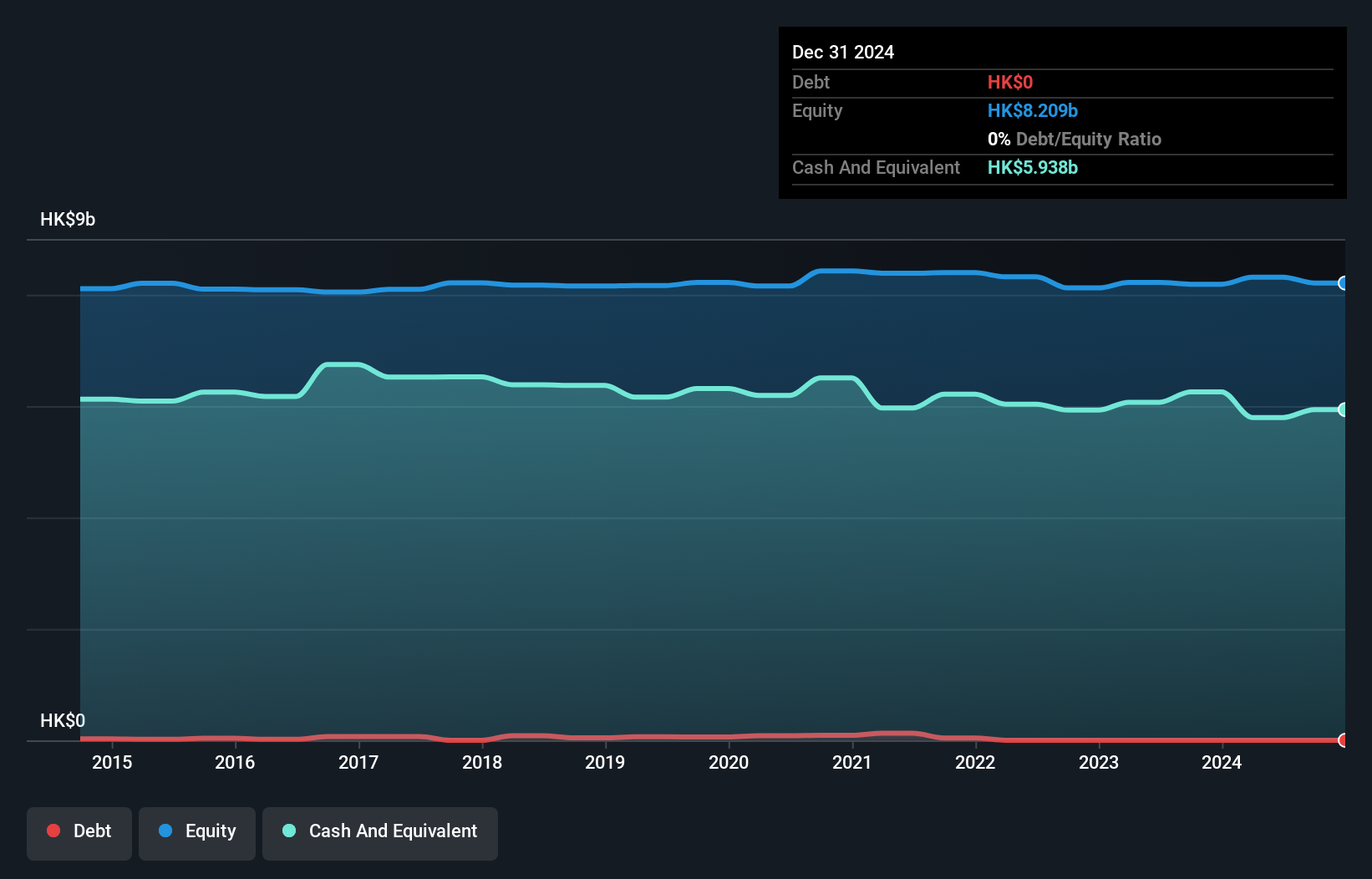

Overview: COSCO SHIPPING International (Hong Kong) Co., Ltd., an investment holding company, provides shipping services in the People’s Republic of China and internationally, with a market cap of HK$6.26 billion.

Operations: COSCO SHIPPING International (Hong Kong) Co., Ltd. generates revenue primarily from marine equipment and spare parts (HK$1.73 billion) and coatings (HK$992.94 million). The company also earns from insurance brokerage (HK$175.51 million), ship trading agency services (HK$99.97 million), and general trading activities (HK$478.19 million).

COSCO SHIPPING International (Hong Kong) has shown impressive earnings growth of 24.8% over the past year, outpacing the Infrastructure industry's 9.3%. The company reported net income of HK$388.04 million for the half-year ending June 2024, up from HK$335.92 million a year earlier. Trading at 32.4% below its estimated fair value and being debt-free enhances its appeal, especially with a recent interim dividend announcement of HK$0.265 per share for shareholders on record by September 12, 2024.

- Delve into the full analysis health report here for a deeper understanding of COSCO SHIPPING International (Hong Kong).

Learn about COSCO SHIPPING International (Hong Kong)'s historical performance.

Key Takeaways

- Dive into all 172 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com