As global markets react to anticipated interest rate cuts and economic indicators show mixed signals, the Hong Kong market presents a unique landscape for investors seeking opportunities in lesser-known stocks. Small-cap companies, often overlooked, can offer significant potential when market conditions align favorably with their growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Xin Point Holdings (SEHK:1571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xin Point Holdings Limited, with a market cap of HK$3.26 billion, manufactures and sells automotive and electronic components in China, North America, Europe, and internationally.

Operations: Xin Point Holdings generates revenue primarily from the sale of automotive and electronic components across various international markets. The company's financial performance includes a notable net profit margin trend, reflecting its cost management and pricing strategies.

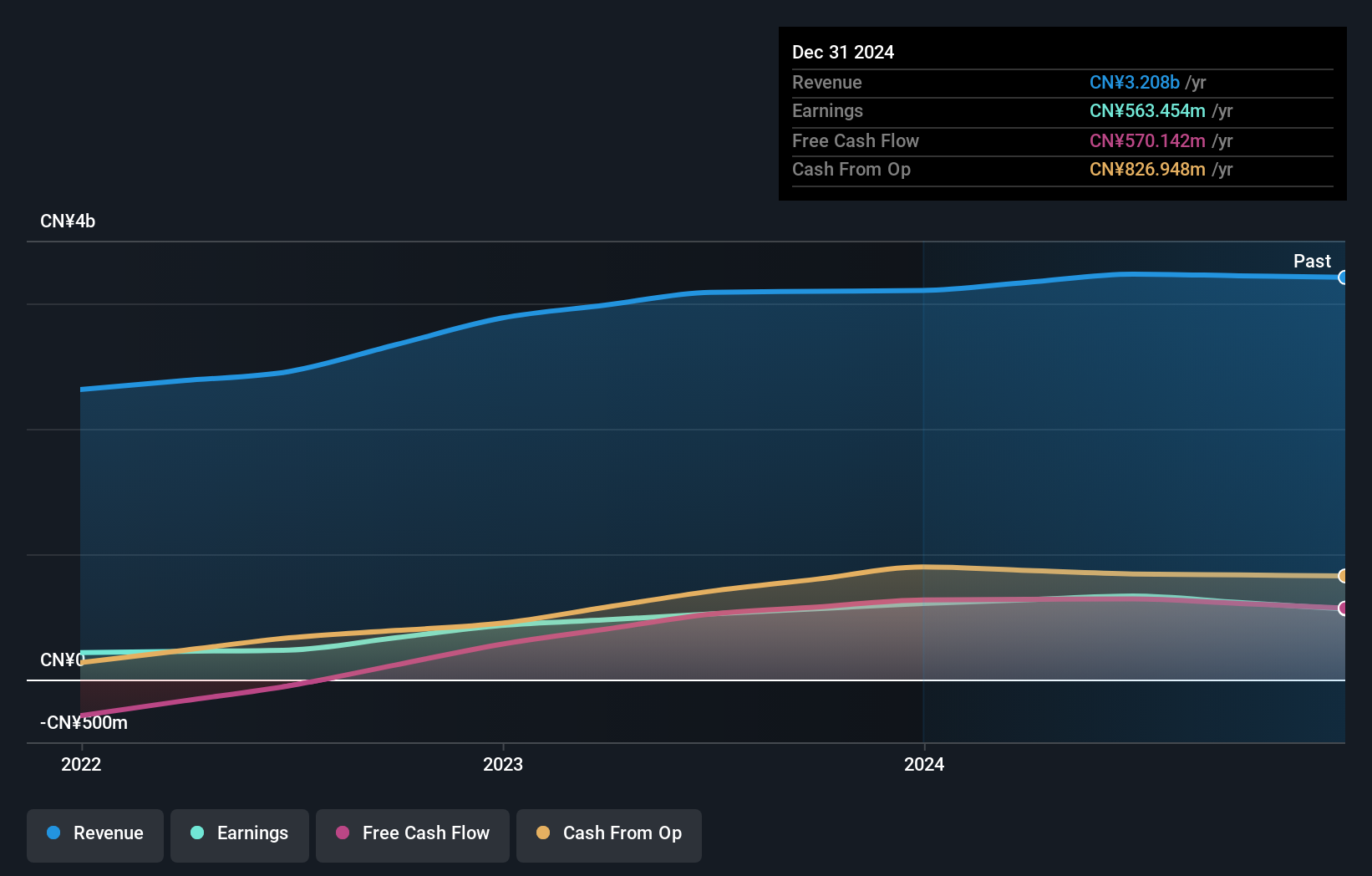

Xin Point Holdings has shown impressive earnings growth of 27.4% over the past year, far outpacing the Auto Components industry's -16.7%. Trading at 76.2% below its estimated fair value, this company appears undervalued. Recent financials reveal net income for the first half of 2024 at CNY 322.16 million, up from CNY 263.67 million a year ago, with basic earnings per share rising to CNY 0.321 from CNY 0.2635 last year.

- Delve into the full analysis health report here for a deeper understanding of Xin Point Holdings.

Understand Xin Point Holdings' track record by examining our Past report.

ZONQING Environmental (SEHK:1855)

Simply Wall St Value Rating: ★★★★★☆

Overview: ZONQING Environmental Limited, with a market cap of HK$6.96 billion, offers construction and maintenance services for landscaping, ecological restoration, and public work projects in the People’s Republic of China through its subsidiaries.

Operations: ZONQING Environmental Limited generates revenue primarily from construction and maintenance services for landscaping, ecological restoration, and public work projects in China. The company has a market cap of HK$6.96 billion.

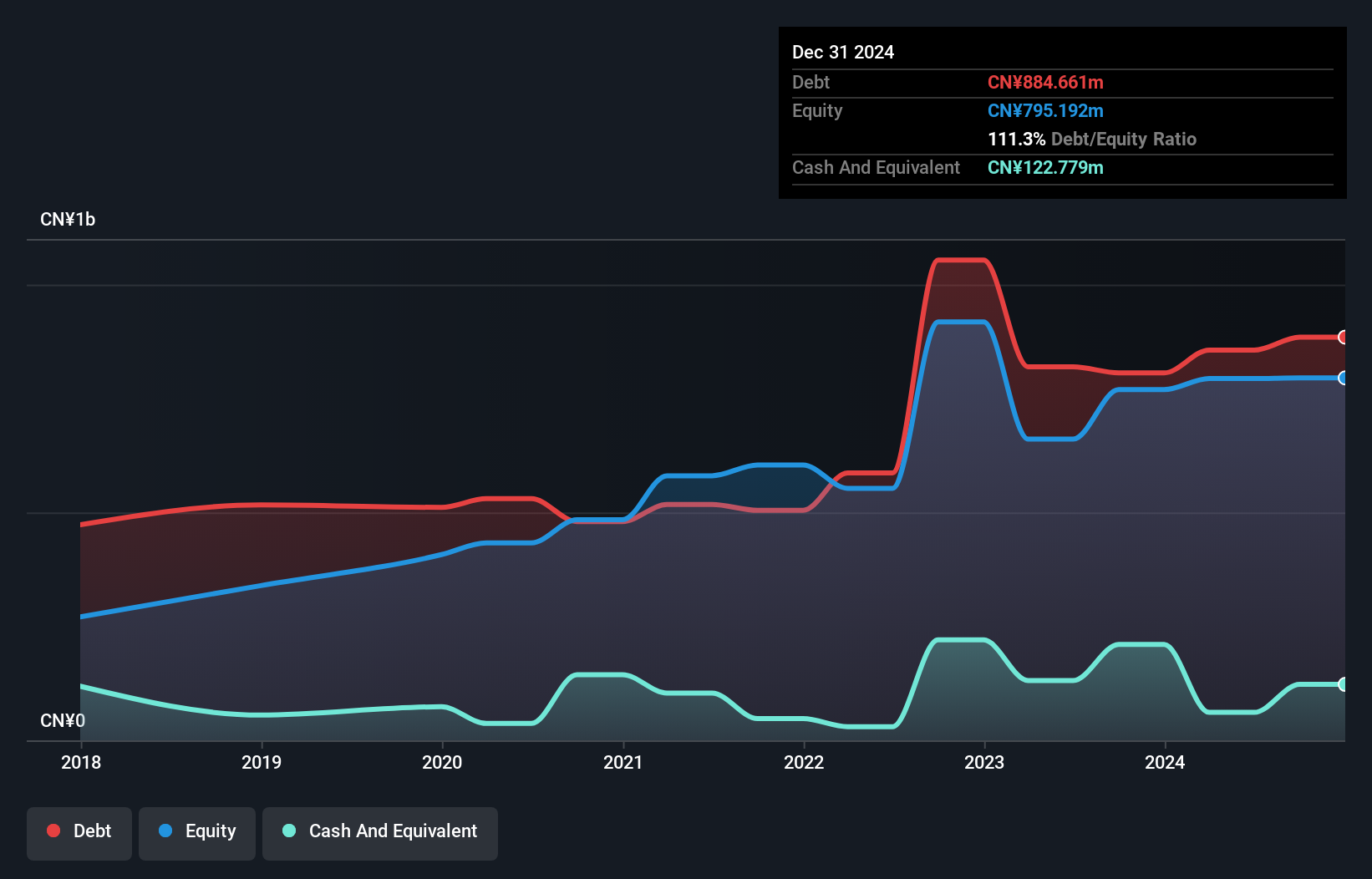

ZONQING Environmental reported earnings for the first half of 2024, showing sales of CNY 775.65 million, down from CNY 909.82 million last year. Net income was CNY 34.26 million compared to CNY 37.1 million previously, with basic and diluted EPS both at CNY 0.12 versus CNY 0.13 a year ago. The company approved a final dividend of RMB 0.071 per share at its AGM in June, reflecting steady shareholder returns amidst fluctuating performance figures.

COSCO SHIPPING International (Hong Kong) (SEHK:517)

Simply Wall St Value Rating: ★★★★★★

Overview: COSCO SHIPPING International (Hong Kong) Co., Ltd. is an investment holding company that offers shipping services both within the People's Republic of China and internationally, with a market cap of HK$5.85 billion.

Operations: COSCO SHIPPING International (Hong Kong) Co., Ltd. generates revenue from its shipping services in the People's Republic of China and internationally. The company has a market cap of HK$5.85 billion.

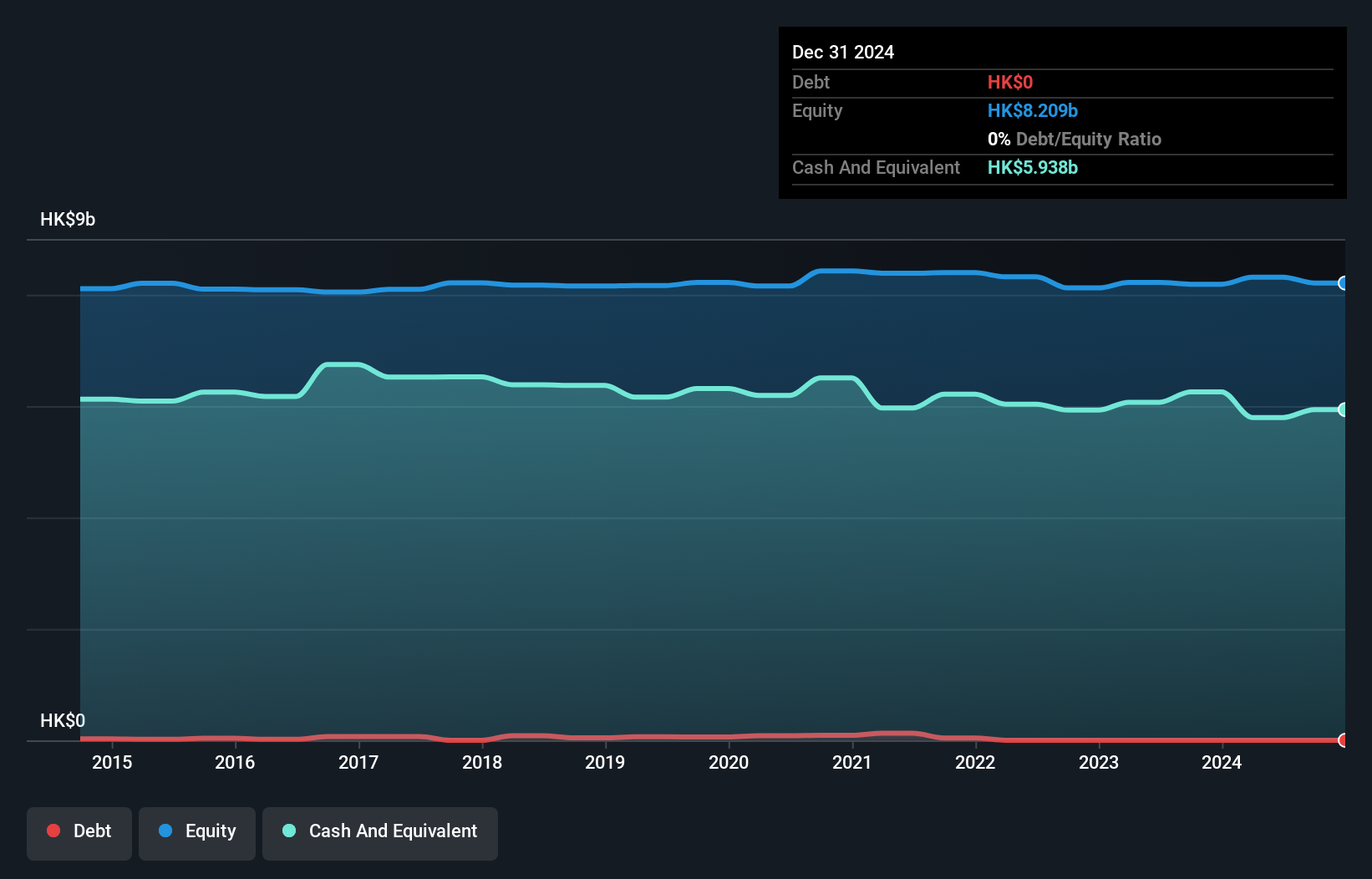

COSCO SHIPPING International (Hong Kong) reported strong earnings growth of 24.8% over the past year, surpassing the Infrastructure industry average of 9.3%. The company has no debt compared to a debt-to-equity ratio of 0.8 five years ago, indicating robust financial health. Recent interim results show sales increased to HKD 1.75 billion from HKD 1.62 billion last year, with net income rising to HKD 388 million from HKD 336 million previously.

- Dive into the specifics of COSCO SHIPPING International (Hong Kong) here with our thorough health report.

Learn about COSCO SHIPPING International (Hong Kong)'s historical performance.

Seize The Opportunity

- Click through to start exploring the rest of the 173 SEHK Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com