What trends should we look for it we want to identify stocks that can multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. That's why when we briefly looked at Perennial Energy Holdings' (HKG:2798) ROCE trend, we were very happy with what we saw.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Perennial Energy Holdings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.26 = CN¥853m ÷ (CN¥4.6b - CN¥1.4b) (Based on the trailing twelve months to June 2024).

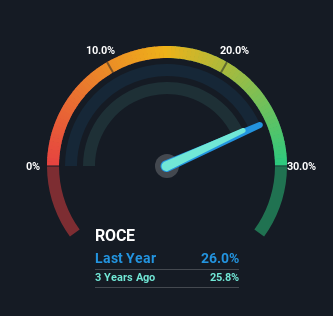

Thus, Perennial Energy Holdings has an ROCE of 26%. In absolute terms that's a great return and it's even better than the Metals and Mining industry average of 11%.

See our latest analysis for Perennial Energy Holdings

Historical performance is a great place to start when researching a stock so above you can see the gauge for Perennial Energy Holdings' ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Perennial Energy Holdings.

What Does the ROCE Trend For Perennial Energy Holdings Tell Us?

Perennial Energy Holdings deserves to be commended in regards to it's returns. Over the past five years, ROCE has remained relatively flat at around 26% and the business has deployed 194% more capital into its operations. Returns like this are the envy of most businesses and given it has repeatedly reinvested at these rates, that's even better. If Perennial Energy Holdings can keep this up, we'd be very optimistic about its future.

Our Take On Perennial Energy Holdings' ROCE

In the end, the company has proven it can reinvest it's capital at high rates of returns, which you'll remember is a trait of a multi-bagger. However, despite the favorable fundamentals, the stock has fallen 37% over the last five years, so there might be an opportunity here for astute investors. For that reason, savvy investors might want to look further into this company in case it's a prime investment.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 2 warning signs for Perennial Energy Holdings (of which 1 is potentially serious!) that you should know about.

Perennial Energy Holdings is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.