As global markets continue to navigate a landscape of economic optimism and cautious recovery, the Hong Kong market has shown resilience with the Hang Seng Index gaining 1.99% recently. This positive momentum provides a fertile ground for investors seeking hidden gems among small-cap stocks. In this dynamic environment, identifying promising stocks often hinges on factors such as robust fundamentals, innovative business models, and strong growth potential. Let's explore three lesser-known but compelling stocks in Hong Kong that could offer unique opportunities in August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Time Interconnect Technology Limited, an investment holding company, manufactures and sells cable assembly and networking cable products internationally, with a market cap of HK$7.26 billion.

Operations: The company generates revenue primarily from its Server (HK$2.98 billion), Digital Cable (HK$1.18 billion), and Cable Assembly (HK$2.31 billion) segments, with a minor adjustment for eliminations (-HK$25.44 million).

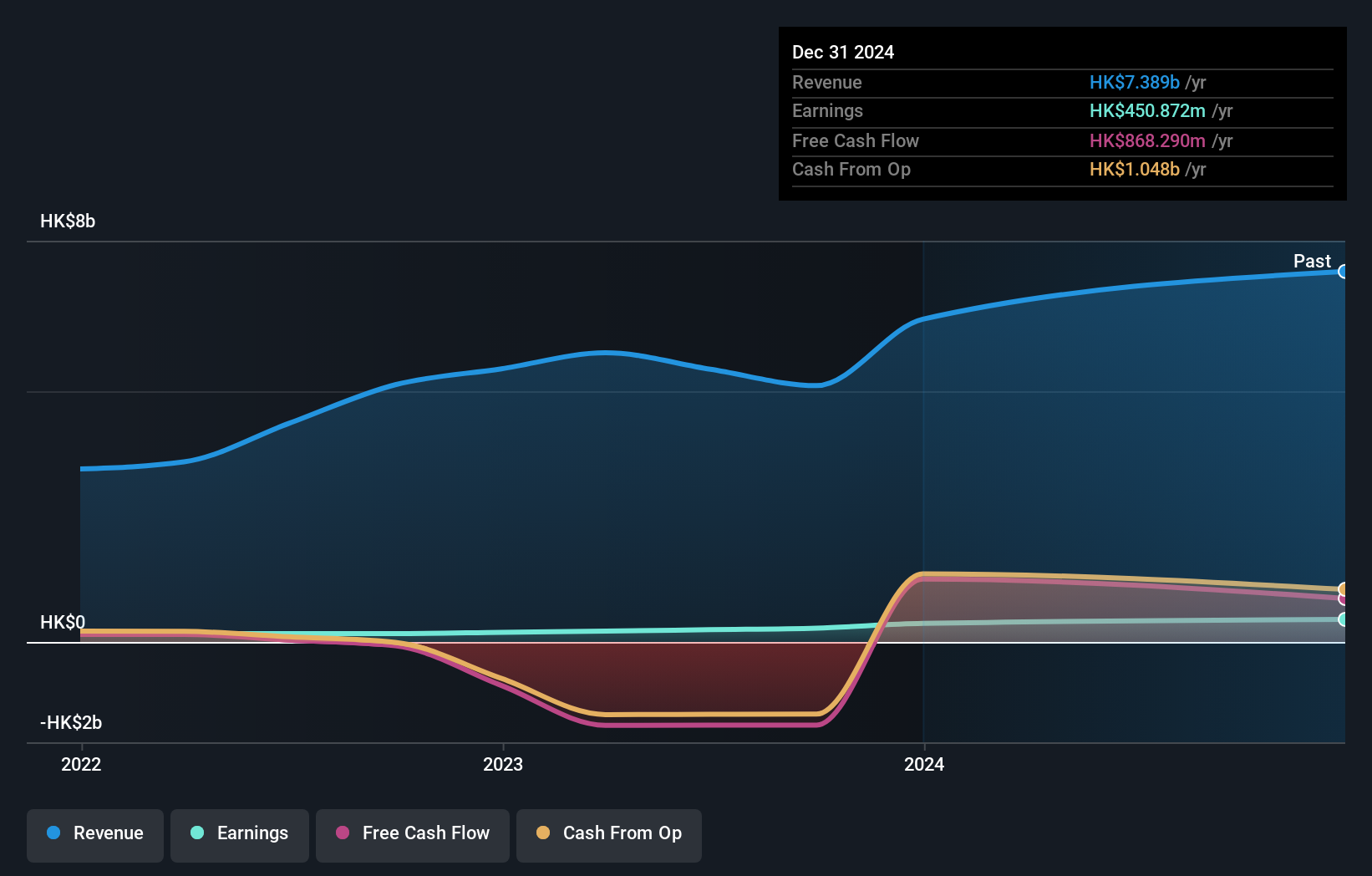

Time Interconnect Technology, with a net debt to equity ratio of 184.9%, has seen its earnings grow by 93.1% over the past year, outpacing the Electrical industry’s 11%. Despite high debt levels, interest payments are well covered by EBIT at 9x coverage. The company recently projected a net profit increase of up to 40% for the six months ending June 2024 due to higher revenue from medical equipment and data center cable assembly sectors.

- Unlock comprehensive insights into our analysis of Time Interconnect Technology stock in this health report.

Gain insights into Time Interconnect Technology's past trends and performance with our Past report.

First Tractor (SEHK:38)

Simply Wall St Value Rating: ★★★★★★

Overview: First Tractor Company Limited engages in the research and development, manufacture, and sale of agricultural and power machinery, and related products worldwide, with a market cap of HK$14.38 billion.

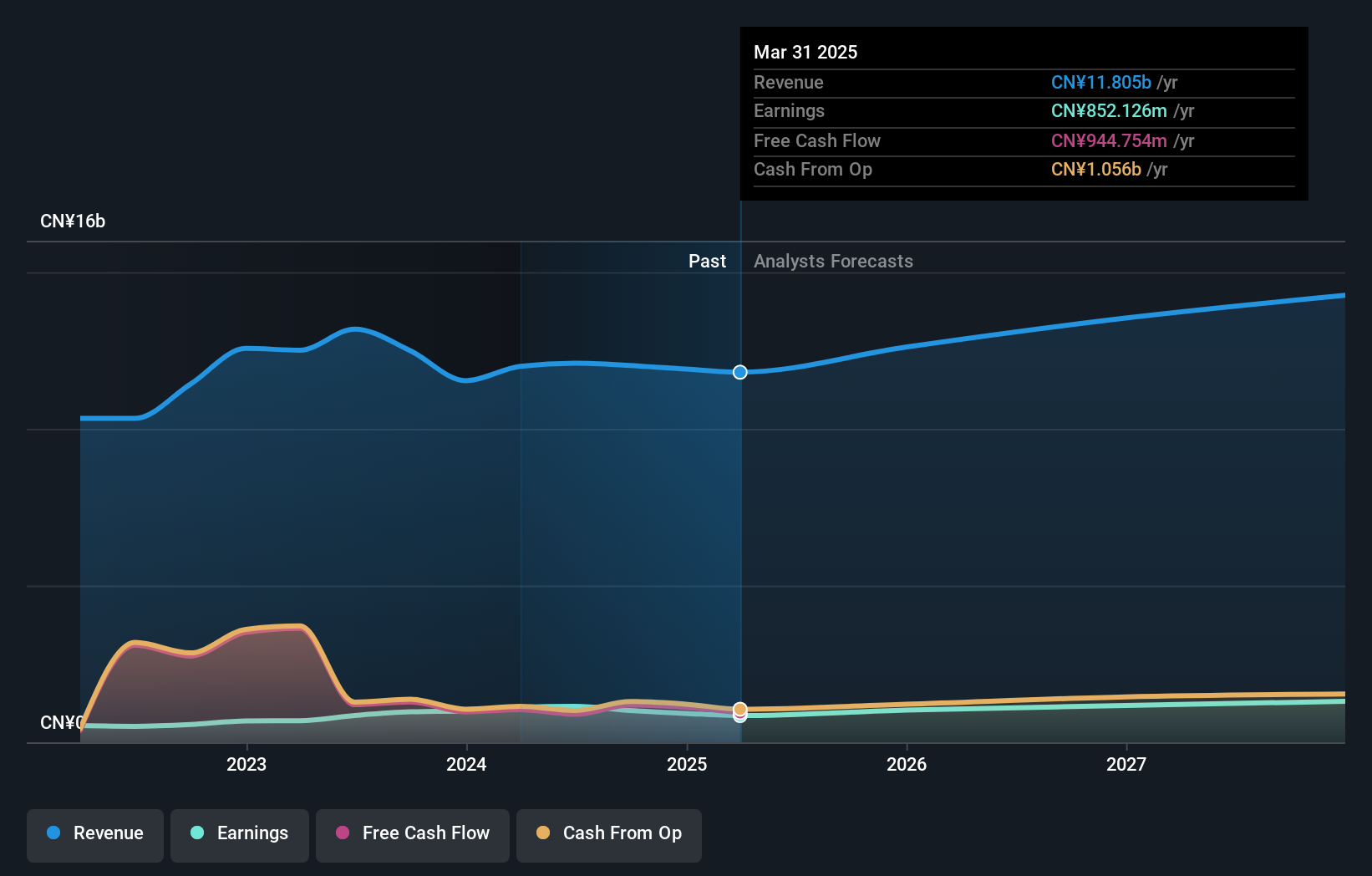

Operations: First Tractor generates revenue primarily from the sale of agricultural and power machinery. The company’s net profit margin is 5.25%.

First Tractor has shown impressive earnings growth of 61.9% over the past year, outpacing the Machinery industry’s 4.1%. Its debt-to-equity ratio has significantly improved from 84% to 2.9% in five years, indicating stronger financial health. The company trades at a favorable P/E ratio of 6.8x compared to the Hong Kong market's average of 8.8x, suggesting it is undervalued relative to peers. Recent board changes include electing Li Xiaoyu as chairman and adding new committee members for enhanced governance and strategic direction.

- Click here to discover the nuances of First Tractor with our detailed analytical health report.

Explore historical data to track First Tractor's performance over time in our Past section.

China Tobacco International (HK) (SEHK:6055)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Tobacco International (HK) Company Limited engages in the tobacco business with a market cap of HK$10.60 billion.

Operations: The company generates revenue primarily from its Tobacco Leaf Products Import Business (HK$8.08 billion), followed by the Tobacco Leaf Products Export Business (HK$1.65 billion) and Cigarettes Export Business (HK$1.21 billion). The New Tobacco Products Export Business and Brazil Operation Business contribute HK$129.98 million and HK$766.28 million, respectively.

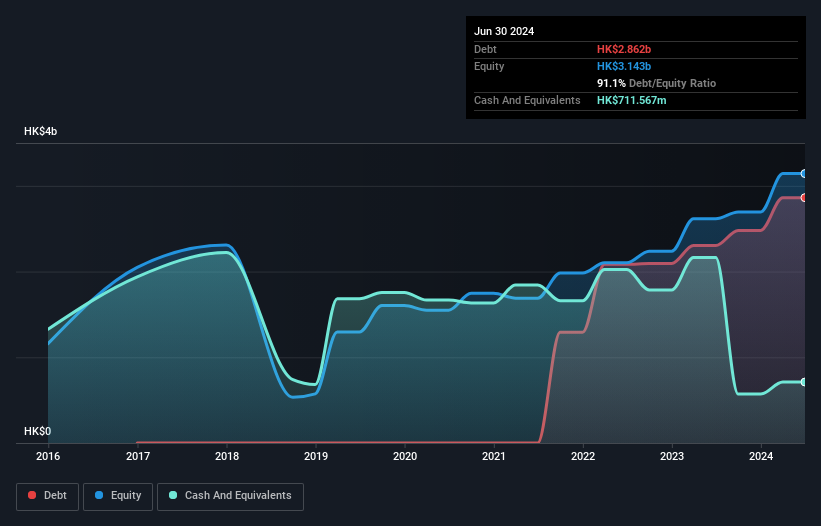

China Tobacco International (HK) has shown robust performance with earnings growth of 59.7% over the past year, outpacing the Retail Distributors industry’s 48.1%. The company’s net debt to equity ratio stands at a high 70.9%, reflecting significant leverage, yet its interest payments are well covered by EBIT at a multiple of 16.8x. Notably, the firm is trading at a substantial discount, approximately 77.5% below its estimated fair value, indicating potential for future appreciation despite current high debt levels and growth forecasts of 15.54% annually.

- Click here and access our complete health analysis report to understand the dynamics of China Tobacco International (HK).

Learn about China Tobacco International (HK)'s historical performance.

Turning Ideas Into Actions

- Unlock our comprehensive list of 170 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com