As global markets continue to navigate the complex landscape of economic indicators and investor sentiment, Hong Kong's Hang Seng Index has shown resilience with a 1.99% gain, reflecting cautious optimism amid mixed economic data from China. In this environment, identifying promising small-cap stocks becomes crucial for investors seeking opportunities in less saturated segments of the market. In such conditions, a good stock typically demonstrates strong fundamentals and growth potential that can withstand broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

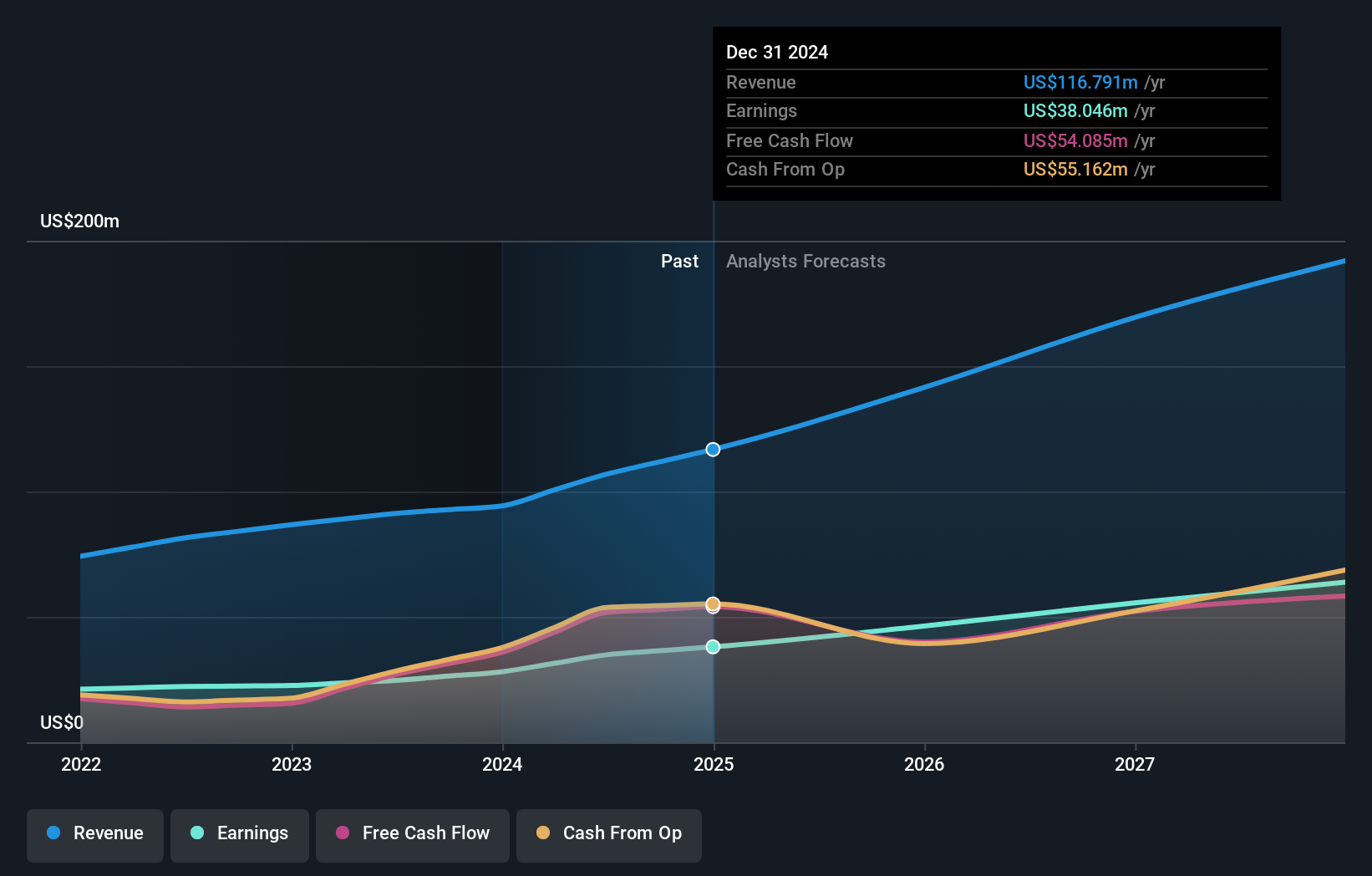

Overview: Plover Bay Technologies Limited, an investment holding company with a market cap of HK$4.35 billion, designs, develops, and markets software-defined wide area network routers.

Operations: Plover Bay Technologies generates revenue from three primary segments: Sales of SD-WAN Routers - Fixed First Connectivity ($15.19 million), Sales of SD-WAN Routers - Mobile First Connectivity ($59.87 million), and Software Licenses and Warranty and Support Services ($31.86 million).

Plover Bay Technologies has shown impressive growth, with earnings increasing by 41.4% over the past year, outpacing the Communications industry’s 10.6%. The company reported sales of US$57.3 million for H1 2024, up from US$44.63 million a year ago, and net income rose to US$19.1 million from US$12.32 million in the same period last year. Additionally, Plover Bay announced an interim dividend of HKD 0.1083 per share for June 2024 and is trading at 59% below its estimated fair value.

- Get an in-depth perspective on Plover Bay Technologies' performance by reading our health report here.

Assess Plover Bay Technologies' past performance with our detailed historical performance reports.

Bank of Tianjin (SEHK:1578)

Simply Wall St Value Rating: ★★★★★★

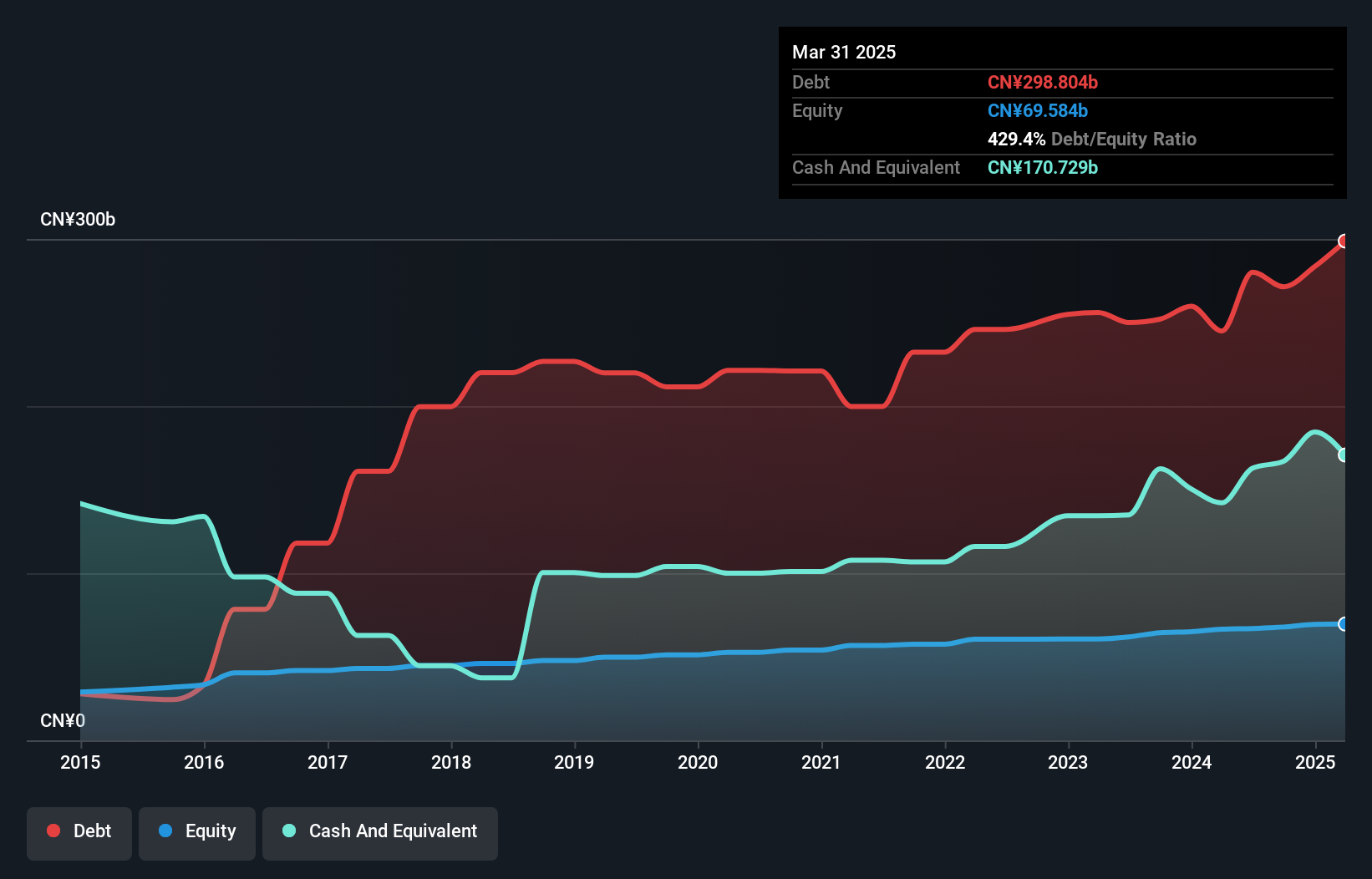

Overview: Bank of Tianjin Co., Ltd. offers a variety of banking and financial services mainly in the People’s Republic of China, with a market cap of approximately HK$10.08 billion.

Operations: Bank of Tianjin Co., Ltd. generates revenue primarily from interest income, fees, and commissions related to its banking services in the People’s Republic of China. The company has a market cap of approximately HK$10.08 billion.

Bank of Tianjin, with total assets of CN¥871.1B and equity of CN¥66.5B, has deposits amounting to CN¥551.8B and loans at CN¥463.2B. The net interest margin stands at 1.7%, while bad loans are appropriately managed at 1.7% of total loans with a sufficient allowance covering 168%. The bank's earnings growth over the past year was a notable 22.5%, outpacing the industry average of 1.6%. Recent board changes include appointing Mr. GU Zhaoyang as an independent non-executive director in July 2024, highlighting ongoing strategic adjustments within the company’s leadership structure.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

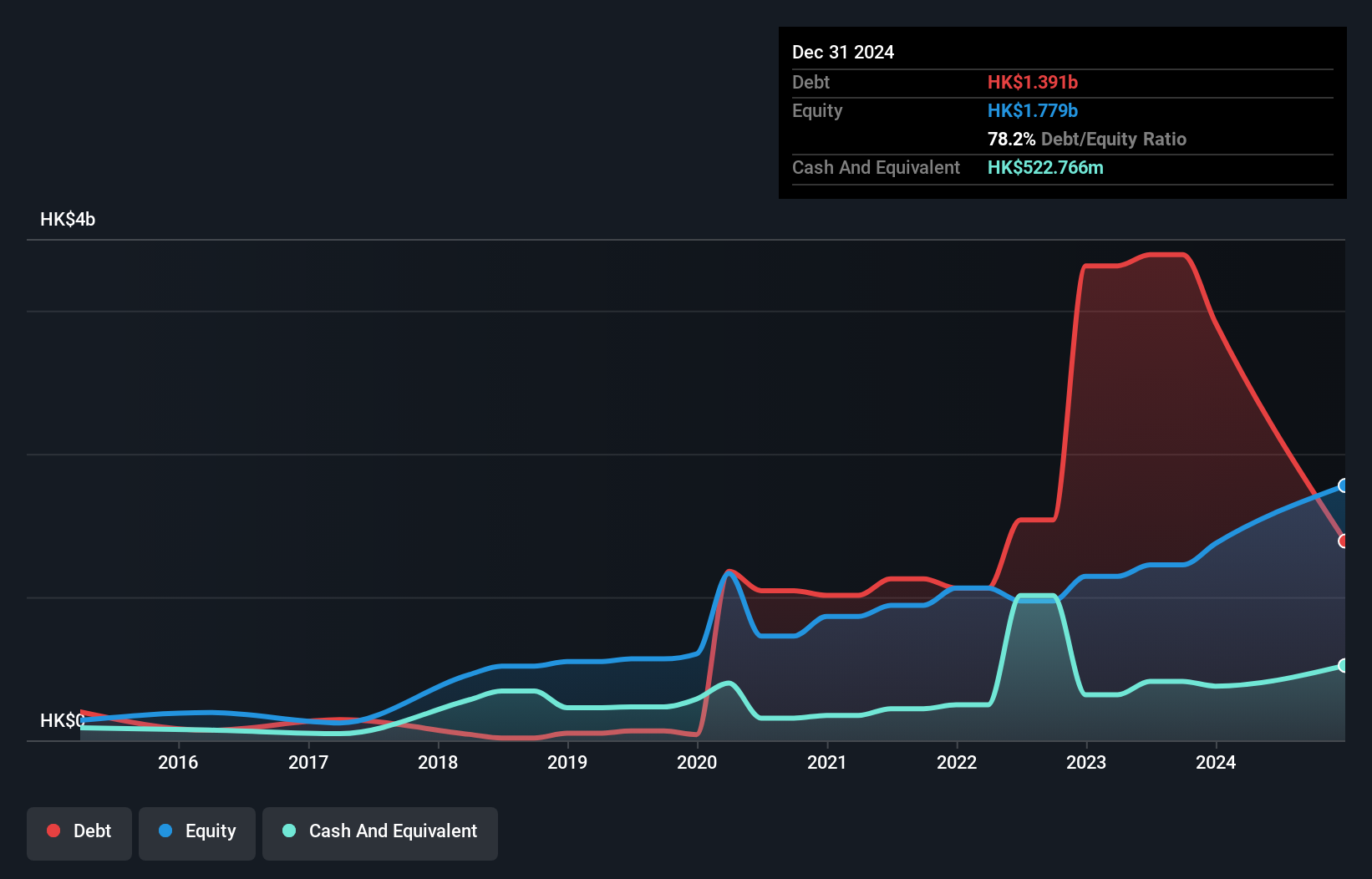

Overview: Time Interconnect Technology Limited, with a market cap of HK$7.03 billion, manufactures and sells cable assembly and networking cable products across various international markets including China, the United States, the Netherlands, Singapore, the United Kingdom, Hong Kong, and Mexico.

Operations: Time Interconnect Technology Limited generates revenue primarily from its Server segment (HK$2.98 billion), Cable Assembly (HK$2.31 billion), and Digital Cable (HK$1.18 billion).

Time Interconnect Technology, a small cap player in cable assembly and specialty cables, has been making waves with its impressive earnings growth of 93.1% over the past year, outpacing the Electrical industry’s 11%. The company’s debt to equity ratio has surged from 9% to 212.5% in five years, reflecting increased leverage. Despite this high debt level (184.9%), interest payments are well covered by EBIT at 9x coverage. Recent guidance indicates a projected net profit increase of up to 40%, driven by strong performance in medical equipment and data center sectors.

Turning Ideas Into Actions

- Discover the full array of 175 SEHK Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com