As the Hong Kong market navigates through a period of economic uncertainty, small-cap stocks have shown resilience amid broader market fluctuations. In this context, identifying undervalued small-caps with notable insider action can offer unique investment opportunities for those looking to capitalize on potential growth and insider confidence.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.6x | 0.4x | 25.63% | ★★★★★☆ |

| Ferretti | 11.4x | 0.8x | 44.75% | ★★★★★☆ |

| Wasion Holdings | 11.6x | 0.8x | 39.35% | ★★★★☆☆ |

| K. Wah International Holdings | 7.0x | 0.9x | 26.06% | ★★★★☆☆ |

| Lion Rock Group | 6.7x | 0.5x | 31.13% | ★★★★☆☆ |

| Comba Telecom Systems Holdings | 369.1x | 0.4x | 43.85% | ★★★★☆☆ |

| Skyworth Group | 5.4x | 0.1x | -245.50% | ★★★☆☆☆ |

| China Leon Inspection Holding | 9.6x | 0.7x | 37.30% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 6.5x | 0.4x | -32.27% | ★★★☆☆☆ |

| Truly International Holdings | 12.0x | 0.2x | 39.91% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

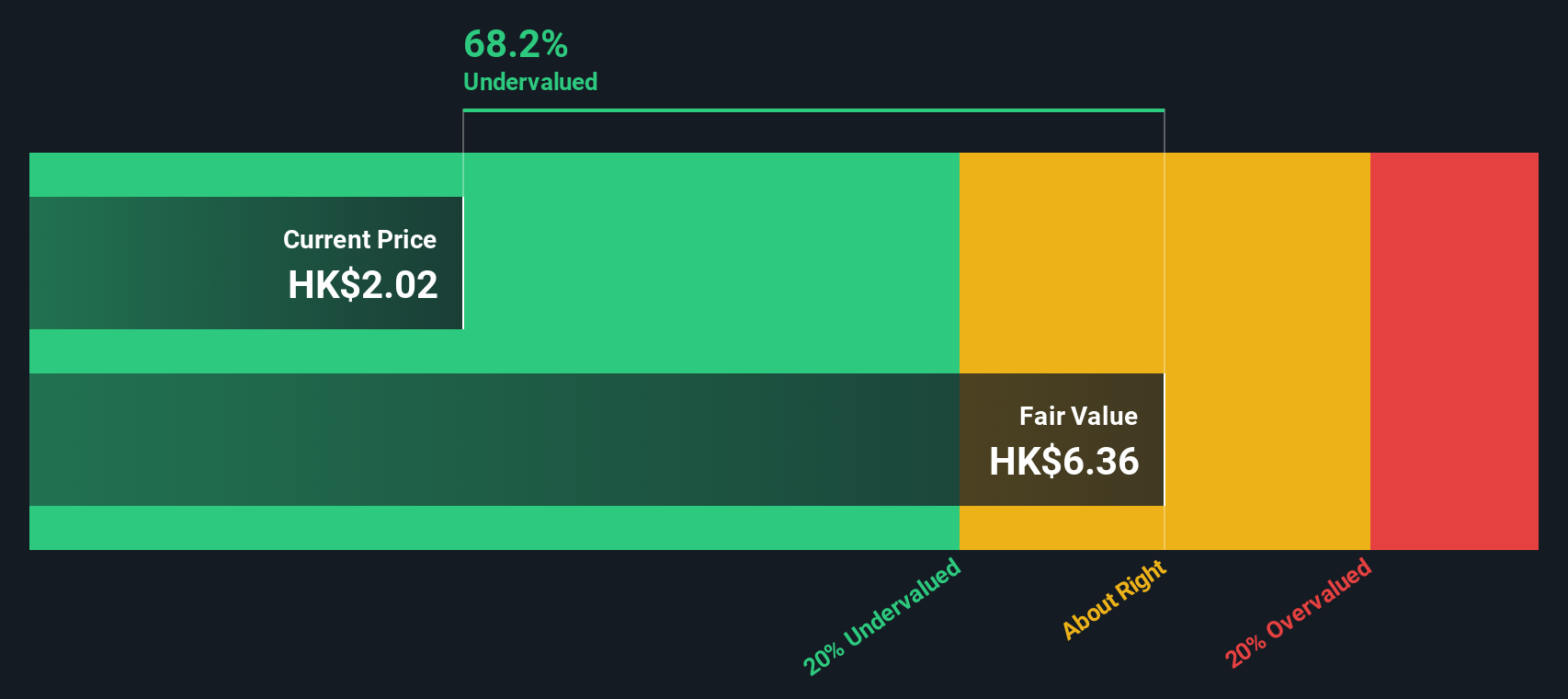

K. Wah International Holdings (SEHK:173)

Simply Wall St Value Rating: ★★★★☆☆

Overview: K. Wah International Holdings is a property development and investment company with operations in Hong Kong and Mainland China, having a market cap of HK$8.72 billion.

Operations: The company generates revenue primarily from property development in Mainland China and Hong Kong, along with property investment. For the period ending 2023-12-31, it reported a gross profit margin of 33.07%.

PE: 7.0x

K. Wah International Holdings, a small cap stock in Hong Kong, recently recommended a final dividend of HK$0.09 per share for 2023, payable on 24 July 2024. The company relies entirely on external borrowing for funding, which is riskier compared to customer deposits. However, earnings are projected to grow by 8.63% annually. Insider confidence is evident with significant share purchases over the past year, indicating potential growth and value recognition within the market.

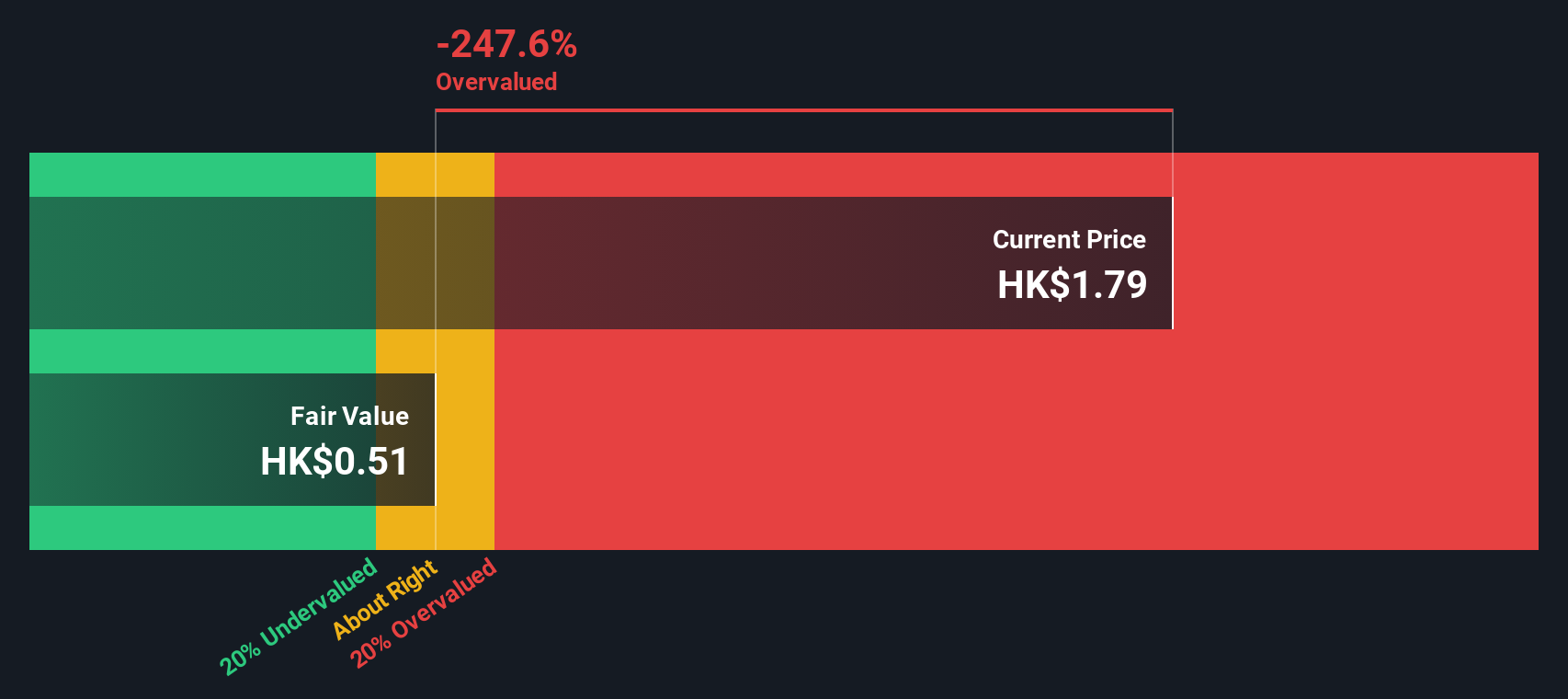

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, as well as operator telecommunication services, with a market cap of HK$1.59 billion.

Operations: The company generates revenue primarily from Wireless Telecommunications Network System Equipment and Services (HK$5824.14 million) and Operator Telecommunication Services (HK$157.83 million). The cost of goods sold (COGS) for the most recent period was HK$4319.29 million, leading to a gross profit of HK$1662.69 million with a gross profit margin of 27.79%. Operating expenses amounted to HK$1701.78 million, impacting the net income which stood at HK$6.70 million with a net income margin of 0.11%.

PE: 369.1x

Comba Telecom Systems Holdings, a small cap in Hong Kong, has seen recent insider confidence with Tung Ling Fok purchasing 1.83 million shares for HK$930,371 in June 2024. Despite the company's guidance indicating a loss of up to HK$160 million for the first half of 2024 due to delayed telecom projects and equity investment losses, it commenced a share repurchase program on June 3, 2024. This program aims to enhance net assets per share and earnings per share by utilizing available cash flow or working capital facilities.

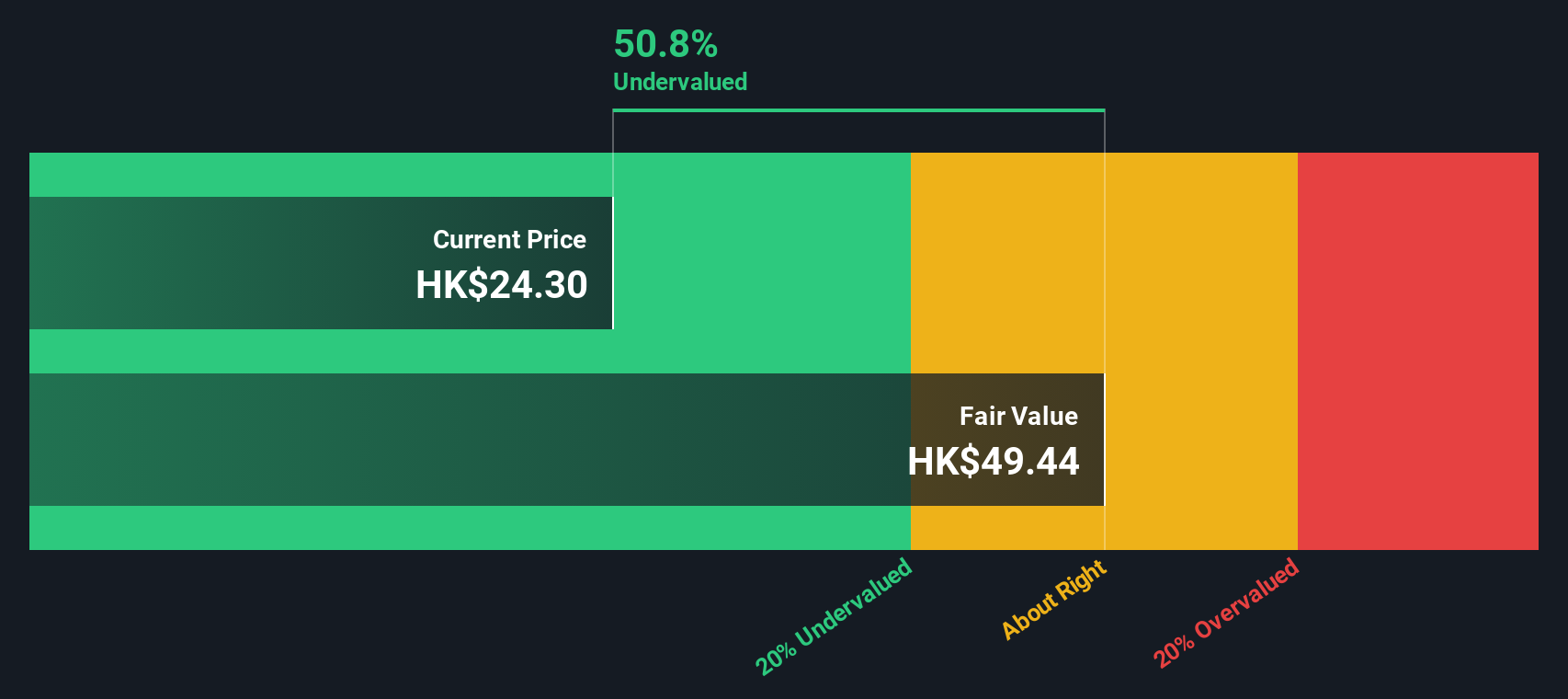

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti is engaged in the design, construction, and marketing of yachts and recreational boats with a market cap of €1.29 billion.

Operations: The company generates revenue primarily from the design, construction, and marketing of yachts and recreational boats. For the period ending December 31, 2023, it reported a gross profit margin of 37.08% and a net income margin of 6.76%. Operating expenses include significant allocations to general & administrative expenses and depreciation & amortization.

PE: 11.4x

Ferretti, a small cap in Hong Kong, is currently undervalued with earnings projected to grow 12.35% annually. Recent insider confidence is evident as key executives have increased their share purchases over the past six months. The company reported no customer deposits and relies entirely on external borrowing for funding, which poses higher risks. On August 12, 2024, Ferretti appointed Mr. Qinggui Hao as joint company secretary alongside Ms. Wong Hoi Ting, signaling potential strategic shifts within its leadership team.

Seize The Opportunity

- Discover the full array of 13 Undervalued SEHK Small Caps With Insider Buying right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com