As the Hong Kong market continues to navigate a landscape marked by global economic shifts, high-growth tech stocks have garnered significant attention. This article will explore three promising stocks, including China Ruyi Holdings, highlighting what makes them compelling investments in today's dynamic environment.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| RemeGen | 26.10% | 54.85% | ★★★★★☆ |

| Cowell e Holdings | 30.92% | 35.35% | ★★★★★★ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

| Beijing Fourth Paradigm Technology | 20.08% | 104.53% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★☆☆

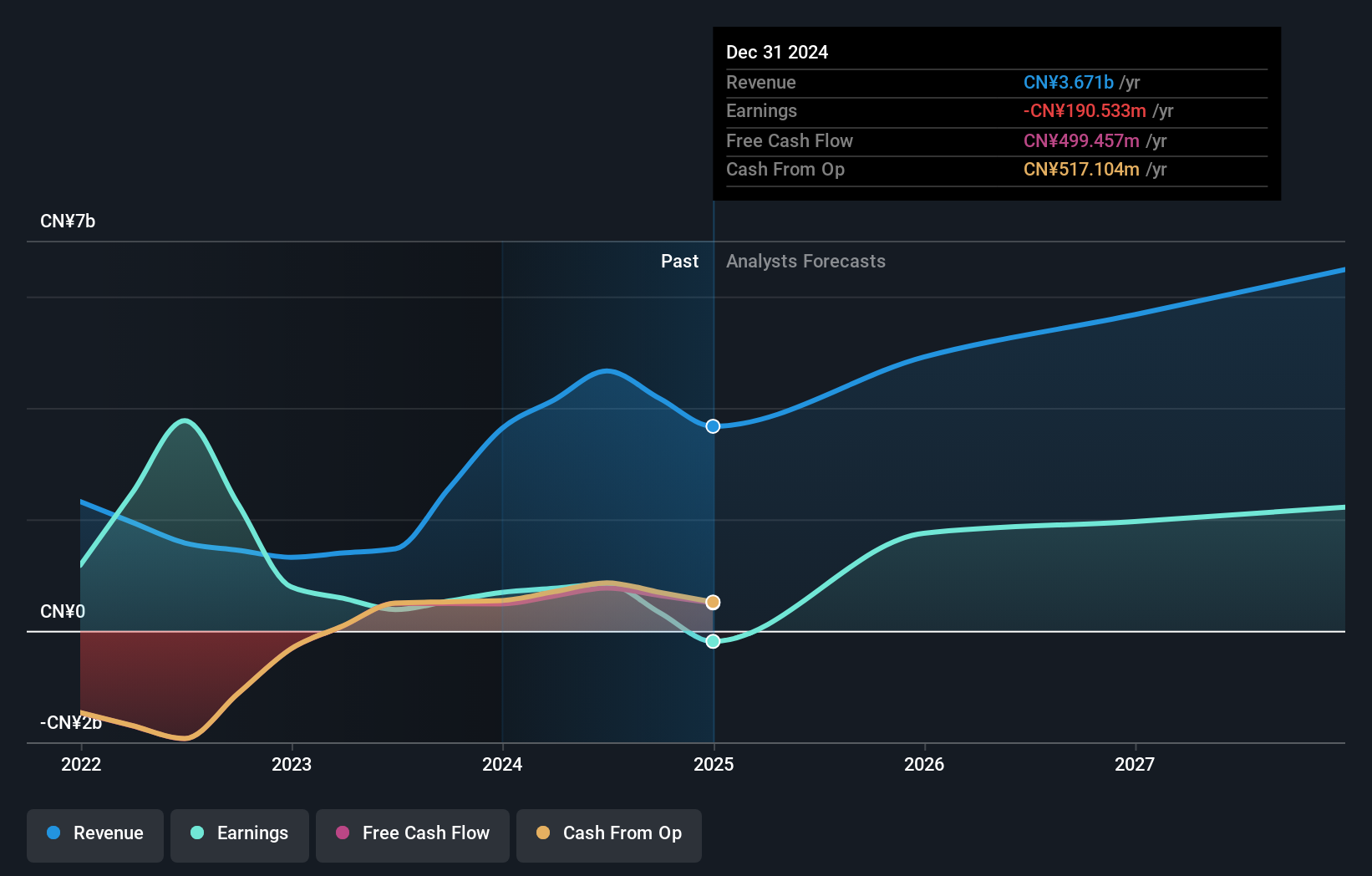

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across the People's Republic of China, Hong Kong, Europe, and internationally, with a market cap of HK$29.14 billion.

Operations: The company generates revenue primarily from its content production business, which brought in CN¥2.23 billion, and online streaming and gaming businesses, contributing CN¥1.38 billion.

China Ruyi Holdings has shown impressive revenue growth, forecasted at 27.7% per year, significantly outpacing the Hong Kong market's 7.4%. Despite a notable one-off gain of CN¥241M impacting its recent financial results, the company's earnings are projected to grow by 14.8% annually, also above the market average of 11%. The company recently completed a follow-on equity offering amounting to HKD 4 billion and repurchased shares in the past year, reflecting strategic moves for capital management and shareholder value enhancement.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company that designs, develops, manufactures, trades in, and sells optical modules and systems integration products for smartphones, multimedia tablets, smart driving, and other mobile devices across various international markets with a market cap of HK$19.36 billion.

Operations: Cowell e Holdings generates revenue primarily from the sale of photographic equipment and supplies, amounting to $1.14 billion. The company operates in various international markets, including China, India, and Korea.

Cowell e Holdings has demonstrated robust revenue growth, with a 59.8% increase to $585.93M for the half-year ending June 30, 2024. Despite a slight dip in net income to $16.04M from $18.03M, the company's earnings are forecasted to grow by an impressive 35.4% annually, significantly outpacing the Hong Kong market's average of 11%. The firm’s strategic partnerships with Luxshare Precision and GZ Luxvisions underscore its commitment to enhancing operational efficiency and R&D capabilities.

- Unlock comprehensive insights into our analysis of Cowell e Holdings stock in this health report.

Gain insights into Cowell e Holdings' past trends and performance with our Past report.

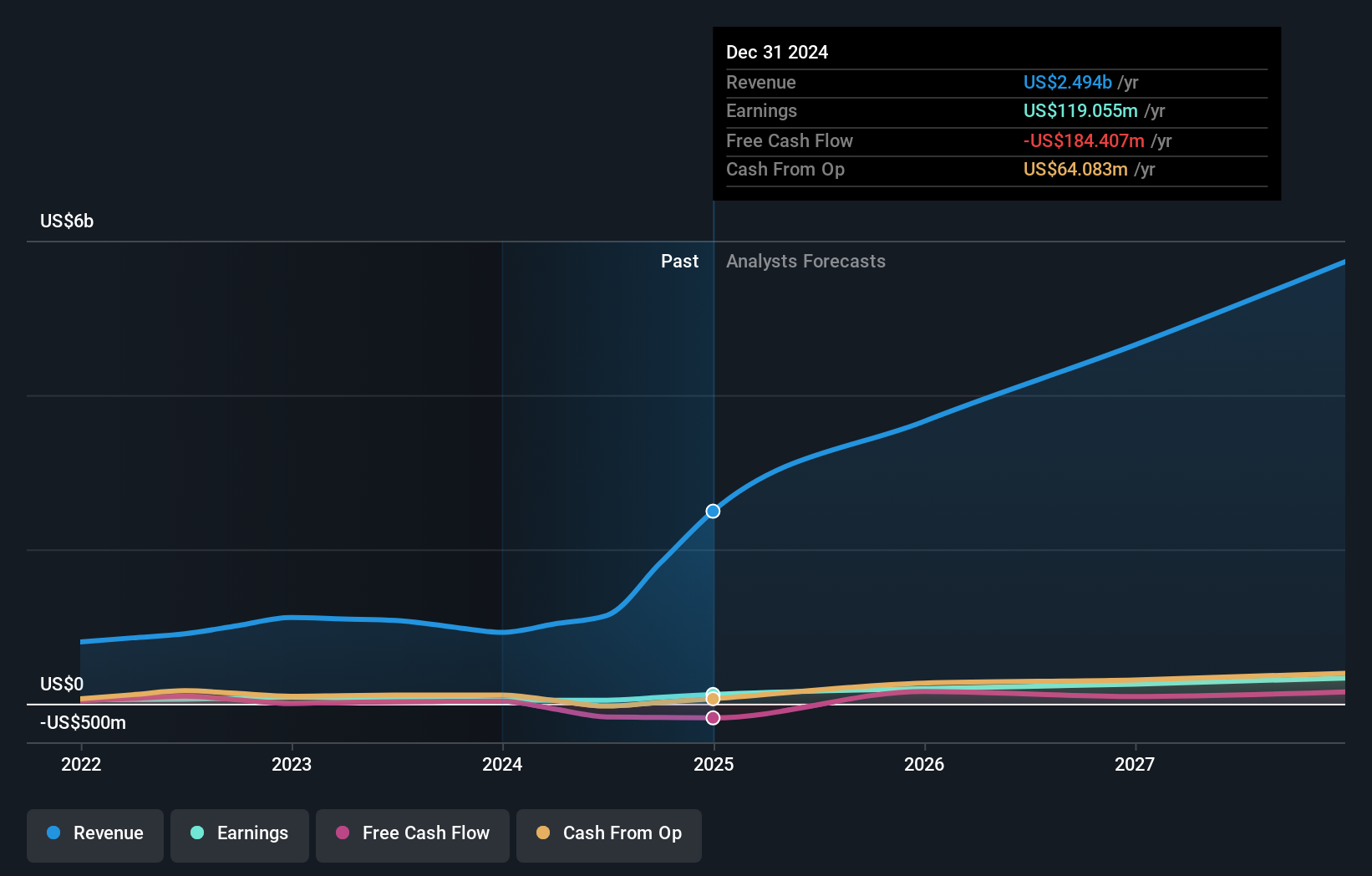

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Electronic (International) Company Limited, an investment holding company, primarily engages in the design, manufacture, assembly, and sale of mobile handset components, modules, and other products in the People’s Republic of China and internationally with a market cap of approximately HK$67.82 billion.

Operations: The company generates revenue primarily through the manufacture, assembly, and sale of mobile handset components and modules, amounting to CN¥129.96 billion. The business operates both in China and internationally.

BYD Electronic (International) has demonstrated significant growth, with earnings surging by 117.6% over the past year, far outpacing the communications industry's 10.6%. The company's revenue is projected to grow at 14.1% annually, faster than Hong Kong's market average of 7.4%, while its earnings are forecasted to increase by an impressive 22.3% per year. Notably, BYD Electronic's R&D expenses have been substantial, reflecting a commitment to innovation that could drive future advancements and competitiveness in the tech sector. Recent developments include its addition to the Hang Seng Index and a final dividend of RMB 0.538 per share for FY2023 approved at its AGM on June 6, 2024. The strategic appointment of Ms. Wang Ying as an independent non-executive director underscores BYD Electronic’s focus on strengthening corporate governance and operational compliance amidst rapid growth prospects in high-tech manufacturing and AI-driven solutions.

- Get an in-depth perspective on BYD Electronic (International)'s performance by reading our health report here.

Learn about BYD Electronic (International)'s historical performance.

Summing It All Up

- Discover the full array of 45 SEHK High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com