The Hong Kong market has recently experienced a notable uptick, with the Hang Seng Index rising by 1.99% amid mixed economic signals from China. Despite some challenges, investor sentiment remains cautiously optimistic, creating an interesting landscape for small-cap stocks. In this environment, identifying undervalued small caps with insider buying can offer unique opportunities. Such stocks often demonstrate strong potential for growth and resilience in fluctuating markets.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.5x | 0.4x | 26.59% | ★★★★★☆ |

| Ferretti | 11.3x | 0.8x | 44.93% | ★★★★★☆ |

| Lion Rock Group | 6.6x | 0.5x | 31.58% | ★★★★☆☆ |

| Kinetic Development Group | 4.4x | 1.9x | 21.51% | ★★★★☆☆ |

| FriendTimes | NA | 0.9x | 14.23% | ★★★★☆☆ |

| Comba Telecom Systems Holdings | 365.0x | 0.4x | 44.18% | ★★★★☆☆ |

| Wasion Holdings | 11.9x | 0.9x | 37.76% | ★★★☆☆☆ |

| Skyworth Group | 5.4x | 0.1x | -243.82% | ★★★☆☆☆ |

| China Leon Inspection Holding | 9.7x | 0.7x | 36.84% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 6.4x | 0.4x | -31.69% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

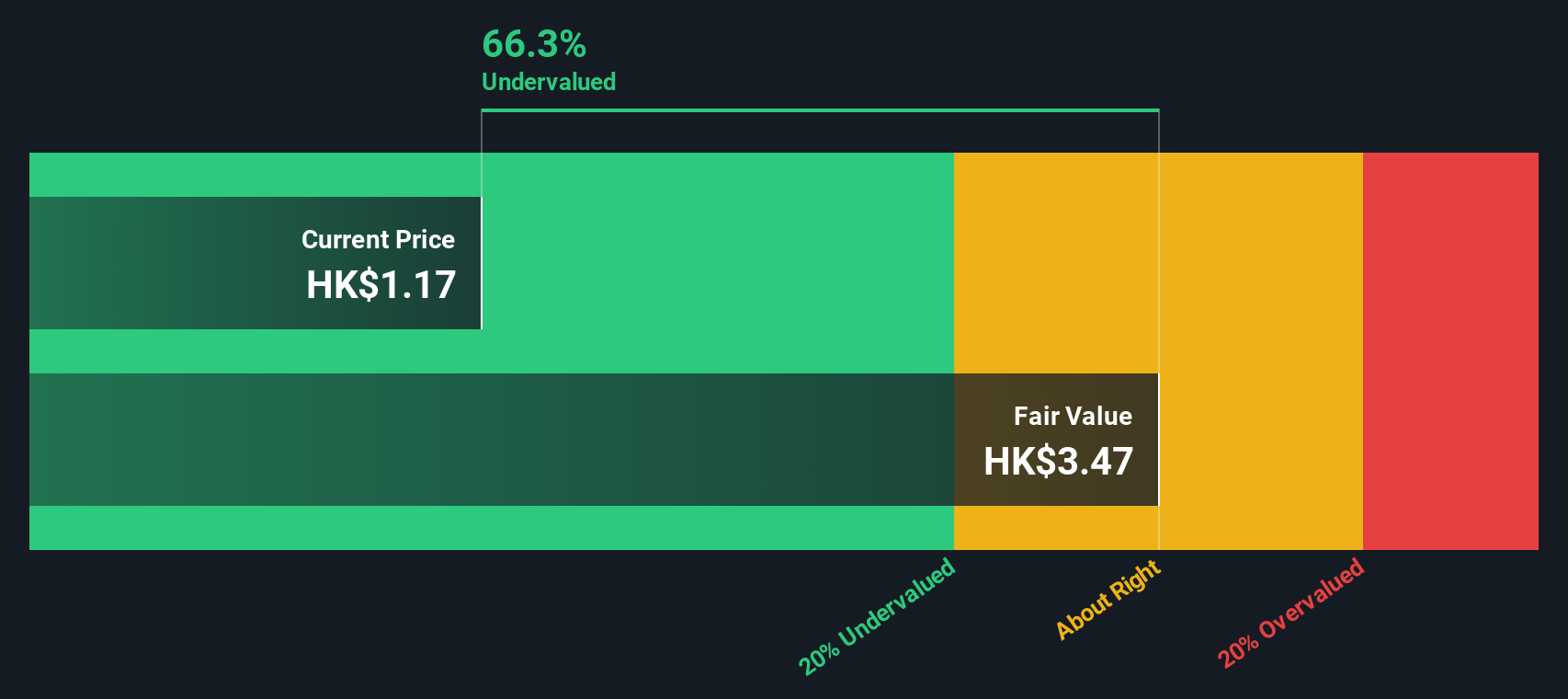

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is a company engaged in property development and investment, with a market cap of CN¥3.45 billion.

Operations: Kinetic Development Group generates revenue primarily through its sales, with significant costs attributed to goods sold (COGS) and operating expenses. The company has experienced fluctuations in net income margins, reaching as high as 46.18% in Q2 2022. Gross profit margins have varied, peaking at 69.80% during the same period.

PE: 4.4x

Kinetic Development Group, a small-cap stock in Hong Kong, has recently announced a special dividend of HK$0.04 per share with an ex-dividend date of August 23, 2024. This move follows their board meeting on July 31, 2024. Despite relying entirely on external borrowing for funding—a higher risk approach—there's notable insider confidence as key executives have been purchasing shares consistently over the past six months. These factors suggest potential for value growth amidst cautious optimism regarding their financial strategy and market positioning.

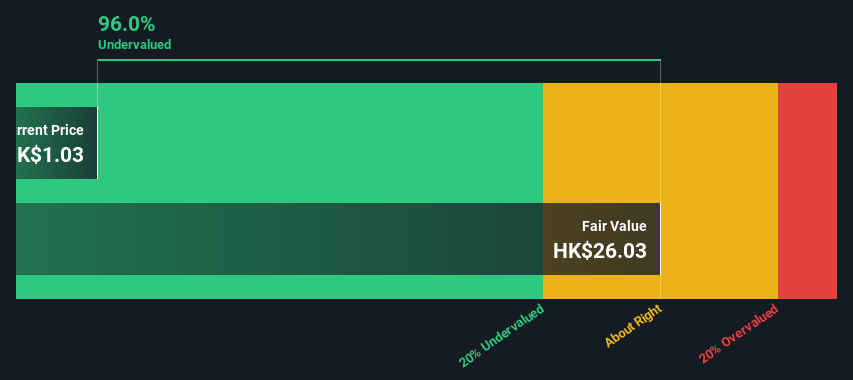

Truly International Holdings (SEHK:732)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Truly International Holdings operates in the electronic consumer products and liquid crystal display (LCD) products sectors, with a market cap of HK$3.45 billion.

Operations: The company's primary revenue streams are from Electronic Consumer Products and Liquid Crystal Display (LCD) Products, with the latter contributing significantly more. Over recent periods, gross profit margin has shown a declining trend, reaching 6.40% in the latest quarter. Operating expenses have consistently impacted net income, with notable fluctuations in non-operating expenses.

PE: 12.4x

Truly International Holdings, a smaller player in Hong Kong's market, has caught attention with its recent financial performance and insider confidence. In July 2024, the company reported a 12.2% increase in net consolidated turnover for June compared to the previous year, reaching HK$1.32 billion. For the first half of 2024, turnover grew by 18.3% to HK$8.59 billion from HK$7.26 billion in H1 2023. Insider Wai Wah Lam purchased 11 million shares worth approximately HK$8.31 million between January and August 2024, indicating strong internal confidence despite reliance on higher-risk external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of Truly International Holdings.

Learn about Truly International Holdings' historical performance.

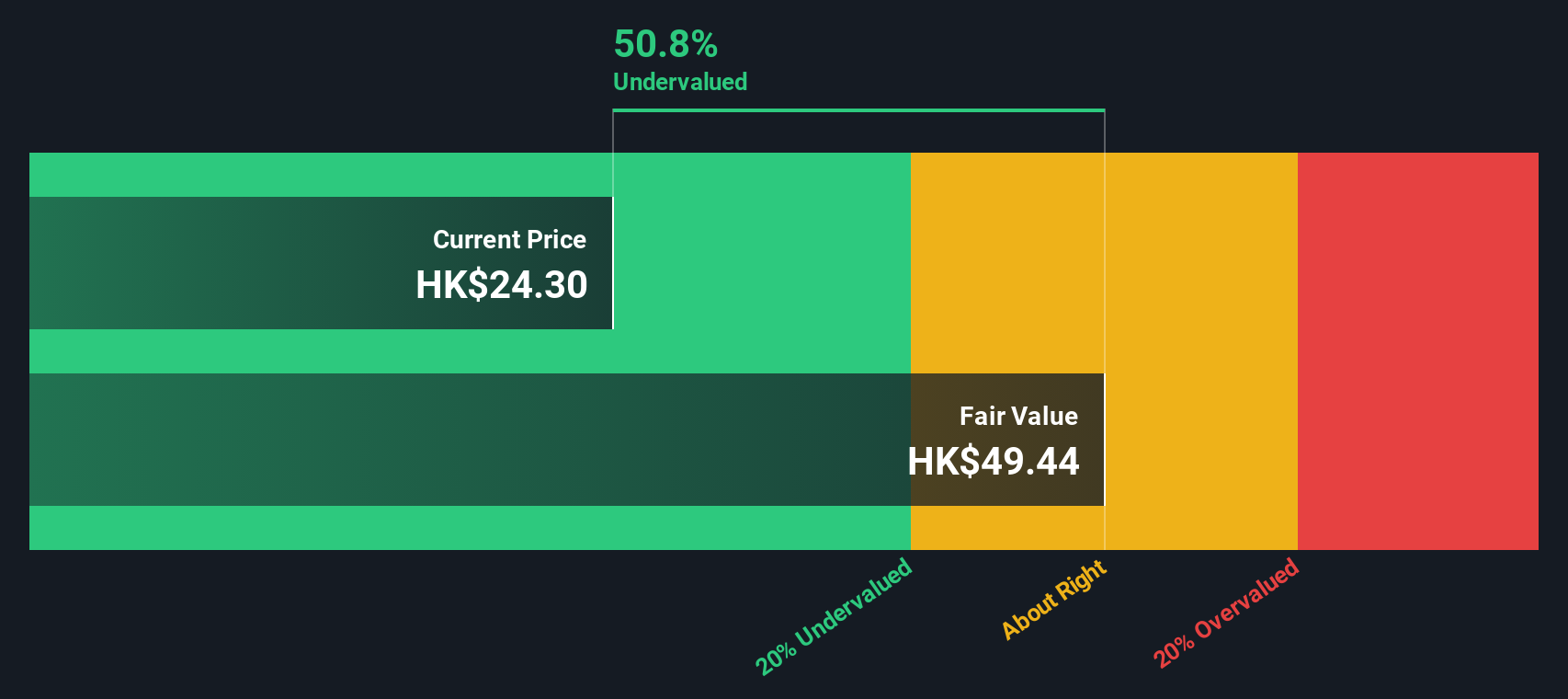

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti is engaged in the design, construction, and marketing of yachts and recreational boats with a market cap of €2.25 billion.

Operations: The company generates revenue primarily from the design, construction, and marketing of yachts and recreational boats. For the period ending December 31, 2023, it reported a gross profit margin of 37.08% with operating expenses totaling €358.24 million. Net income for this period was €83.05 million, resulting in a net income margin of 6.76%.

PE: 11.3x

Ferretti, a small-cap company in Hong Kong, has shown significant insider confidence with recent share purchases by executives. Earnings are forecasted to grow 12.35% annually, indicating potential for future profitability. Despite relying solely on external borrowing for funding, Ferretti maintains high-quality earnings with minimal non-cash components. Recent board changes include Mr. Qinggui Hao as joint company secretary and alternate authorized representative from August 12, 2024, adding experienced leadership to the team.

- Click here to discover the nuances of Ferretti with our detailed analytical valuation report.

Gain insights into Ferretti's historical performance by reviewing our past performance report.

Key Takeaways

- Discover the full array of 16 Undervalued SEHK Small Caps With Insider Buying right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com