As global markets experience volatility and mixed economic signals, the Hong Kong market has shown resilience with the Hang Seng Index gaining 0.85%. Amid these fluctuations, dividend stocks remain an attractive option for investors seeking stable returns. In such an environment, a good dividend stock typically offers consistent payouts and strong fundamentals, making it a reliable choice even when broader market conditions are uncertain.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.40% | ★★★★★★ |

| Lenovo Group (SEHK:992) | 3.74% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.92% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 9.99% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.81% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.23% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.57% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 6.65% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.80% | ★★★★★☆ |

| Beijing Tong Ren Tang Chinese Medicine (SEHK:3613) | 3.78% | ★★★★★☆ |

Click here to see the full list of 87 stocks from our Top SEHK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

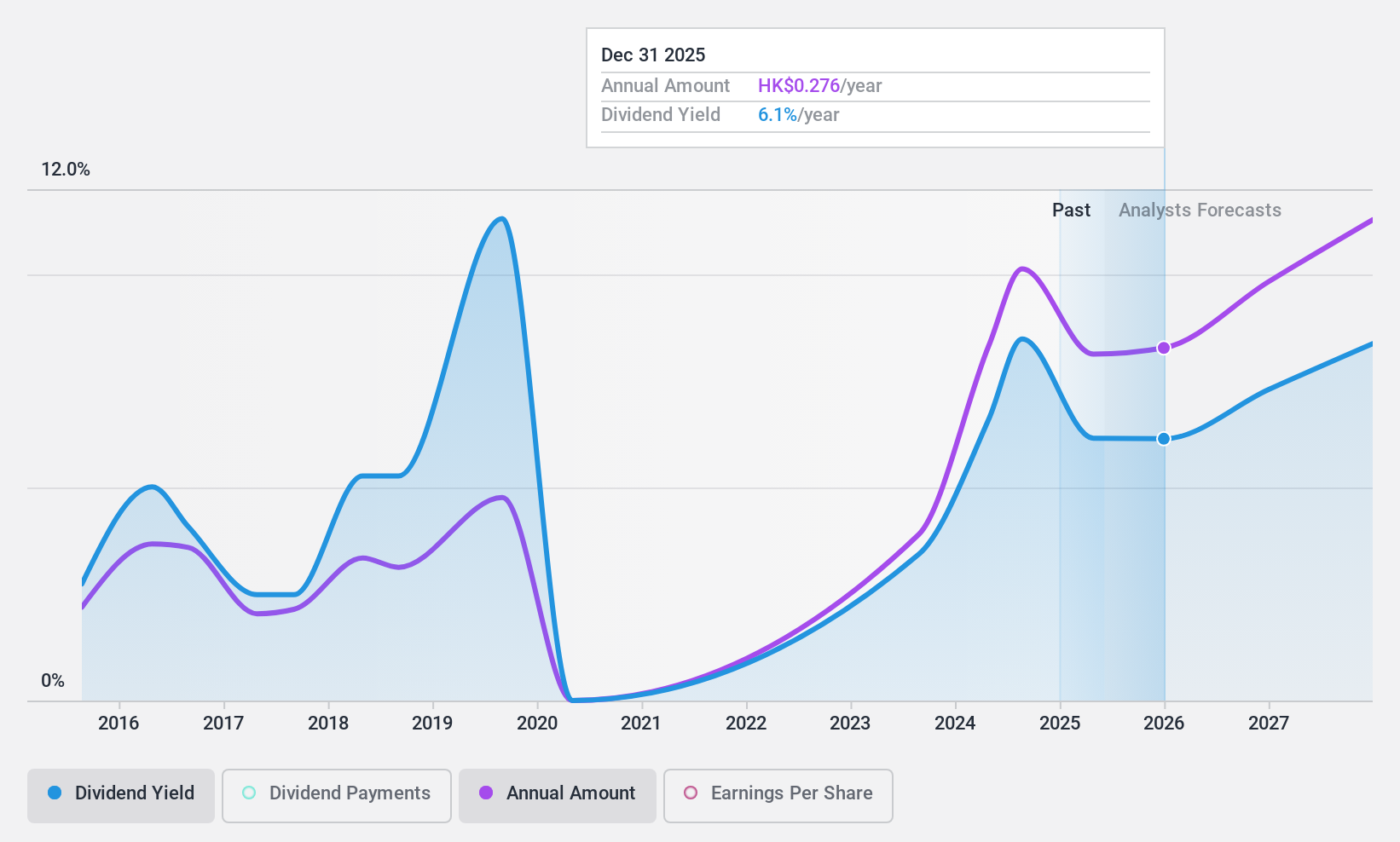

361 Degrees International (SEHK:1361)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: 361 Degrees International Limited, an investment holding company with a market cap of HK$7.17 billion, manufactures and trades in sporting goods in the People’s Republic of China.

Operations: The company's revenue segments (in millions of CN¥) are as follows: Footwear: 3,890.50, Apparel: 2,680.30, and Accessories: 450.20.

Dividend Yield: 9.5%

361 Degrees International has declared an interim dividend of HKD 0.165 per share for the first half of 2024, but its dividend payments have been volatile over the past decade. Despite a reasonable payout ratio of 55.4%, dividends are not well covered by free cash flow due to a high cash payout ratio of 159.4%. The company’s earnings grew by 16.4% last year and are forecasted to grow annually by 14.02%.

- Dive into the specifics of 361 Degrees International here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that 361 Degrees International is priced lower than what may be justified by its financials.

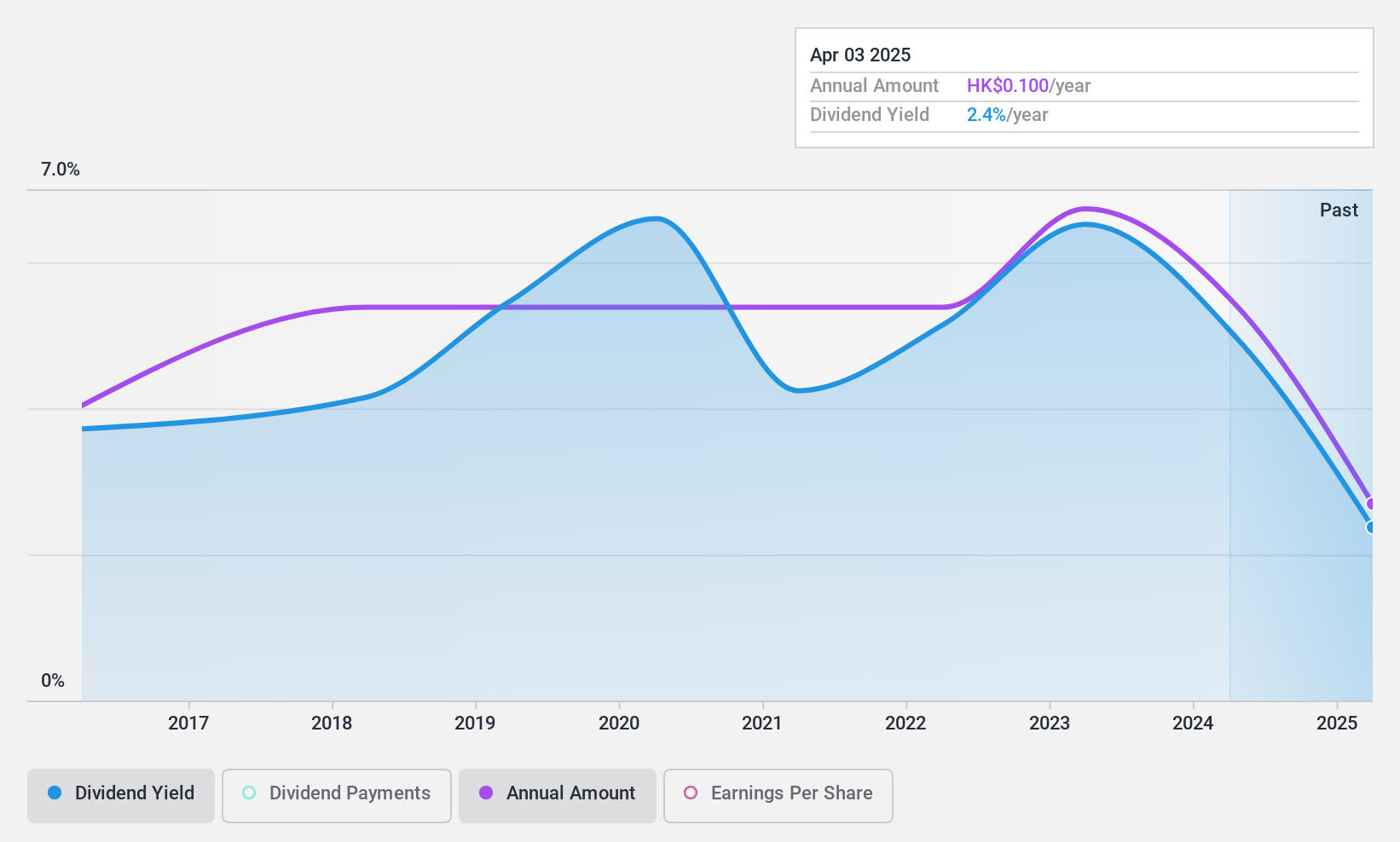

Tian An China Investments (SEHK:28)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia with a market cap of HK$5.91 billion.

Operations: Tian An China Investments Company Limited generates revenue primarily from property development (HK$1.53 billion), property investment (HK$591.38 million), and healthcare operations (HK$394.15 million).

Dividend Yield: 5%

Tian An China Investments offers a stable dividend with a low payout ratio of 24.1%, ensuring dividends are well-covered by earnings and cash flows. The company's dividend payments have been consistent and growing over the past decade, supported by a low cash payout ratio of 16.9%. Despite recent board changes, including the retirement of two Independent Non-Executive Directors and new committee appointments, Tian An maintains a reliable dividend yield at 4.96%, though it's below Hong Kong's top tier payers.

- Delve into the full analysis dividend report here for a deeper understanding of Tian An China Investments.

- In light of our recent valuation report, it seems possible that Tian An China Investments is trading beyond its estimated value.

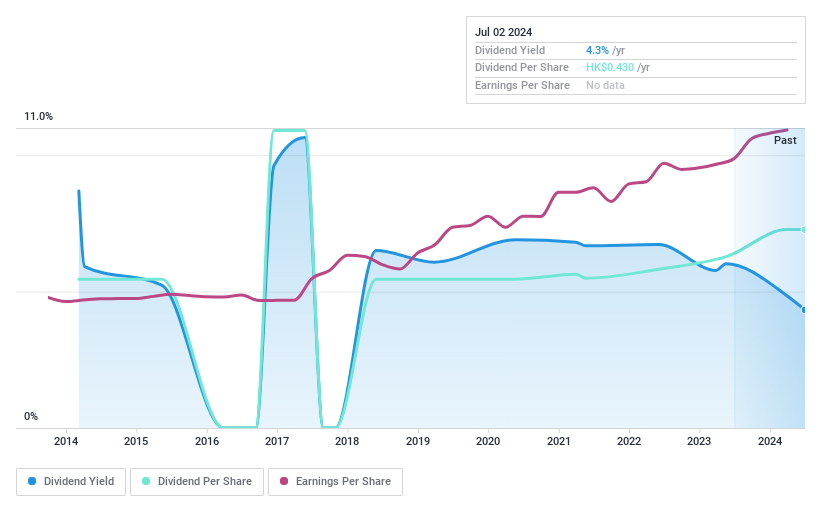

Xinhua Winshare Publishing and Media (SEHK:811)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd., along with its subsidiaries, operates in the publishing and distribution sectors in China and has a market cap of HK$16.83 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd. generates revenue through its publishing and distribution operations in China, with a market capitalization of HK$16.83 billion.

Dividend Yield: 4.4%

Xinhua Winshare Publishing and Media recently approved a final dividend of RMB 0.40 per share for 2023, demonstrating a commitment to shareholder returns. Despite trading at 77% below its estimated fair value, the company maintains a low payout ratio of 30.9%, ensuring dividends are well-covered by earnings and cash flows. However, the dividend track record has been volatile over the past decade, raising concerns about long-term reliability despite recent increases in payments.

- Unlock comprehensive insights into our analysis of Xinhua Winshare Publishing and Media stock in this dividend report.

- Our expertly prepared valuation report Xinhua Winshare Publishing and Media implies its share price may be lower than expected.

Turning Ideas Into Actions

- Reveal the 87 hidden gems among our Top SEHK Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com