The Hong Kong market has shown resilience amid global economic fluctuations, with the Hang Seng Index gaining 0.85% recently despite broader concerns about deflationary pressures in China. This environment presents a unique opportunity to explore promising small-cap stocks that could offer significant potential for growth. In this article, we will discuss Kinetic Development Group and two other promising small caps in Hong Kong, highlighting what makes these stocks stand out in the current market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited (SEHK:1277) is an investment holding company focused on the extraction and sale of coal products in the People’s Republic of China, with a market cap of HK$9.86 billion.

Operations: Kinetic Development Group generates revenue primarily from the sale of coal products in China. The company has a market cap of HK$9.86 billion and focuses on efficient extraction processes to optimize its cost structure.

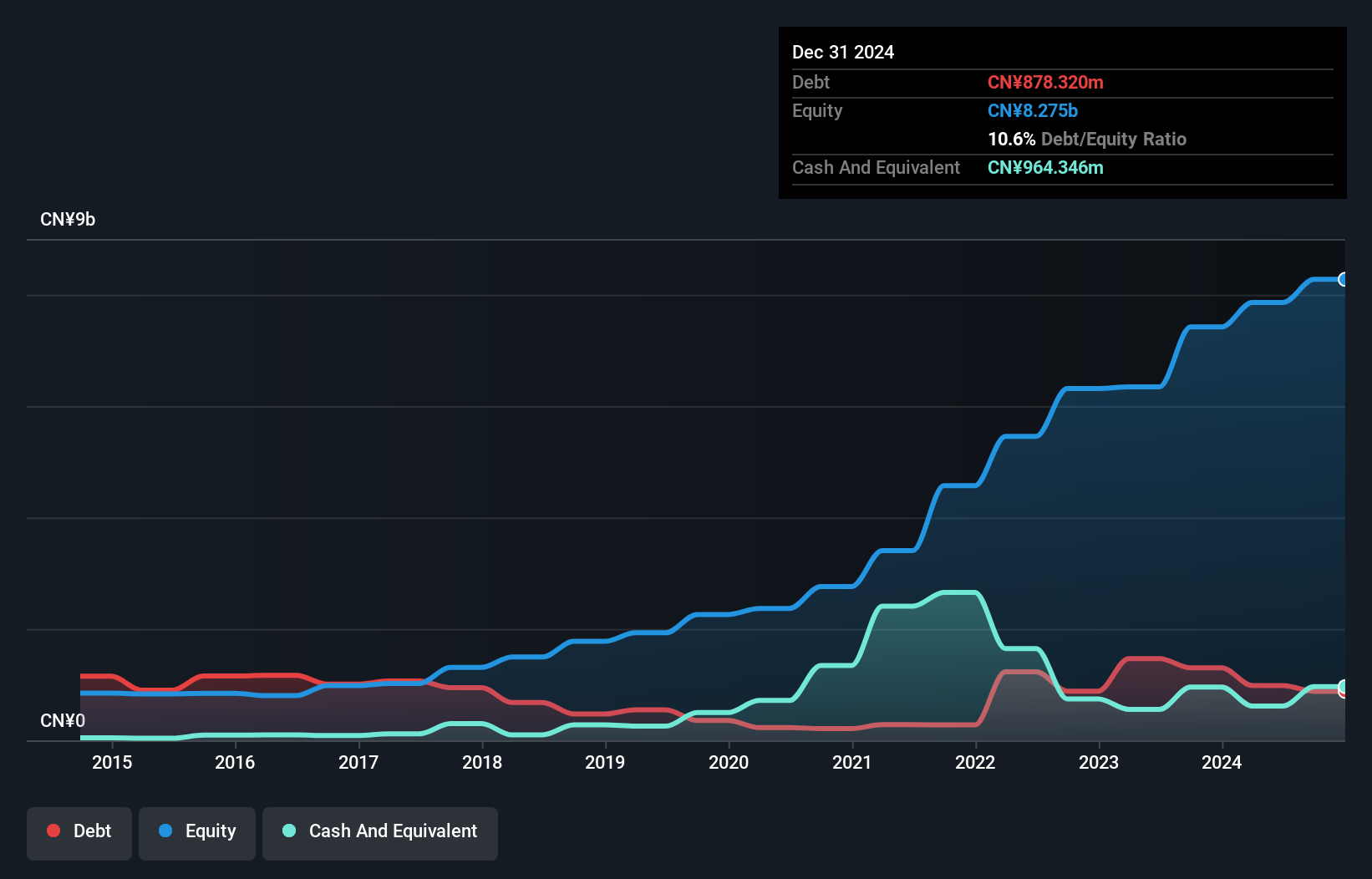

Kinetic Development Group's recent board meeting on August 12, 2024, approved a special dividend, highlighting strong financial health. The debt to equity ratio has improved from 26.6% to 17.6% over the past five years, and interest payments are well covered by EBIT at 55.7x coverage. Despite negative earnings growth of -22% last year compared to the industry average of -6.8%, Kinetic trades at a significant discount of 22.8% below estimated fair value, suggesting potential upside for investors.

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for various global markets including China, Africa, the United States, Europe, and Asia with a market cap of HK$6.52 billion.

Operations: Wasion Holdings generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥2.67 billion), Advanced Distribution Operations (CN¥2.48 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion).

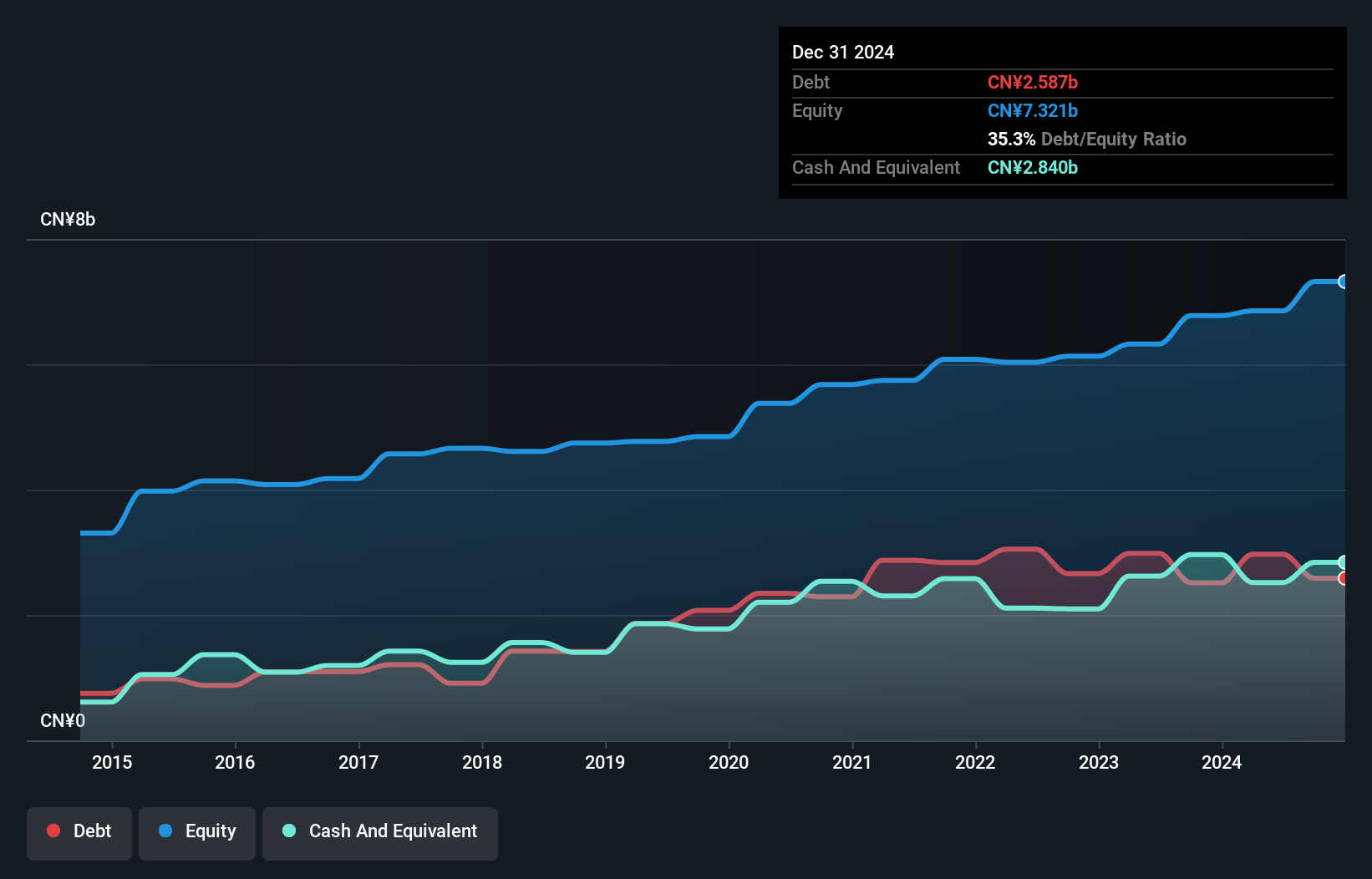

Wasion Holdings has seen its debt to equity ratio rise from 29.9% to 37.1% over the past five years, yet it trades at nearly 40% below our fair value estimate. The company’s earnings surged by 61% last year, outpacing the electronic industry’s -8.7%. Recent wins include a €31.62 million smart meter contract in Hungary and additional contracts worth US$15.16 million in Singapore and Malaysia, signaling robust international recognition and growth prospects for Wasion's smart grid solutions.

- Navigate through the intricacies of Wasion Holdings with our comprehensive health report here.

Gain insights into Wasion Holdings' historical performance by reviewing our past performance report.

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinopec Kantons Holdings Limited, an investment holding company, provides crude oil jetty services and has a market cap of HK$11.24 billion.

Operations: The company's primary revenue stream comes from crude oil jetty and storage services, generating HK$609.87 million. The net profit margin is %.

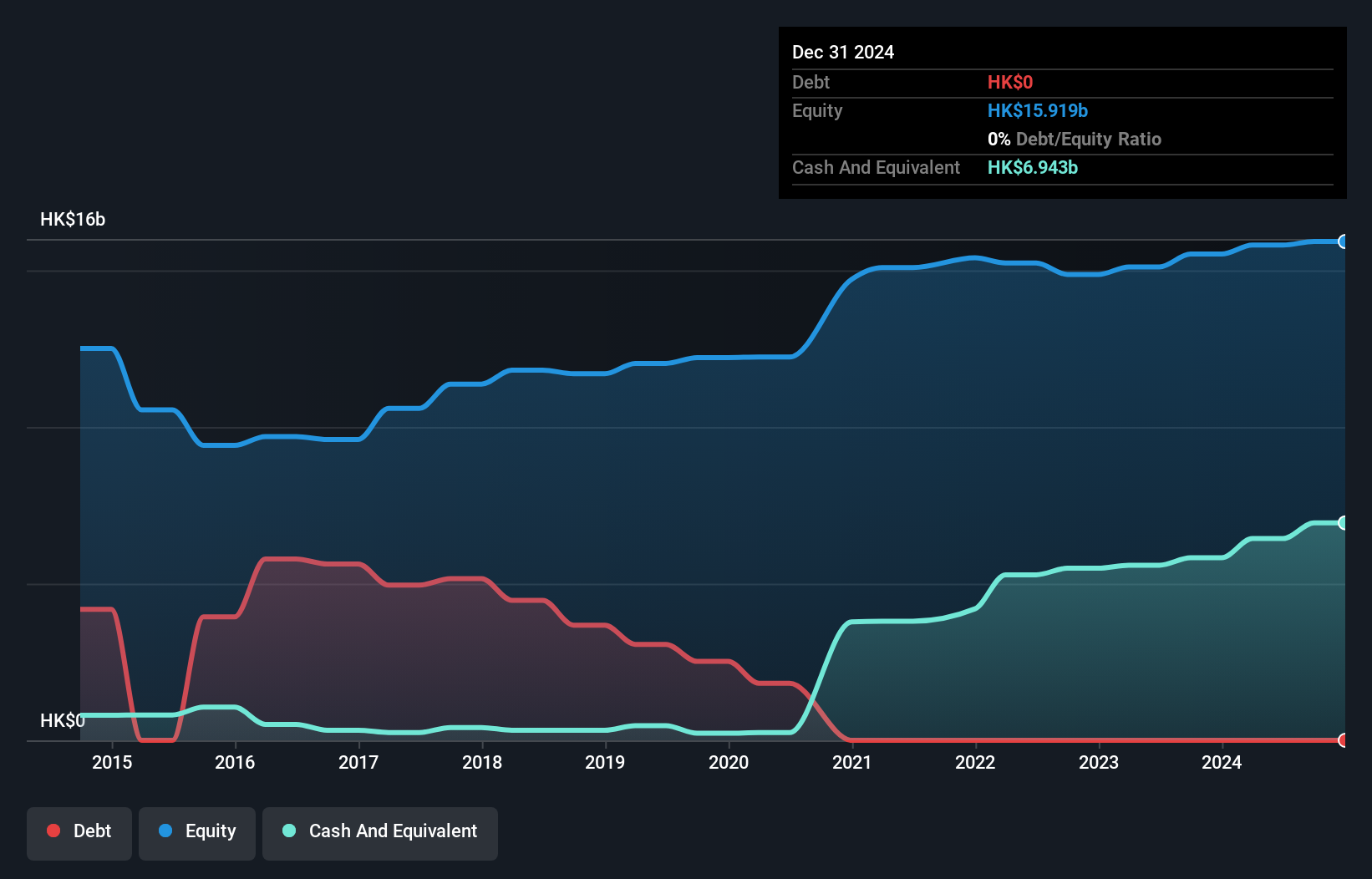

Sinopec Kantons Holdings, a smaller player in the oil and gas sector, has shown impressive financial health with no debt compared to five years ago when its debt to equity ratio was 31.4%. Its earnings grew by 198.6% over the past year, significantly outpacing the industry’s -6.8%. The company is trading at 77.5% below its estimated fair value, making it an attractive prospect for investors seeking undervalued stocks with strong growth potential.

Summing It All Up

- Dive into all 172 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com