As global markets react to economic data and shifting investor sentiment, the Hong Kong market has seen its own share of fluctuations. Despite these challenges, opportunities for finding undervalued stocks remain present in the SEHK. In this environment, a good stock often demonstrates strong fundamentals and resilience against broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Best Pacific International Holdings (SEHK:2111) | HK$2.18 | HK$4.34 | 49.7% |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$6.78 | 42.5% |

| ANTA Sports Products (SEHK:2020) | HK$68.80 | HK$136.45 | 49.6% |

| BYD Electronic (International) (SEHK:285) | HK$28.30 | HK$53.03 | 46.6% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.20 | HK$56.15 | 49.8% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.62 | HK$2.99 | 45.8% |

| iDreamSky Technology Holdings (SEHK:1119) | HK$2.24 | HK$4.22 | 46.9% |

| Weimob (SEHK:2013) | HK$1.19 | HK$2.18 | 45.5% |

| Innovent Biologics (SEHK:1801) | HK$41.15 | HK$73.85 | 44.3% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.77 | HK$1.38 | 44.2% |

Let's dive into some prime choices out of the screener.

Pacific Textiles Holdings (SEHK:1382)

Overview: Pacific Textiles Holdings Limited manufactures and trades textile products across various international markets, with a market cap of approximately HK$2.26 billion.

Operations: The company generates HK$4.67 billion in revenue from the manufacturing and trading of textile products.

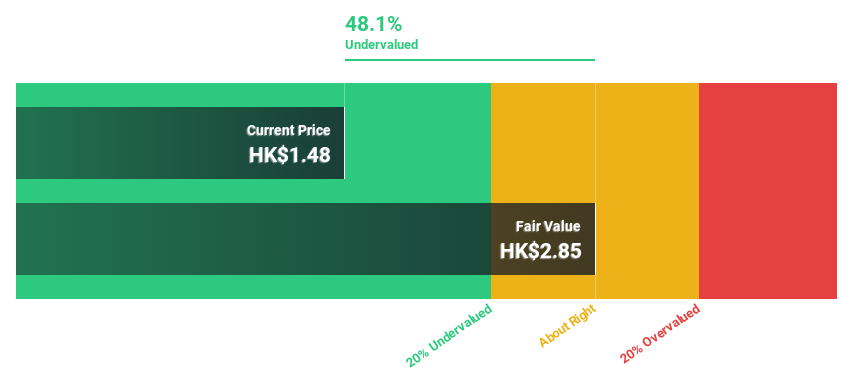

Estimated Discount To Fair Value: 45.8%

Pacific Textiles Holdings is trading at HK$1.62, significantly below its estimated fair value of HK$2.99, suggesting it may be undervalued based on cash flows. Despite a forecasted annual earnings growth of 37.67%, profit margins have declined from 5.4% to 3.6%. Recent amendments to company bylaws aim to align with regulatory changes, and the proposed final dividend is HKD 0.05 per share for FY2024, despite a notable drop in net income from HKD 268.57 million to HKD 167.12 million year-over-year.

- Our comprehensive growth report raises the possibility that Pacific Textiles Holdings is poised for substantial financial growth.

- Click here to discover the nuances of Pacific Textiles Holdings with our detailed financial health report.

Shanghai INT Medical Instruments (SEHK:1501)

Overview: Shanghai INT Medical Instruments Co., Ltd. (SEHK:1501) operates in the medical instruments sector and has a market cap of HK$4.94 billion.

Operations: The company's revenue from the Cardiovascular Interventional Business is CN¥641.32 million.

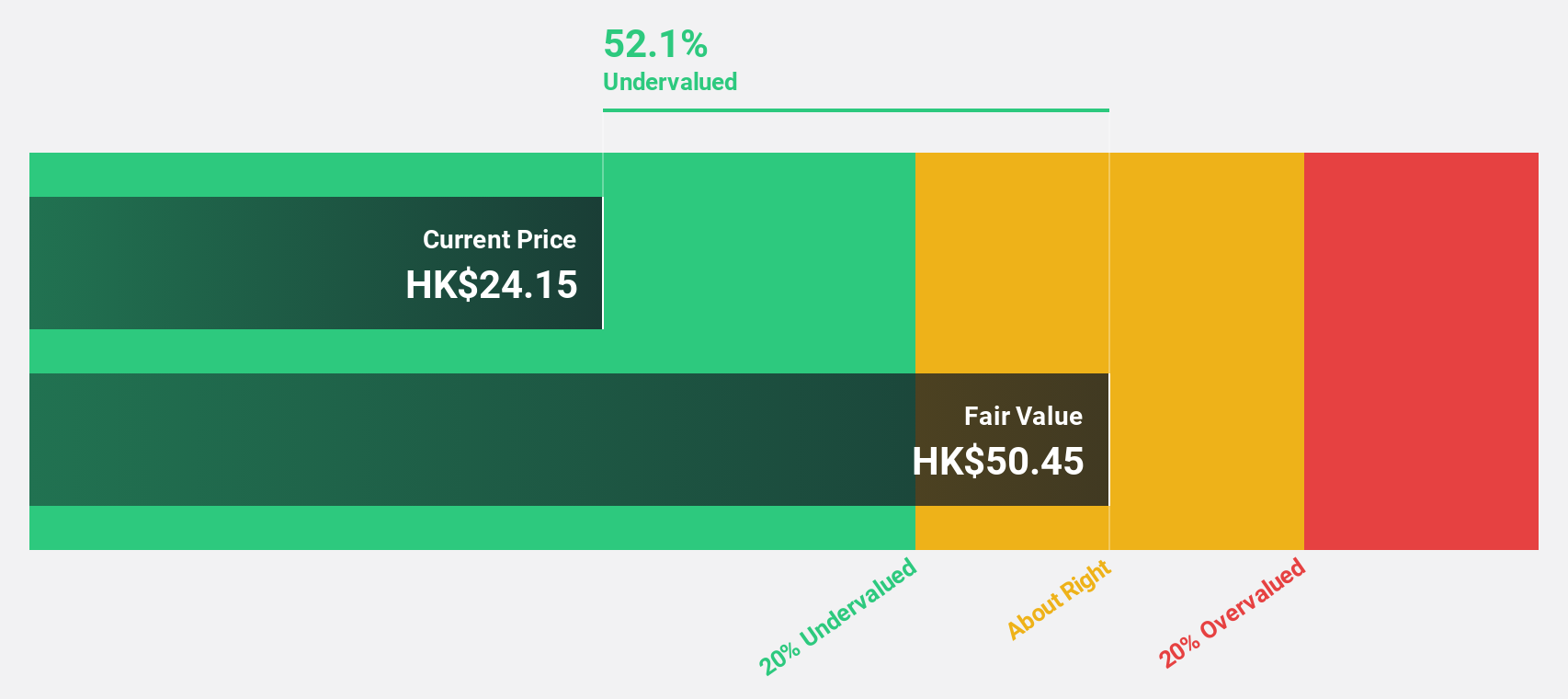

Estimated Discount To Fair Value: 49.8%

Shanghai INT Medical Instruments is trading at HK$28.2, well below its estimated fair value of HK$56.15, indicating significant undervaluation based on cash flows. Despite past shareholder dilution, earnings are projected to grow significantly at 25.41% annually over the next three years, outpacing the Hong Kong market's growth rate. The company recently approved a final dividend of HKD 0.30 per share for FY2023, reflecting solid financial health and commitment to returning value to shareholders.

- Our growth report here indicates Shanghai INT Medical Instruments may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Shanghai INT Medical Instruments.

Techtronic Industries (SEHK:669)

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products globally, with a market cap of HK$179.04 billion.

Operations: Techtronic Industries generates revenue from power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and international markets.

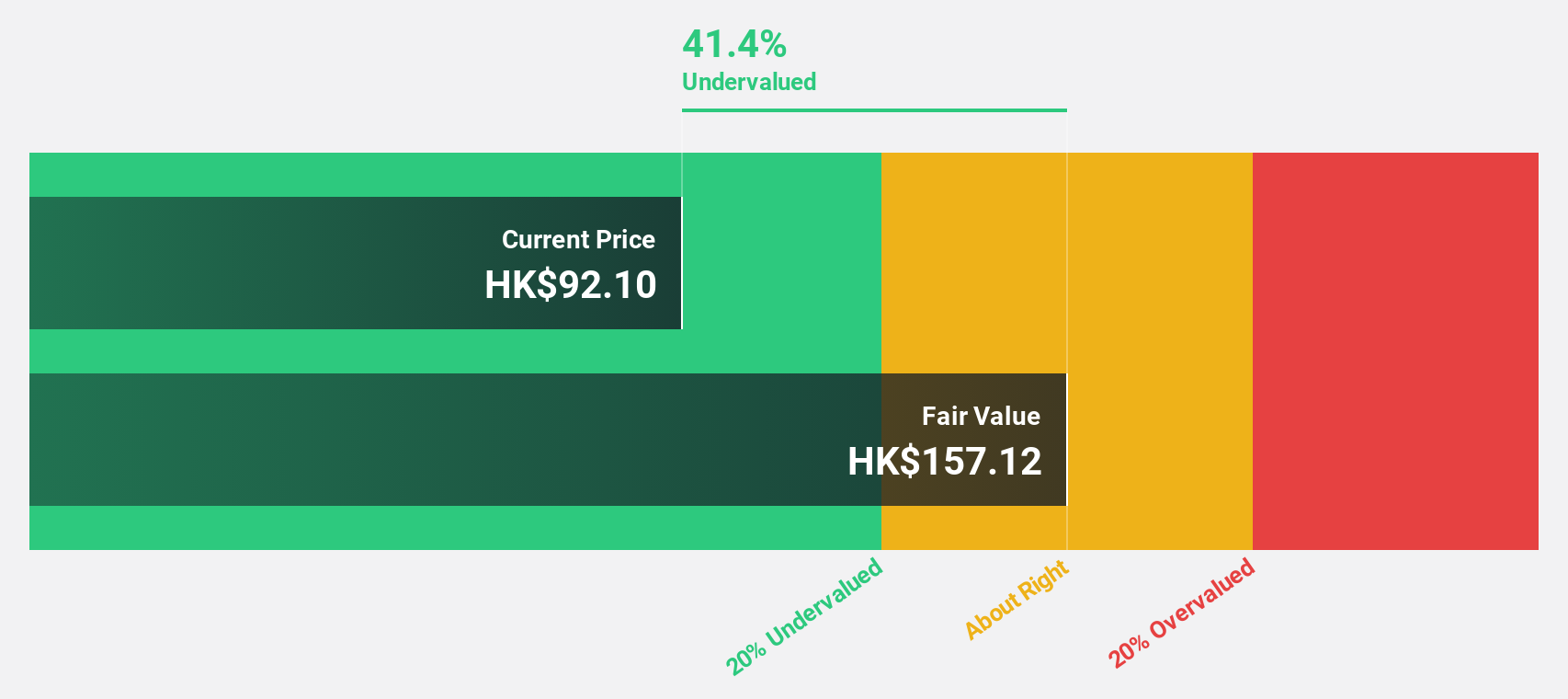

Estimated Discount To Fair Value: 10.4%

Techtronic Industries, trading at HK$97.7, is undervalued based on cash flows with an estimated fair value of HK$109.01. Earnings are forecast to grow 15.16% annually, outpacing the Hong Kong market's 11.3% growth rate, although revenue growth is slower at 8.5%. Recent earnings showed net income rising to US$550.37 million from US$475.78 million year-over-year and an interim dividend of HKD1.08 per share was announced for H1 2024.

- Our expertly prepared growth report on Techtronic Industries implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Techtronic Industries' balance sheet health report.

Key Takeaways

- Click this link to deep-dive into the 31 companies within our Undervalued SEHK Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com