As global markets face heightened volatility and economic uncertainties, the Hong Kong market has experienced its own set of challenges, with the Hang Seng Index recently declining by 0.45%. Despite these headwinds, there remain promising opportunities within this dynamic financial hub, particularly among lesser-known small-cap stocks that have shown resilience. In such a fluctuating environment, identifying stocks with strong fundamentals and growth potential becomes crucial for enhancing your portfolio. Here are three undiscovered gems in Hong Kong that merit closer attention.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, an investment holding company with a market cap of HK$9.19 billion, engages in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company reported revenue segments amounting to millions of CN¥.

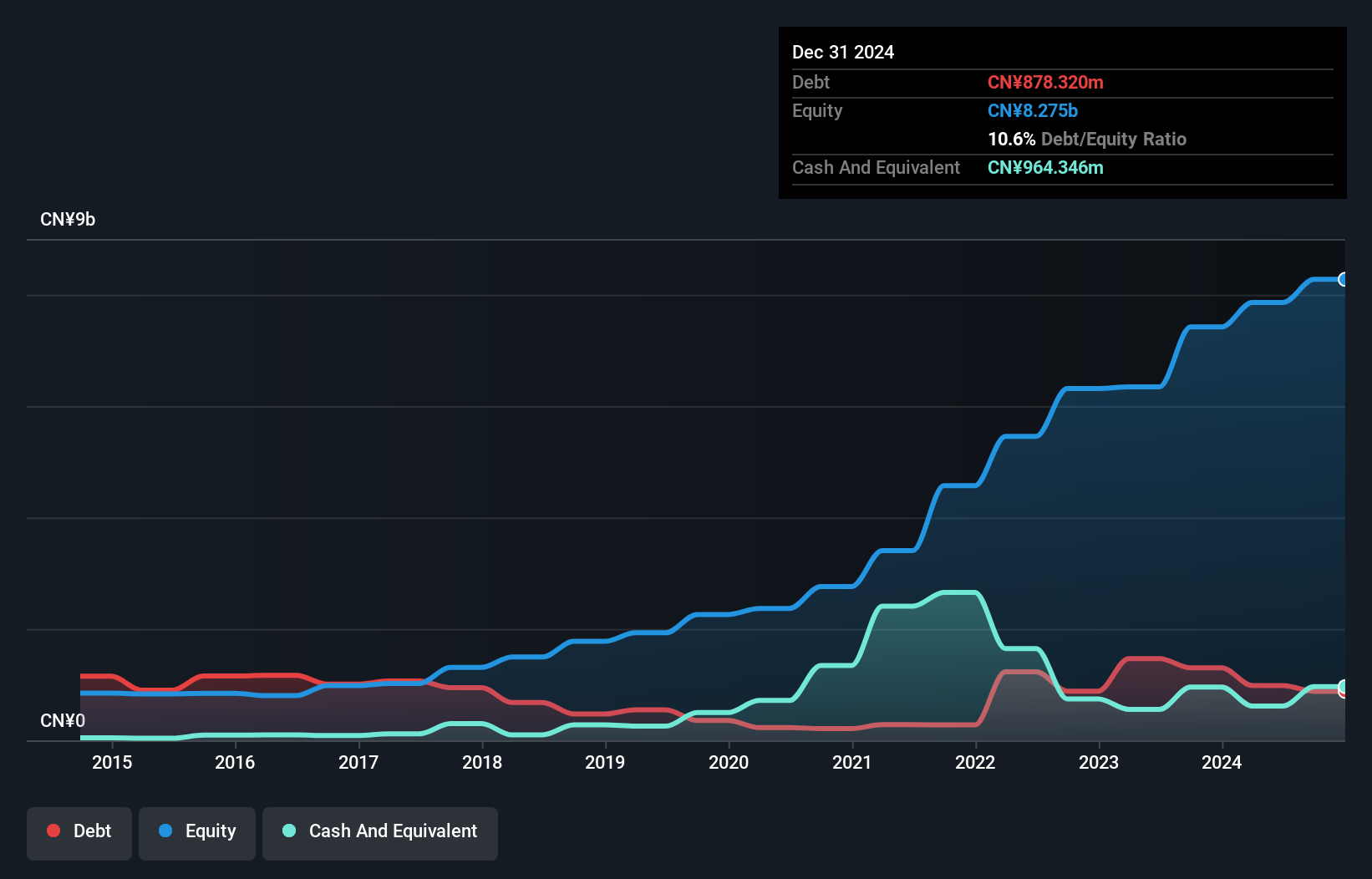

Kinetic Development Group, a smaller player in the Hong Kong market, trades at 28.5% below its estimated fair value and boasts high-quality earnings. The company’s interest payments are well covered by EBIT with a 55.7x coverage ratio, suggesting strong financial health. Despite negative earnings growth of -22% last year compared to the industry average of -6.8%, Kinetic has reduced its net debt to equity ratio from 26.6% to 17.6% over five years and declared a final dividend of HK$0.05 per share for 2023.

Medlive Technology (SEHK:2192)

Simply Wall St Value Rating: ★★★★★★

Overview: Medlive Technology Co., Ltd. operates an online professional physician platform in Mainland China and internationally, with a market cap of HK$5.83 billion.

Operations: Medlive Technology generates revenue primarily from its healthcare software segment, which contributed CN¥412 million. The company has a market capitalization of HK$5.83 billion.

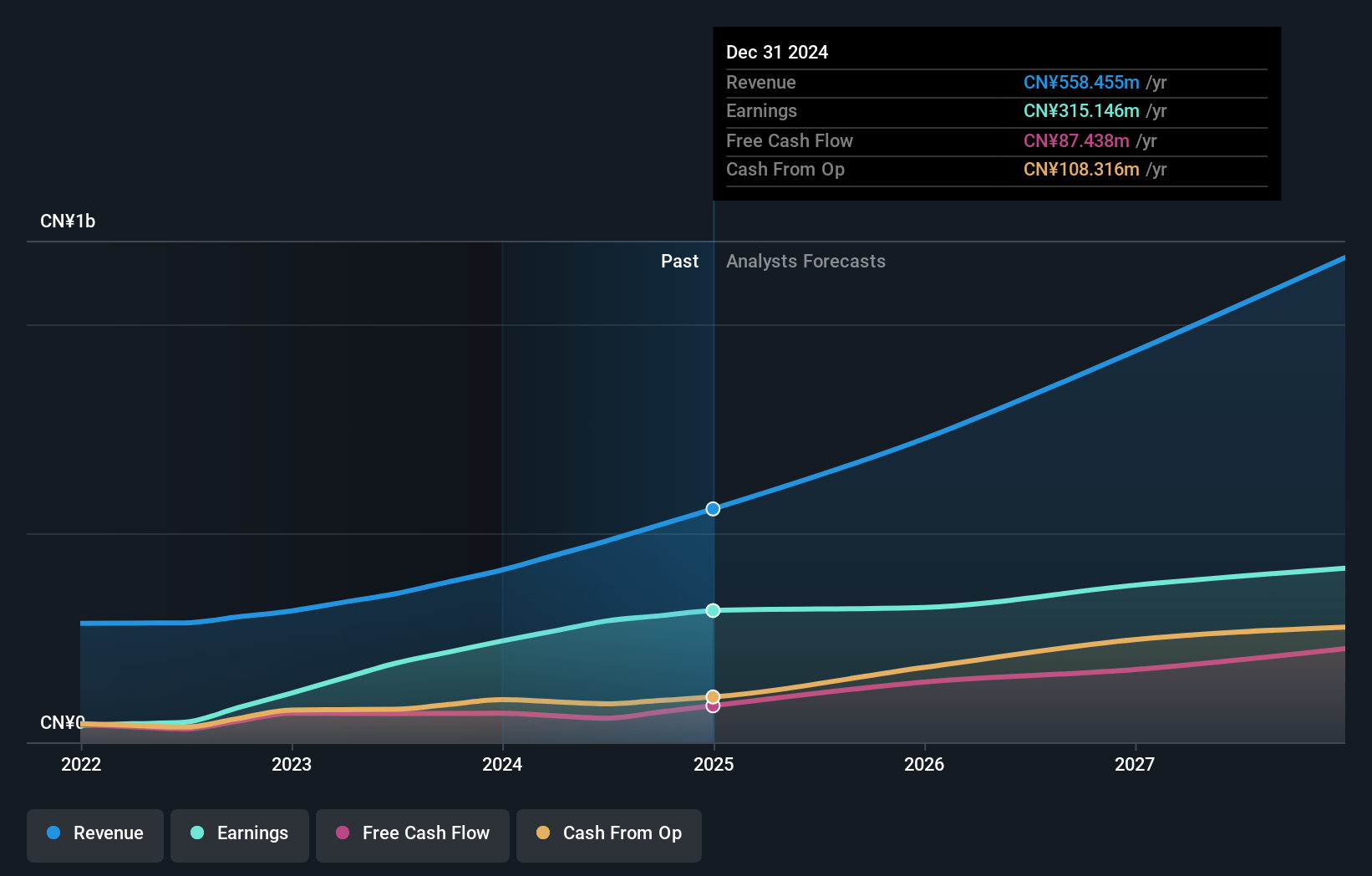

Medlive Technology, a promising player in the healthcare services sector, saw its earnings grow by 106.5% over the past year, significantly outperforming the industry average of -3.7%. The company is debt-free and has maintained positive free cash flow, with figures reaching US$69.34M as of December 2023. Revenue growth is projected at 13.91% annually for the next few years, although earnings are expected to decline by an average of 7.2% per year over three years. Recent board changes include Ms. Yang Yanling being appointed as company secretary from July 2024 onwards.

- Click here and access our complete health analysis report to understand the dynamics of Medlive Technology.

Understand Medlive Technology's track record by examining our Past report.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$9.15 billion.

Operations: Guoquan Food (Shanghai) generates revenue primarily from retail sales through grocery stores, amounting to CN¥6094.10 million. The company's market cap is HK$9.15 billion.

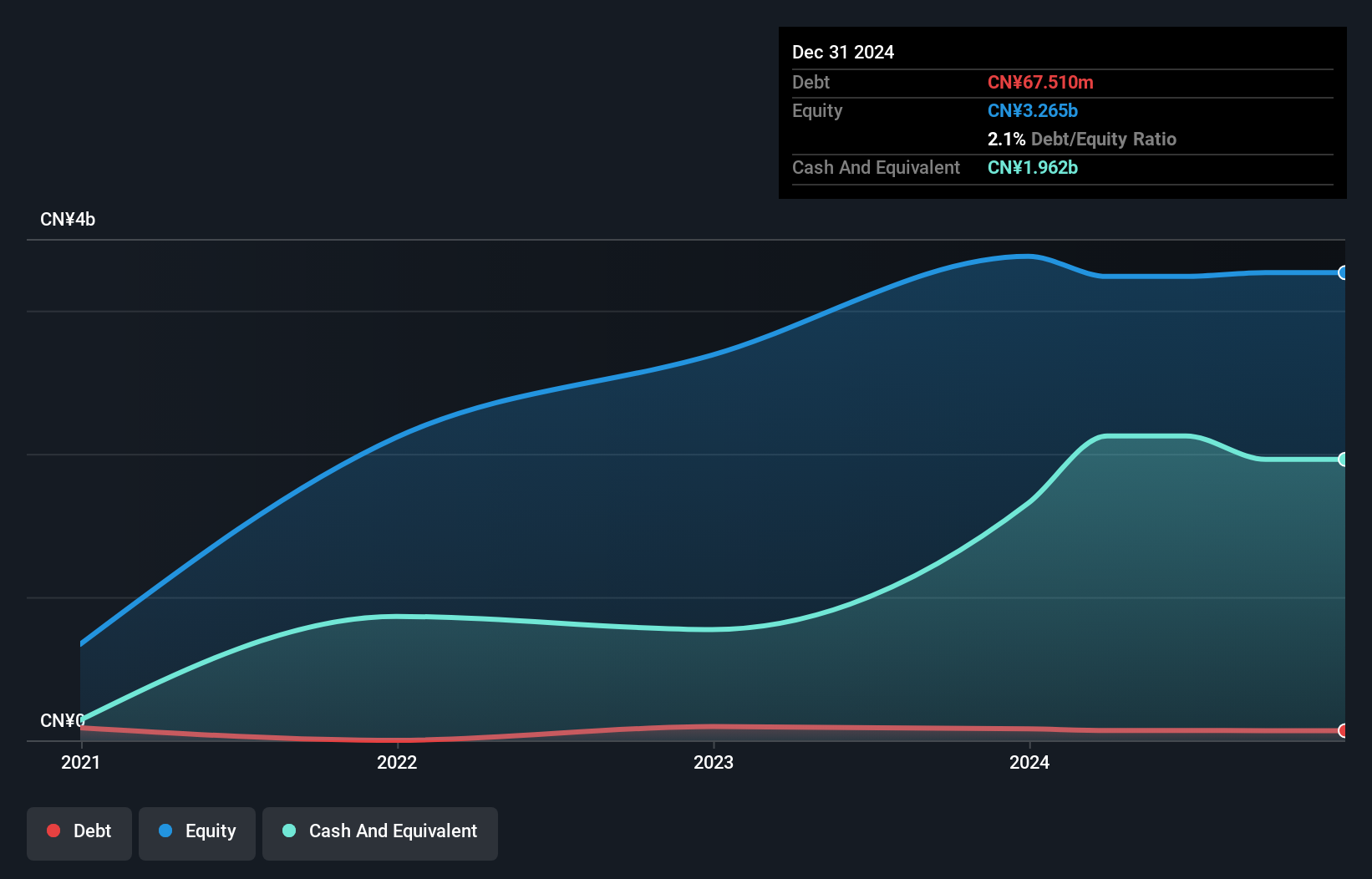

Guoquan Food (Shanghai) stands out with its recent 4.2% earnings growth, surpassing the Consumer Retailing industry's 1.6%. The company enjoys a solid financial position, boasting more cash than total debt and high-quality past earnings. Recent board changes include appointing Mr. Cheung Kai Cheong Willie as Joint Company Secretary, enhancing governance structure. Additionally, a final dividend of RMB 0.0521 per share has been approved for shareholders, reflecting strong shareholder returns and confidence in future prospects.

Taking Advantage

- Get an in-depth perspective on all 173 SEHK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com