The Hong Kong market has recently experienced a mixed performance, with the Hang Seng Index declining slightly by 0.45% amidst weak manufacturing data and broader global economic concerns. Despite these challenges, the search for promising small-cap stocks continues to be a focal point for investors looking to diversify their portfolios. In this environment, identifying high-potential stocks involves looking for companies that demonstrate resilience and growth potential despite broader market volatility. Here are three undiscovered gems in Hong Kong that could enhance your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| Sundart Holdings | 0.01% | -2.76% | -4.34% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

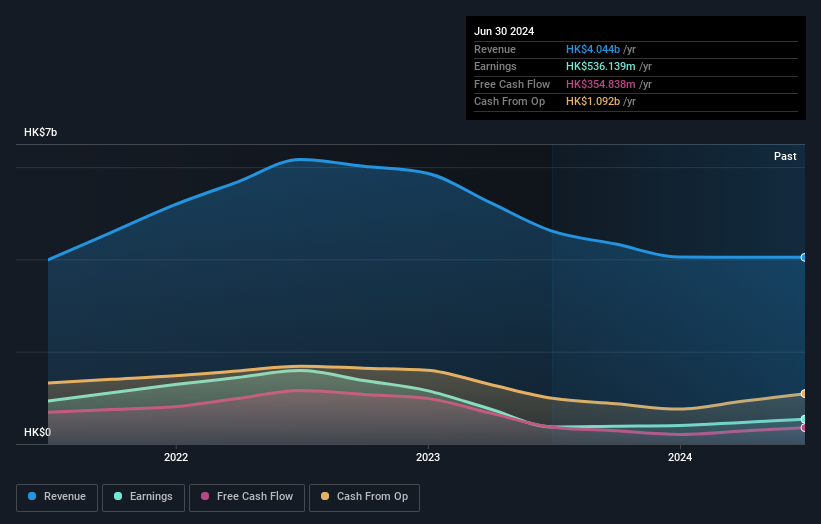

Overview: Kinetic Development Group Limited (SEHK:1277) is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China, with a market cap of HK$9.78 billion.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company's net profit margin stands at 15.75%, reflecting its efficiency in converting revenue into actual profit after expenses.

Kinetic Development Group, a small-cap entity in Hong Kong, saw its earnings growth at -22% over the past year, contrasting with the Oil and Gas industry average of -6.8%. Their debt to equity ratio improved from 26.6% to 17.6% over five years, and interest payments are well-covered by EBIT (55.7x). Trading at 23.7% below fair value estimates, Kinetic recently approved amendments to its articles of association and declared a final dividend of HK$0.05 per share for 2023.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$8.79 billion.

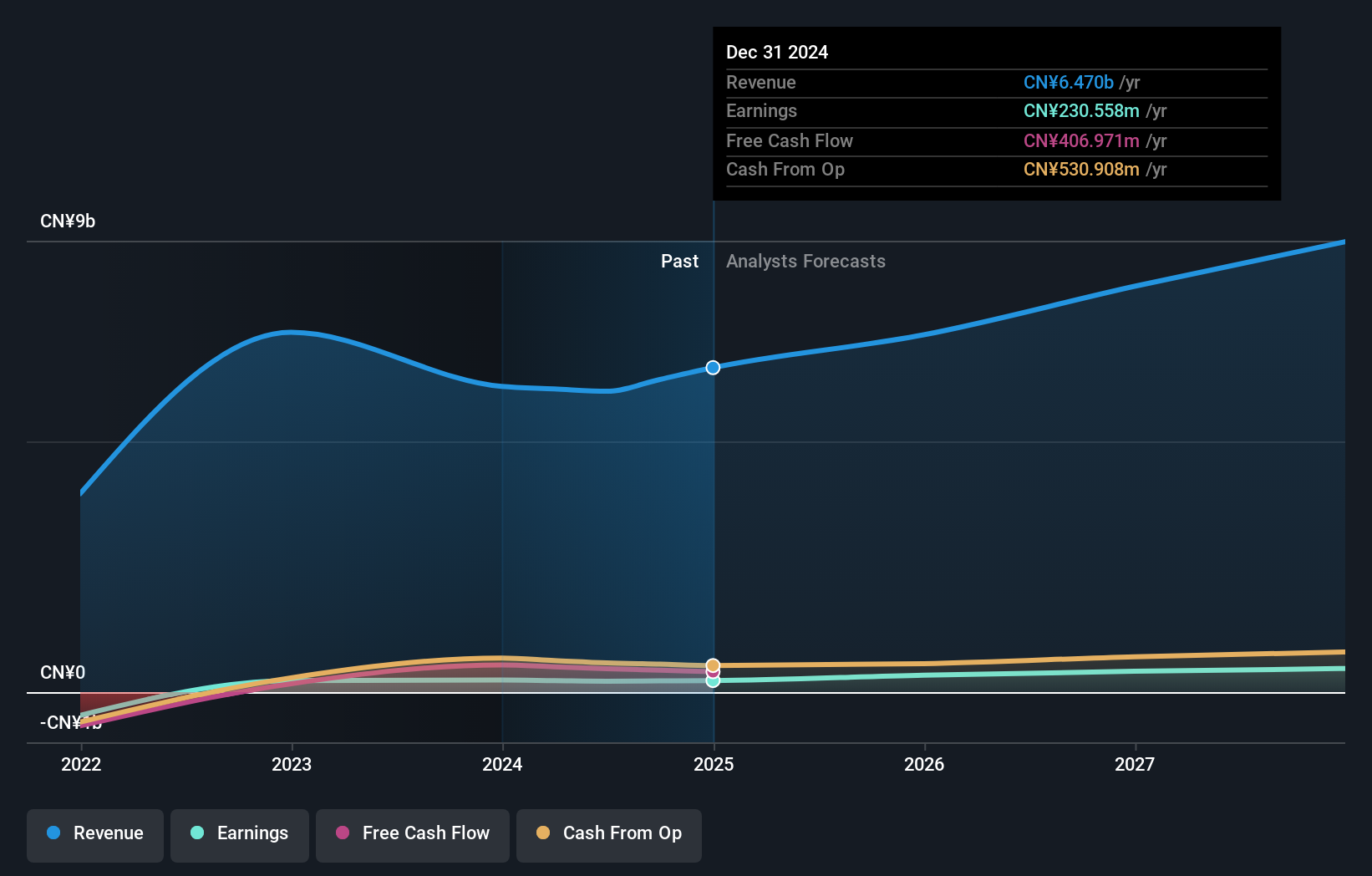

Operations: Guoquan Food (Shanghai) Co., Ltd. generates revenue primarily through retail sales in grocery stores, amounting to CN¥6.09 billion. The company's financial performance is highlighted by its gross profit margin of 25%.

Guoquan Food (Shanghai) has shown promising growth, with earnings increasing by 4.2% over the past year, outpacing the Consumer Retailing industry’s 1.6%. The company repurchased shares in 2024 and approved a final cash dividend of RMB 0.0521 per share for FY2023. Despite some executive changes, including appointing Mr. Cheung Kai Cheong Willie as joint company secretary, Guoquan remains financially robust with levered free cash flow improving to RMB 543 million by August 2024 from negative figures in prior years.

- Unlock comprehensive insights into our analysis of Guoquan Food (Shanghai) stock in this health report.

Gain insights into Guoquan Food (Shanghai)'s past trends and performance with our Past report.

Lee & Man Chemical (SEHK:746)

Simply Wall St Value Rating: ★★★★★★

Overview: Lee & Man Chemical Company Limited, with a market cap of HK$3.17 billion, is an investment holding company that manufactures and sells chemical products in the People’s Republic of China.

Operations: The company generates revenue from the manufacture and sale of chemical products in the People’s Republic of China. It has a market cap of HK$3.17 billion.

Lee & Man Chemical has shown impressive financial performance with a net debt to equity ratio of 4.8%, down from 49.4% over five years, indicating strong debt management. The company reported a robust earnings growth of 44.9% last year, outpacing the chemicals industry’s -11%. Trading at 48.1% below its estimated fair value and forecasting an annual earnings growth of 30%, Lee & Man Chemical appears well-positioned for future gains despite recent executive changes and increased interim dividends (HK$0.14 per share).

- Take a closer look at Lee & Man Chemical's potential here in our health report.

Understand Lee & Man Chemical's track record by examining our Past report.

Make It Happen

- Reveal the 177 hidden gems among our SEHK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com