The Hong Kong market has been experiencing notable fluctuations, with the Hang Seng Index retreating by 2.28% recently amid broader economic concerns and unexpected rate cuts by the central bank. Despite this volatility, small-cap stocks in Hong Kong have shown resilience and potential for growth, particularly those with insider buying activity. In this context, identifying undervalued small-cap stocks can be a strategic move for investors looking to capitalize on market inefficiencies. A good stock in such conditions often exhibits strong fundamentals, a solid business model, and insider confidence through recent purchases.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.7x | 0.4x | 30.20% | ★★★★★☆ |

| Wasion Holdings | 11.2x | 0.8x | 40.59% | ★★★★☆☆ |

| Nissin Foods | 14.0x | 1.3x | 49.65% | ★★★★☆☆ |

| Kinetic Development Group | 4.2x | 1.8x | 24.55% | ★★★★☆☆ |

| Shenzhen International Holdings | 8.0x | 0.7x | 24.74% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.9x | 0.7x | 35.27% | ★★★★☆☆ |

| iDreamSky Technology Holdings | NA | 1.9x | 45.43% | ★★★★☆☆ |

| Skyworth Group | 5.6x | 0.1x | -259.88% | ★★★☆☆☆ |

| Truly International Holdings | 12.5x | 0.2x | 37.34% | ★★★☆☆☆ |

| Jinke Smart Services Group | NA | 0.9x | 39.87% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

iDreamSky Technology Holdings (SEHK:1119)

Simply Wall St Value Rating: ★★★★☆☆

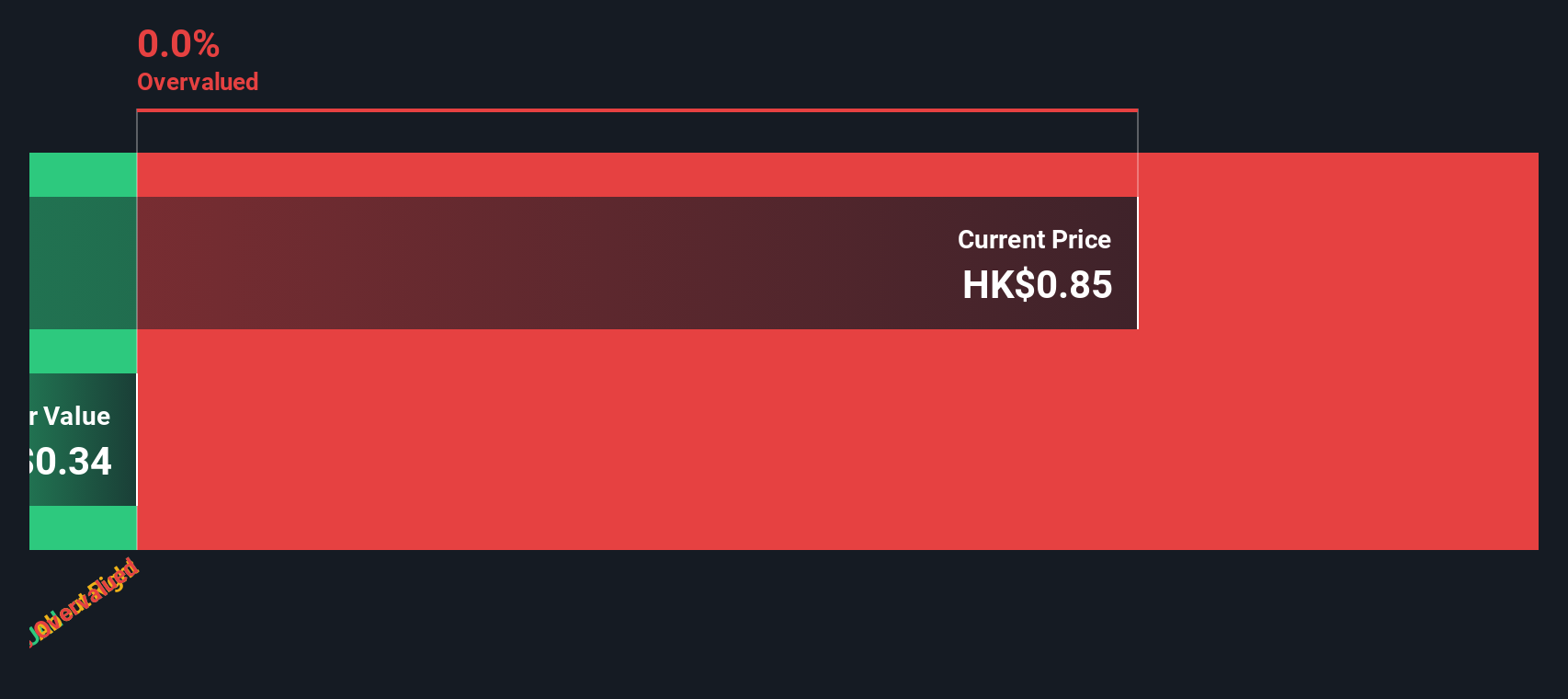

Overview: iDreamSky Technology Holdings is a company that primarily operates in the game and information services sector, including SaaS and other related services, with a market cap of approximately CN¥3.50 billion.

Operations: iDreamSky Technology Holdings generates revenue primarily from Game and Information Services, including SaaS and other related services. For the period ending December 31, 2023, the company reported a gross profit of CN¥673.46 million with a gross profit margin of 35.14%. Operating expenses stood at CN¥800.90 million, contributing to a net loss of CN¥452.36 million and a net income margin of -23.60%.

PE: -7.9x

iDreamSky Technology Holdings, a small cap in Hong Kong, recently filed a follow-on equity offering for HK$257.68 million on 23 July 2024, pricing shares at HK$2.15 each with a slight discount of HK$0.025 per share. At the Annual General Meeting on 28 June 2024, key agenda items included re-election of directors and auditor appointments. Despite having higher-risk external borrowing as its sole funding source, earnings are projected to grow by an impressive 104% annually.

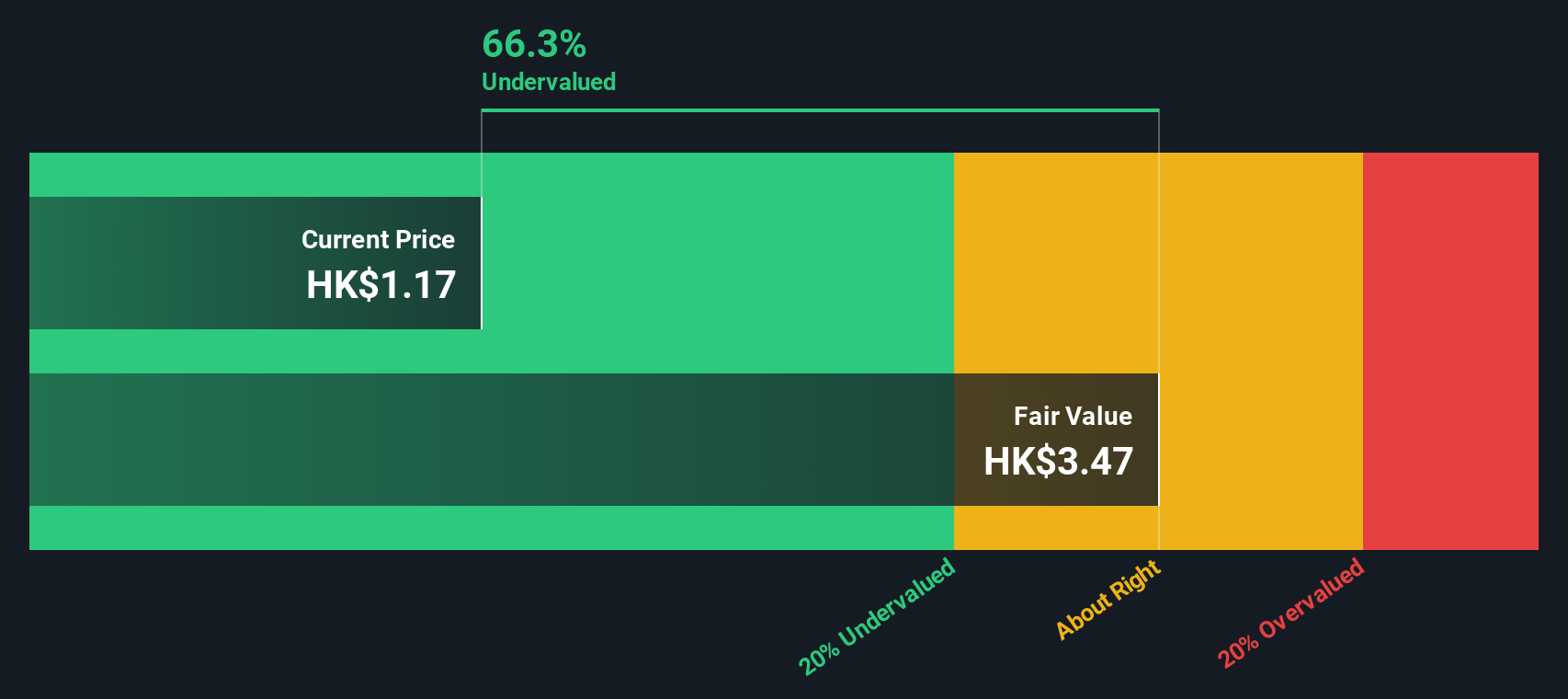

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is a company engaged in property development and investment, with a market cap of CN¥2.34 billion.

Operations: Kinetic Development Group's revenue streams primarily come from its core business operations, with recent quarterly revenues reaching CN¥4.75 billion and gross profit margins around 59.07%. The company has experienced fluctuations in net income margin, most recently reported at 43.79%, influenced by various operating and non-operating expenses including general & administrative costs and sales & marketing expenses.

PE: 4.2x

Kinetic Development Group, a small cap in Hong Kong, recently declared a final dividend of HK$0.05 per share for 2023. Despite having higher-risk funding solely from external borrowing, the company has seen insider confidence with significant share purchases by executives over the past six months. The recent amendments to their bylaws suggest strategic shifts aimed at improving governance and operational flexibility. These factors indicate potential for growth amidst its current undervalued status in the market.

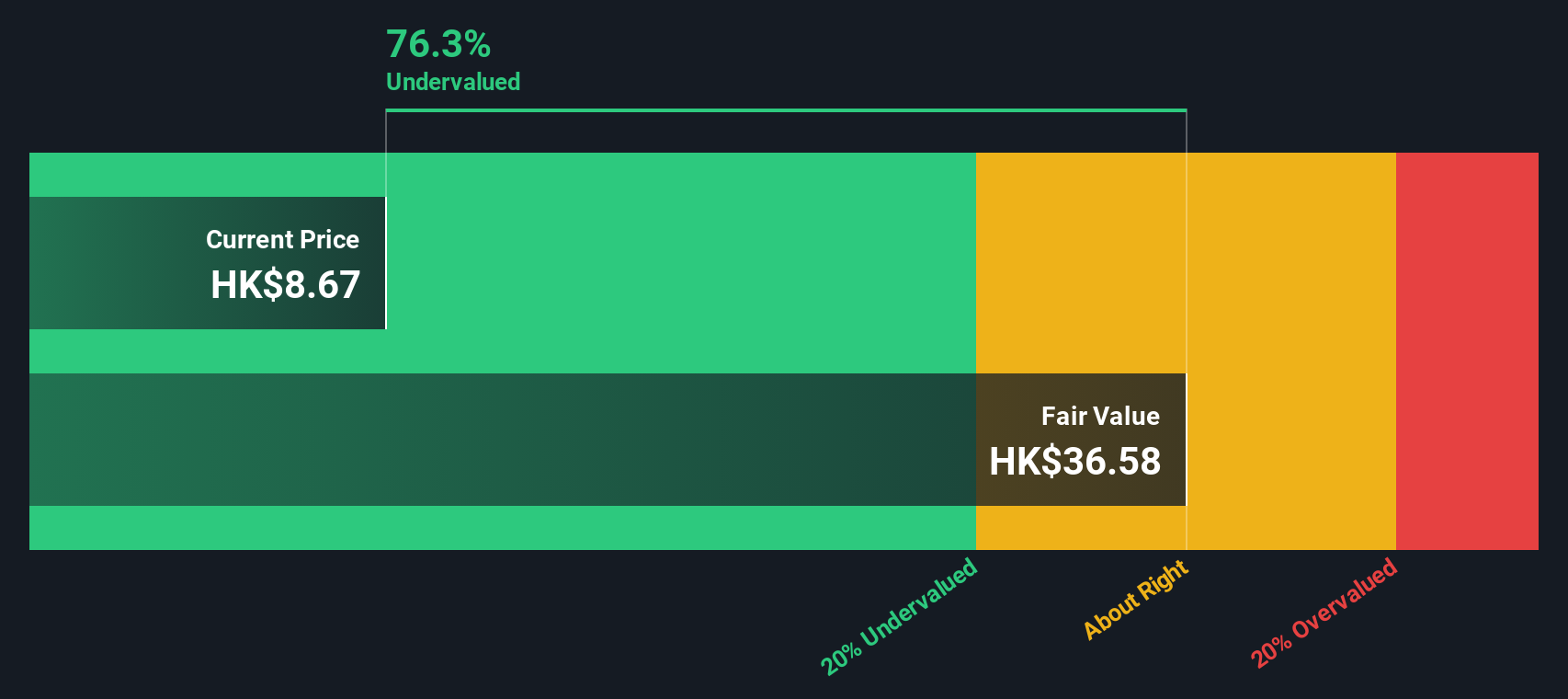

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wasion Holdings is engaged in the production and sale of advanced metering infrastructure and distribution operations, with a market cap of approximately CN¥4.55 billion.

Operations: The company derives its revenue primarily from Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion). The gross profit margin has shown a trend of increasing, reaching 34.97% in the latest period.

PE: 11.2x

Wasion Holdings has garnered attention with recent insider confidence, as Founder and Executive Chairman Wei Ji purchased 500,000 shares for HK$3.17 million between May and July 2024. This activity highlights potential undervaluation in the market's eyes. Additionally, Wasion secured significant contracts in Hungary (EUR 31.62 million), Singapore (US$9.42 million), and Malaysia (US$5.74 million) for smart meters, reflecting strong international demand for its products. Despite relying solely on external borrowing for funding, the company’s earnings are projected to grow by 25.8% annually.

- Click here to discover the nuances of Wasion Holdings with our detailed analytical valuation report.

Explore historical data to track Wasion Holdings' performance over time in our Past section.

Next Steps

- Gain an insight into the universe of 14 Undervalued SEHK Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com