As the Hong Kong market navigates through a period of mixed economic signals and fluctuating investor sentiment, small-cap stocks have shown resilience against broader market trends. In this dynamic environment, identifying promising opportunities requires a keen eye for companies with strong fundamentals, innovative potential, and robust growth strategies.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| Sundart Holdings | 0.01% | -2.76% | -4.34% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd., along with its subsidiaries, focuses on the research, development, production, and marketing of edible bird’s nest products in China and has a market cap of HK$7.03 billion.

Operations: Yan Palace Bird's Nest Industry generates revenue through multiple channels, including direct sales to online customers (CN¥824.40 million) and offline distributors (CN¥509.04 million). The company also earns from sales to e-commerce platforms (CN¥262.89 million) and online distributors (CN¥16.75 million).

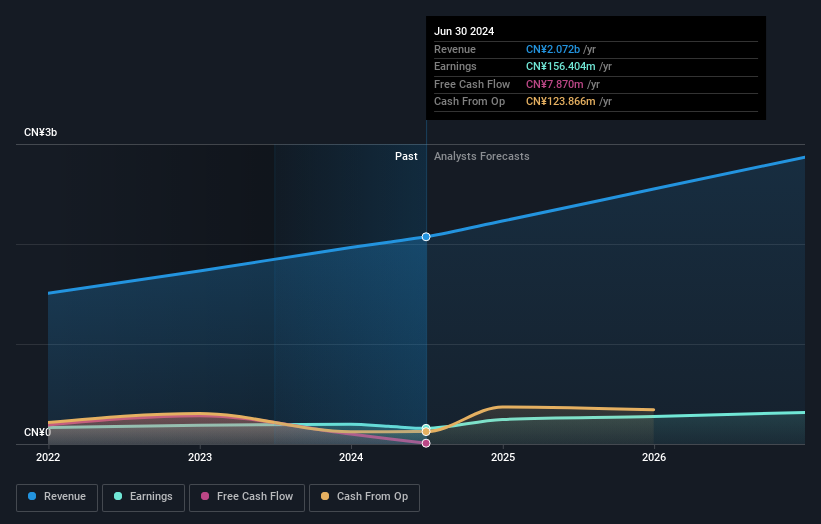

Xiamen Yan Palace Bird's Nest Industry has shown resilience despite a challenging first half of 2024, with revenue expected to reach RMB 1.09 billion, up 15% from the previous year. However, net profit is projected to drop by up to 50%, likely due to increased operating costs. The company remains debt-free and has reduced its debt-to-equity ratio from 10.5% five years ago. Earnings grew by 4.9% last year and are forecasted to grow at an annual rate of nearly 15%.

- Unlock comprehensive insights into our analysis of Xiamen Yan Palace Bird's Nest Industry stock in this health report.

Understand Xiamen Yan Palace Bird's Nest Industry's track record by examining our Past report.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$7.86 billion.

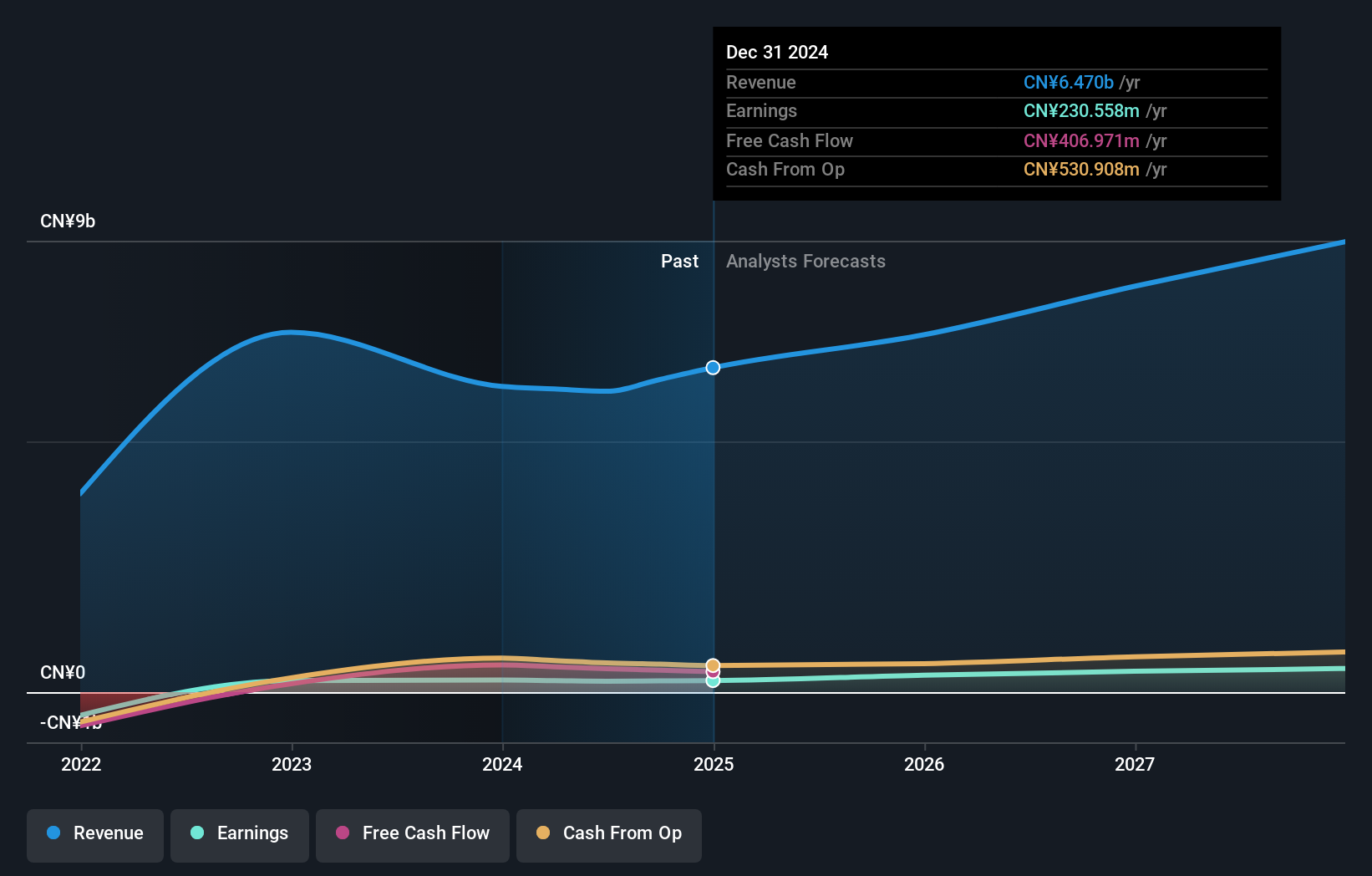

Operations: Guoquan Food generates revenue primarily from retail sales through grocery stores, totaling CN¥6.09 billion. The company has a market cap of HK$7.86 billion.

Guoquan Food (Shanghai) has shown promising performance with earnings growth of 4.2% over the past year, outpacing the Consumer Retailing industry’s 1.6%. The company is profitable and has more cash than its total debt, indicating financial stability. Recent board changes include Mr. Wang Hui's appointment as CFO in February 2024, enhancing their financial oversight. Additionally, a final cash dividend of RMB 0.0521 per share was approved for shareholders in June 2024, reflecting shareholder value commitment.

- Delve into the full analysis health report here for a deeper understanding of Guoquan Food (Shanghai).

Learn about Guoquan Food (Shanghai)'s historical performance.

First Tractor (SEHK:38)

Simply Wall St Value Rating: ★★★★★★

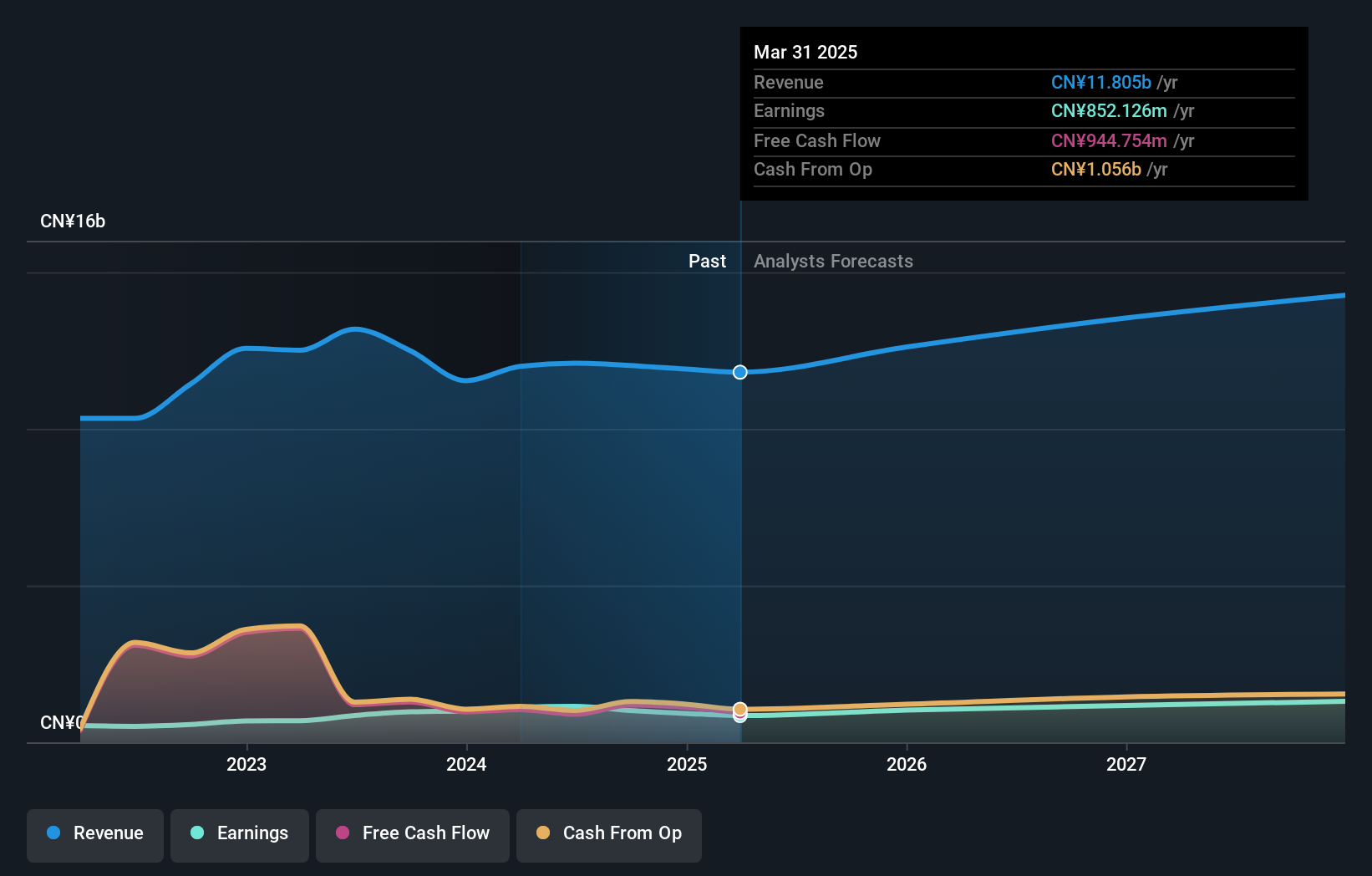

Overview: First Tractor Company Limited engages in the research and development, manufacture, and sale of agricultural and power machinery, along with related spare parts worldwide; it has a market cap of HK$14.61 billion.

Operations: First Tractor's primary revenue streams include the sale of agricultural machinery and power machinery, along with related spare parts. The company's net profit margin is 2.5%.

First Tractor has shown impressive earnings growth of 61.9% over the past year, outpacing the Machinery industry’s 1.5%. The company’s debt to equity ratio has reduced significantly from 84% to 2.9% in five years, indicating strong financial management. Recently, First Tractor approved a final dividend of HK$0.352 per share for FY2023 and saw notable board resignations due to age and work re-arrangement reasons on July 4, 2024.

- Get an in-depth perspective on First Tractor's performance by reading our health report here.

Assess First Tractor's past performance with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 179 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com