The Hong Kong market has recently experienced a notable decline, with the Hang Seng Index retreating by 2.28%, reflecting broader concerns about economic growth and investor sentiment. Amidst this backdrop, small-cap stocks in Hong Kong present intriguing opportunities for investors looking to capitalize on potential undervaluation and insider buying trends. In the current market environment, identifying good stocks often involves looking at companies that demonstrate strong fundamentals, possess growth potential despite broader economic challenges, and show signs of confidence from insiders through their buying activities.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ferretti | 11.3x | 0.8x | 45.36% | ★★★★★☆ |

| Ever Sunshine Services Group | 5.7x | 0.4x | 21.19% | ★★★★★☆ |

| Wasion Holdings | 11.2x | 0.8x | 33.47% | ★★★★☆☆ |

| Nissin Foods | 14.0x | 1.3x | 42.79% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.9x | 0.7x | 27.26% | ★★★★☆☆ |

| Transport International Holdings | 11.7x | 0.6x | 43.81% | ★★★★☆☆ |

| Skyworth Group | 5.6x | 0.1x | -305.48% | ★★★☆☆☆ |

| Kinetic Development Group | 4.0x | 1.8x | 19.44% | ★★★☆☆☆ |

| Shenzhen International Holdings | 7.9x | 0.7x | 15.48% | ★★★☆☆☆ |

| Jinke Smart Services Group | NA | 0.9x | 32.16% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

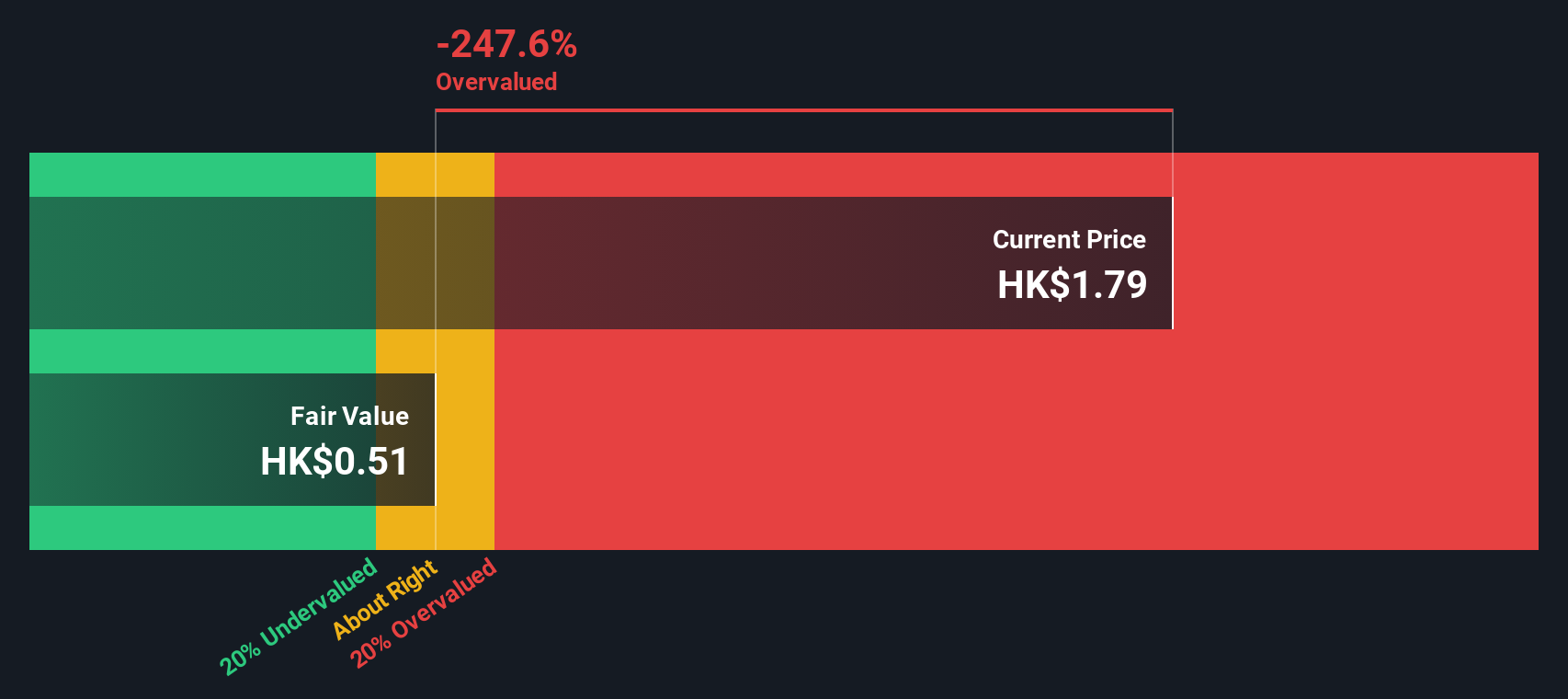

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, as well as operator telecommunication services, with a market cap of approximately HK$1.50 billion.

Operations: The company generates revenue primarily from Wireless Telecommunications Network System Equipment and Services (HK$5824.14 million) and Operator Telecommunication Services (HK$157.83 million). Over the observed periods, its gross profit margin fluctuated, reaching a high of 30.93% in Q1 2020 before decreasing to 27.79% by Q4 2023. Operating expenses are significant, with Sales & Marketing and R&D being major components.

PE: 356.8x

Comba Telecom Systems Holdings, a small player in the Hong Kong market, has shown insider confidence with Tung Ling Fok purchasing 1.83 million shares valued at HK$930,371 in June 2024. Despite lower profit margins (0.1%) compared to last year (3%), the company is actively repurchasing shares as part of a program authorized on May 23, 2024. This move aims to enhance net assets and earnings per share, reflecting strategic efforts to leverage cash flow for shareholder value enhancement.

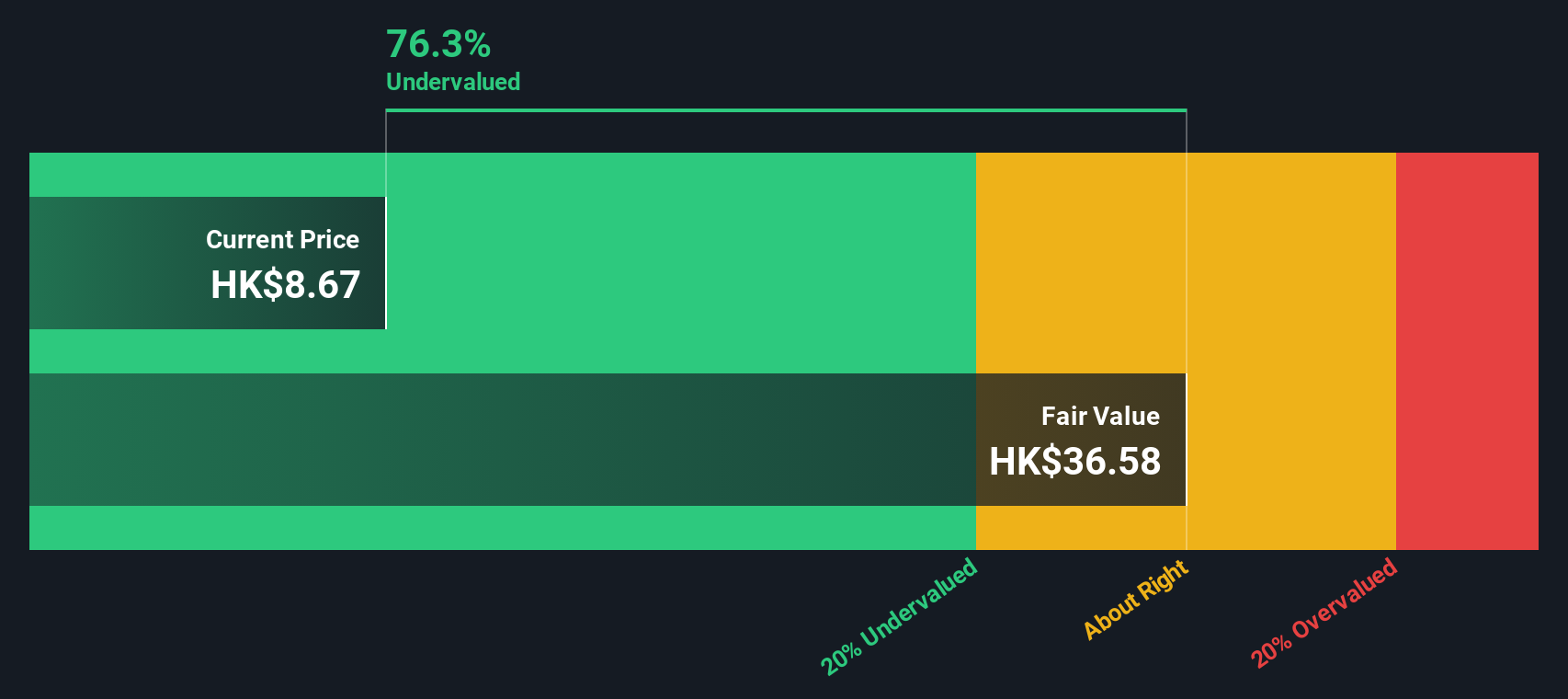

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wasion Holdings specializes in advanced metering infrastructure and distribution operations, with a market cap of approximately CN¥3.70 billion.

Operations: The company generates revenue primarily from Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion). Over recent periods, the gross profit margin has shown an upward trend, reaching 35.59% in the most recent quarter ending December 31, 2023. Operating expenses include significant allocations to Sales & Marketing and R&D, with CN¥649.48 million and CN¥681.38 million respectively in the latest period analyzed

PE: 11.2x

Wasion Holdings, a small-cap company in Hong Kong, has recently secured significant smart meter contracts worth approximately EUR 31.62 million in Hungary and USD 15.16 million combined from Singapore and Malaysia as of May and July 2024. This international success underscores the company's expanding global footprint. Insider confidence is evident with Wei Ji purchasing 500,000 shares valued at HKD 3.17 million between May and July 2024, reflecting strong belief in the company's future prospects amidst expected earnings growth of 25.8% annually.

- Navigate through the intricacies of Wasion Holdings with our comprehensive valuation report here.

Review our historical performance report to gain insights into Wasion Holdings''s past performance.

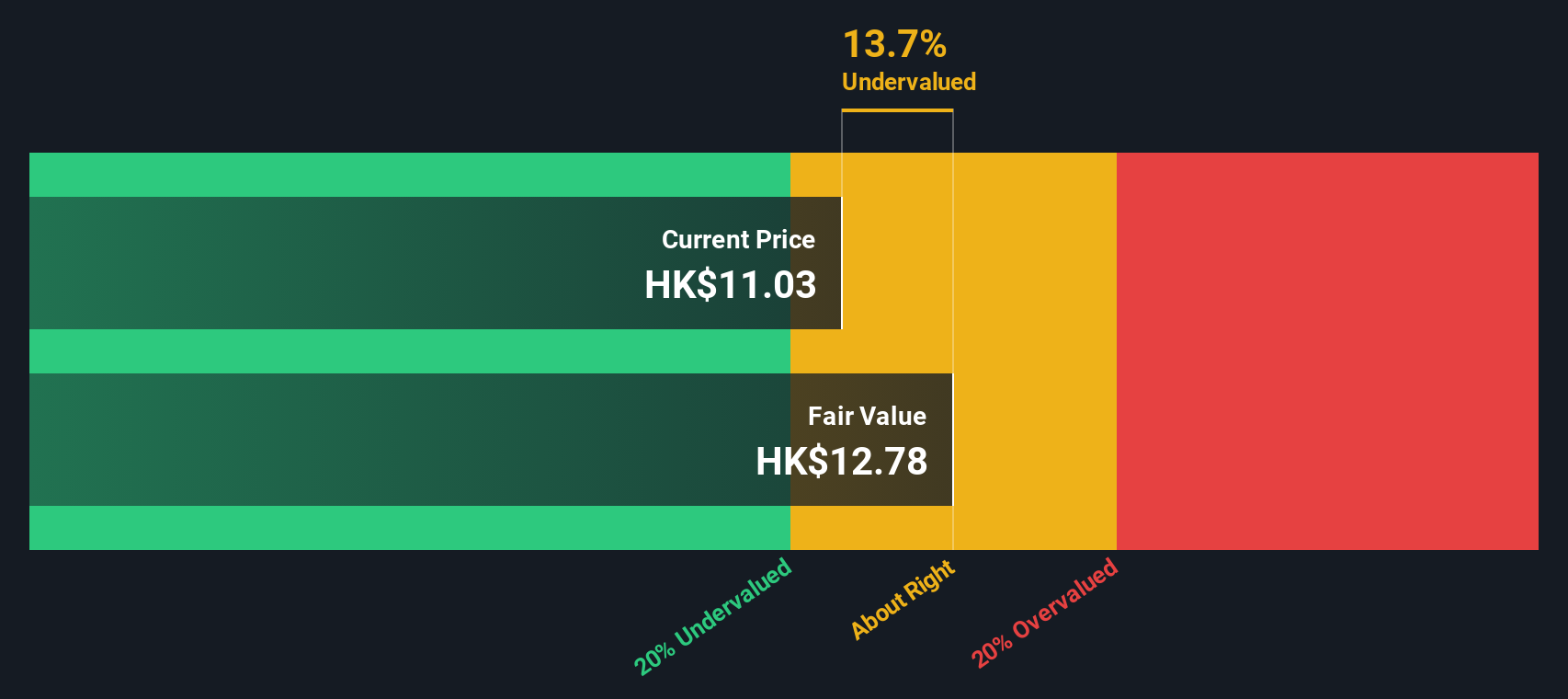

Transport International Holdings (SEHK:62)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Transport International Holdings operates primarily in franchised bus services, property holdings and development, and other related businesses, with a market cap of HK$5.18 billion.

Operations: The company's primary revenue stream is from franchised bus operations, with additional contributions from property holdings and development. Over the periods observed, the net income margin varied, reaching a high of 30.76% in Q4 2020 and a low of 2.24% in Q1 2023.

PE: 11.7x

Transport International Holdings, a Hong Kong-based transport company, has seen insider confidence with Non-Executive Director Winnie J. Ng purchasing 124,000 shares valued at HK$1.11 million in the past year. Despite a decline in profit margins from 8.3% to 5.1%, the company continues to pay dividends, approving HK$0.50 per share as of May 2024. Recent board changes include appointing Julia Lau as an alternate director, bringing extensive experience in urban planning and architecture to the team since June 2024.

- Dive into the specifics of Transport International Holdings here with our thorough valuation report.

Taking Advantage

- Delve into our full catalog of 16 Undervalued SEHK Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com