Amidst a backdrop of mixed global market performances, Hong Kong's small-cap sector presents unique opportunities. As broader indices like the Russell 2000 show modest gains, understanding the intrinsic qualities that contribute to a stock being undervalued becomes crucial in today’s dynamic economic environment.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ferretti | 11.1x | 0.8x | 46.23% | ★★★★★☆ |

| Ever Sunshine Services Group | 5.7x | 0.4x | 21.25% | ★★★★★☆ |

| Wasion Holdings | 10.8x | 0.8x | 35.45% | ★★★★☆☆ |

| Kinetic Development Group | 3.9x | 1.7x | 21.88% | ★★★★☆☆ |

| Nissin Foods | 14.3x | 1.3x | 41.66% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.9x | 0.7x | 27.19% | ★★★★☆☆ |

| Transport International Holdings | 11.6x | 0.6x | 44.07% | ★★★★☆☆ |

| Skyworth Group | 5.6x | 0.1x | -308.43% | ★★★☆☆☆ |

| Shenzhen International Holdings | 8.0x | 0.7x | 14.72% | ★★★☆☆☆ |

| Jinke Smart Services Group | NA | 0.8x | 37.52% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

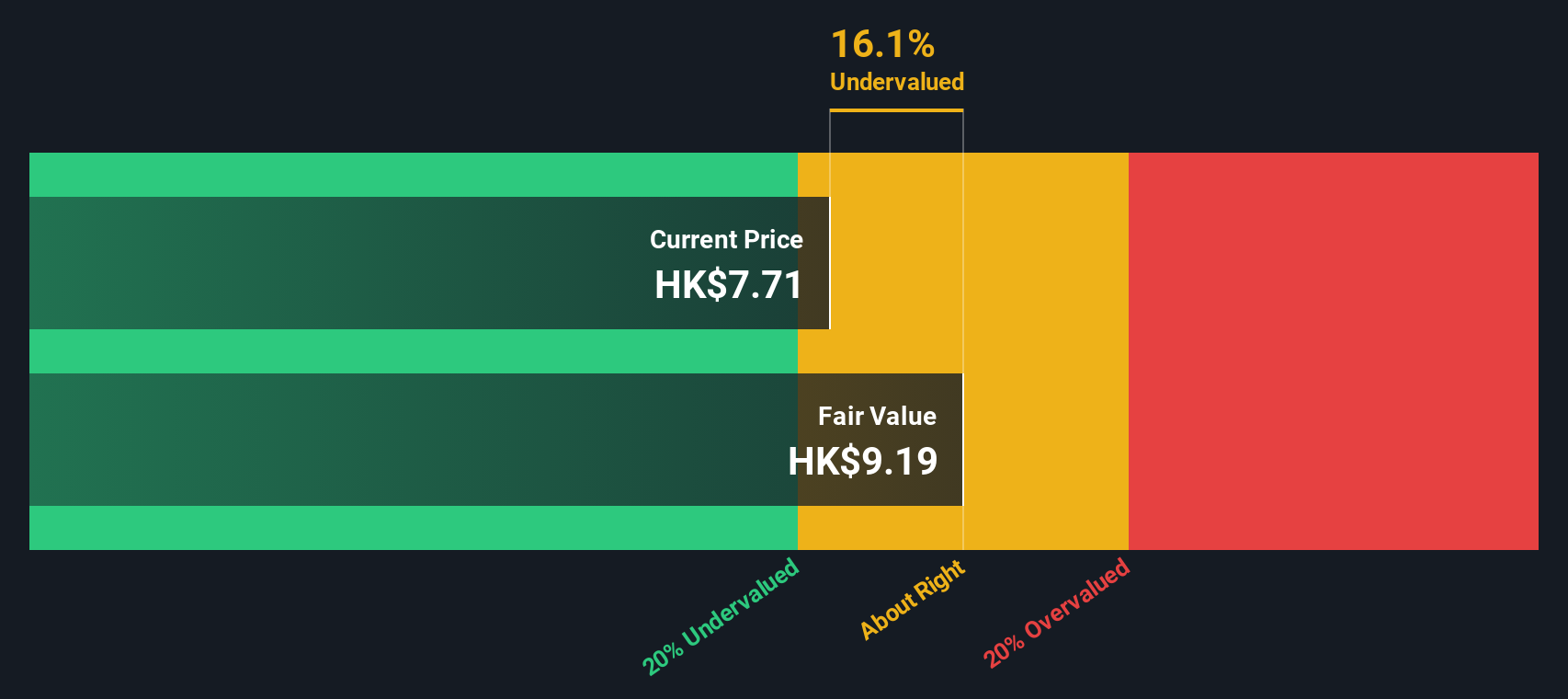

Shenzhen International Holdings (SEHK:152)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Shenzhen International Holdings operates in logistics, including parks and services, port-related services, toll roads, and environmental protection businesses.

Operations: The company's gross profit margin has shown variability over the observed periods, ranging from 26.70% to 39.76%, reflecting changes in cost of goods sold and revenue dynamics. Notably, the net income margin also fluctuated, indicating shifts in operational efficiency and non-operating expenses influence.

PE: 8.0x

Shenzhen International Holdings, often spotlighted for its potential in the Hong Kong small-cap sector, recently underscored insider confidence with a significant purchase by Zhengyu Liu, who acquired 693,000 shares. This move in July 2024 reflects a robust belief in the company's prospects amidst financial challenges like debt not being well covered by operating cash flow. Additionally, recent board changes and strategic investments hint at a dynamic approach to governance and expansion. The company's decision to pay dividends partially via Scrip Shares also suggests an innovative financial strategy aimed at maintaining liquidity while rewarding shareholders.

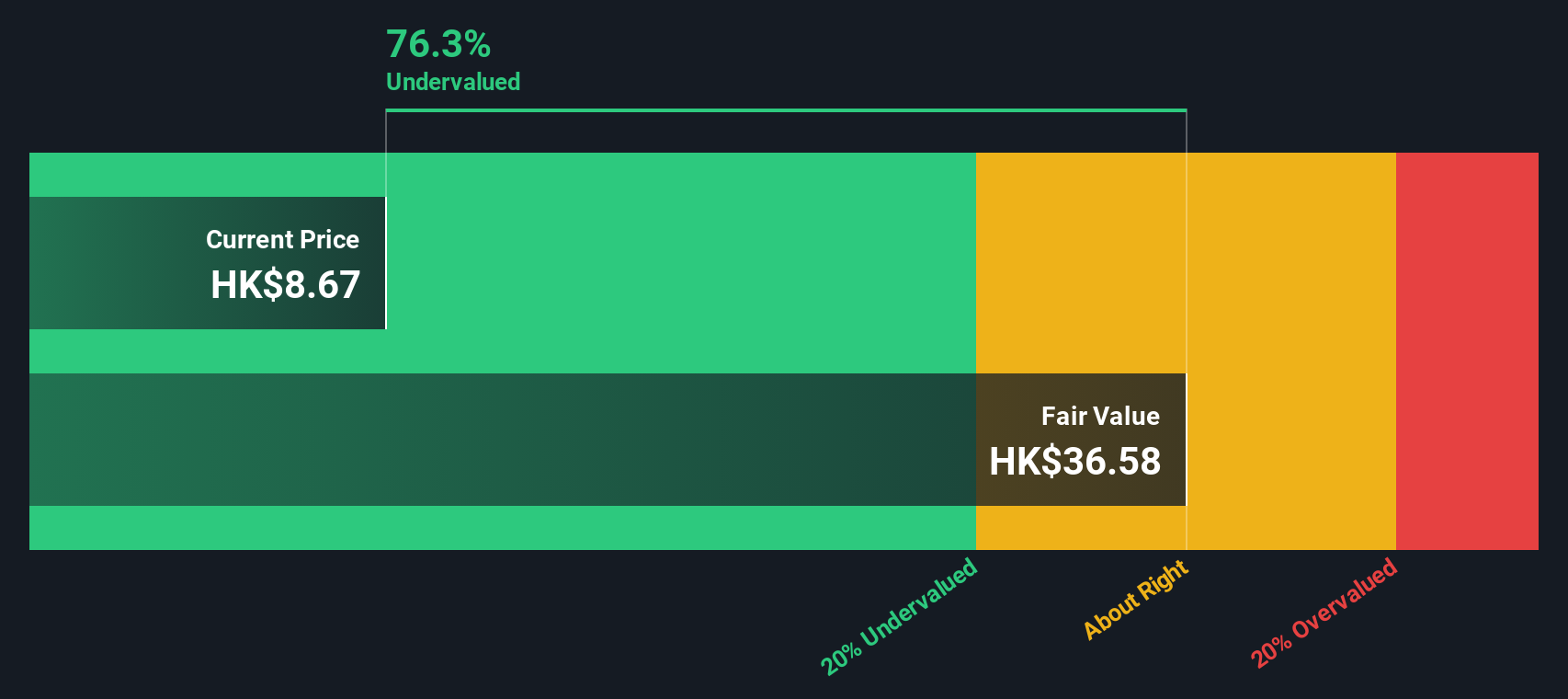

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wasion Holdings is a company engaged in the manufacturing and sale of advanced metering products, with operations spanning power, communication, and fluid metering infrastructure, boasting a market capitalization of approximately CN¥4.37 billion.

Operations: Advanced Distribution Operations, Power Advanced Metering Infrastructure, and Communication and Fluid Advanced Metering Infrastructure collectively generated revenues of CN¥7.37 billion. The company's gross profit margin has shown a gradual increase over the periods reviewed, reaching 35.59% by the end of the last reported period.

PE: 10.8x

Recently, Wasion Holdings demonstrated insider confidence as Wei Ji acquired 500,000 shares on May 10, 2024, signaling a strong belief in the company's prospects. This move coincides with a dividend increase to HK$0.28 per share and an anticipated annual earnings growth of 25.8%. Despite relying solely on external borrowing—a higher risk funding source—Wasion remains a compelling watch for those seeking overlooked opportunities in Hong Kong’s market landscape.

- Dive into the specifics of Wasion Holdings here with our thorough valuation report.

Explore historical data to track Wasion Holdings' performance over time in our Past section.

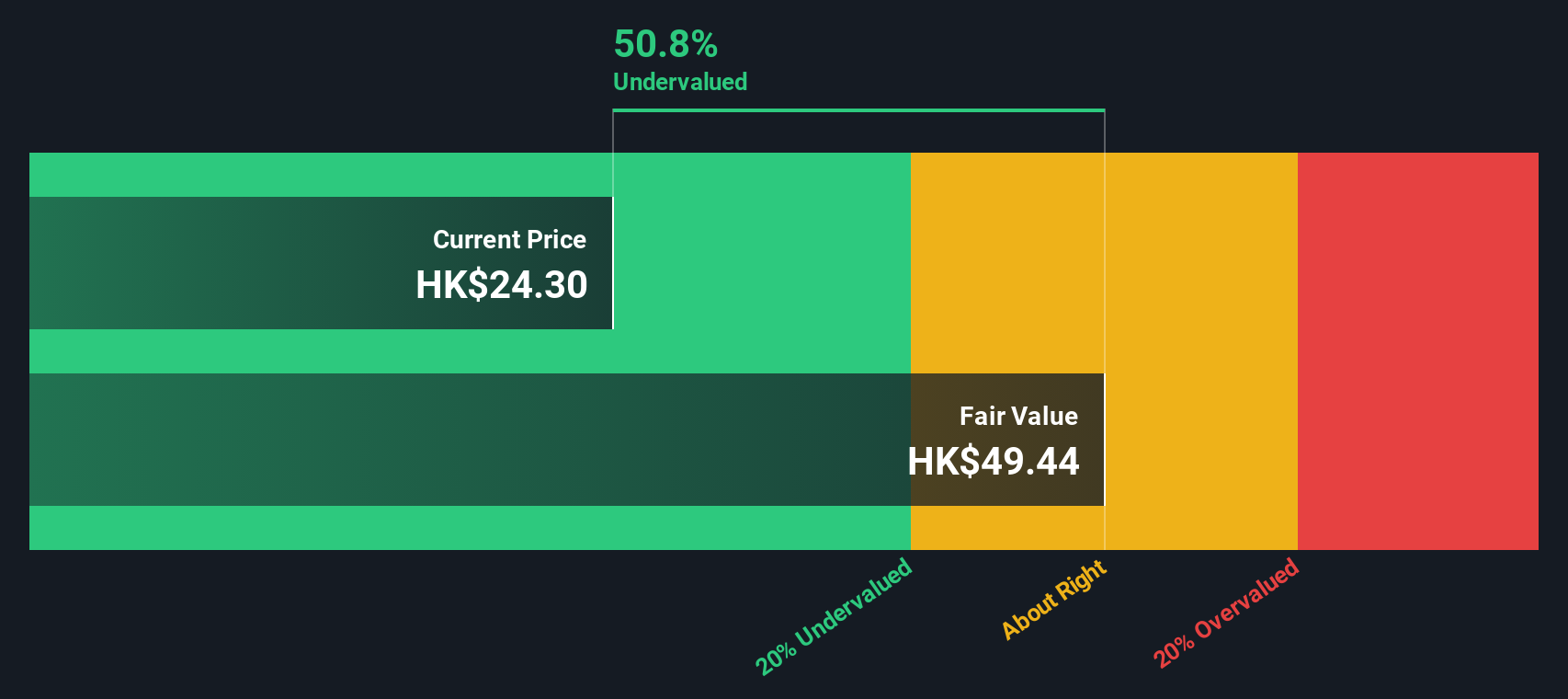

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats.

Operations: The company generates revenue primarily from the design, construction, and marketing of yachts and recreational boats, achieving €1.23 billion in its latest reporting period. It has seen a gross profit margin increase to 37.08% recently, reflecting improved operational efficiency or pricing strategies in its core business activities.

PE: 11.1x

Ferretti, recently spotlighted at the UniCredit Italian Investment Conference, has confirmed robust 2024 revenue forecasts between €1.22 billion and €1.24 billion, reflecting growth up to 11.6%. With earnings expected to surge by approximately 12% annually and a funding strategy reliant solely on external borrowing—indicating a higher risk profile—the firm exhibits strong non-cash earnings quality. Insider confidence is evident as they recently purchased shares, underscoring their belief in the company's financial health and future prospects.

- Take a closer look at Ferretti's potential here in our valuation report.

Understand Ferretti's track record by examining our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 16 Undervalued SEHK Small Caps With Insider Buying by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com