Top 2 Consumer Stocks Which Could Rescue Your Portfolio In Q3

Benzinga · 07/25/2024 13:00

Share

Listen to the news

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies. `

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

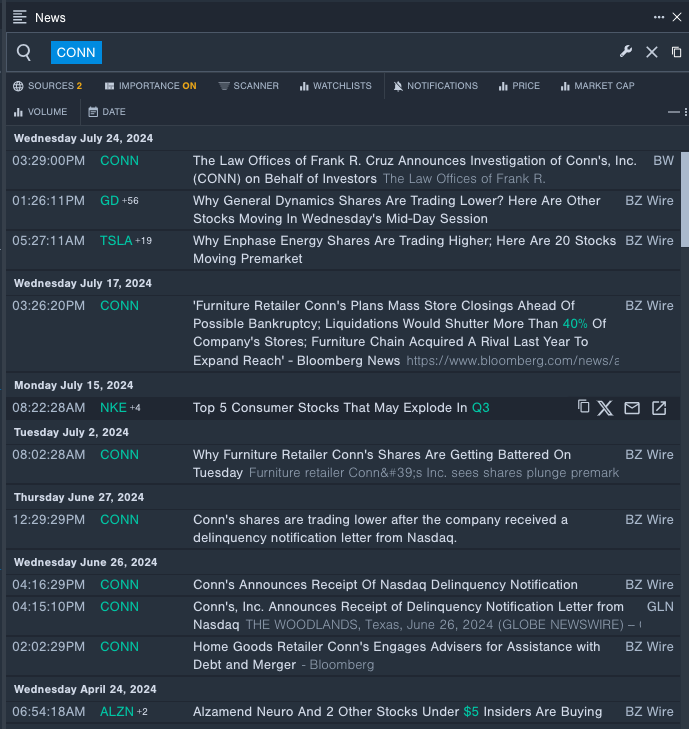

Conn’s Inc (NASDAQ:CONN)

- On June 26, Conn's received a delinquency notification letter from the Nasdaq. The company's stock fell around 48% over the past five days and has a 52-week low of $0.31.

- RSI Value: 17.61

- CONN Price Action: Shares of Conn’s closed at $0.35 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest CONN news.

Levi Strauss & Co (NYSE:LEVI)

- On June 26, Levi Strauss reported quarterly earnings of 16 cents per share which beat the analyst consensus estimate of 11 cents. "We delivered another strong quarter driven by the Levi's brand's prominence at the center of culture, a robust pipeline of newness and innovation, and continued momentum in our global direct-to-consumer channel. Our amplified focus on women's and denim lifestyle is delivering outsized growth and driving meaningful market share gains," said Michelle Gass, CEO of Levi Strauss & Co. The company's stock fell around 24% over the past month. It has a 52-week low of $12.42.

- RSI Value: 25.55

- LEVI Price Action: Shares of Levi Strauss fell slightly to close at $17.50 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in LEVI stock.

Read Next:

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved