Amidst a backdrop of fluctuating global markets, the Hong Kong stock market has shown signs of potential undervaluation in several sectors. This presents an intriguing opportunity for investors to consider stocks that may be poised for recovery or growth as market dynamics evolve. In identifying undervalued stocks, it's crucial to look for companies with strong fundamentals, including robust earnings potential and stable financial health, which may be overlooked in turbulent times.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$39.60 | HK$75.71 | 47.7% |

| Beauty Farm Medical and Health Industry (SEHK:2373) | HK$16.84 | HK$33.00 | 49% |

| China Cinda Asset Management (SEHK:1359) | HK$0.66 | HK$1.29 | 48.8% |

| West China Cement (SEHK:2233) | HK$1.08 | HK$2.15 | 49.7% |

| Mobvista (SEHK:1860) | HK$1.84 | HK$3.67 | 49.8% |

| BYD (SEHK:1211) | HK$233.00 | HK$460.29 | 49.4% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.30 | HK$19.58 | 47.4% |

| AK Medical Holdings (SEHK:1789) | HK$4.48 | HK$7.96 | 43.7% |

| Vobile Group (SEHK:3738) | HK$1.19 | HK$2.30 | 48.3% |

| MicroPort Scientific (SEHK:853) | HK$5.07 | HK$9.41 | 46.1% |

Underneath we present a selection of stocks filtered out by our screen.

Pacific Textiles Holdings (SEHK:1382)

Overview: Pacific Textiles Holdings Limited is engaged in the manufacturing and trading of textile products across a diverse set of regions including China, Vietnam, Bangladesh, Hong Kong, and internationally, with a market capitalization of approximately HK$2.43 billion.

Operations: The company generates HK$4.67 billion from its manufacturing and trading of textile products.

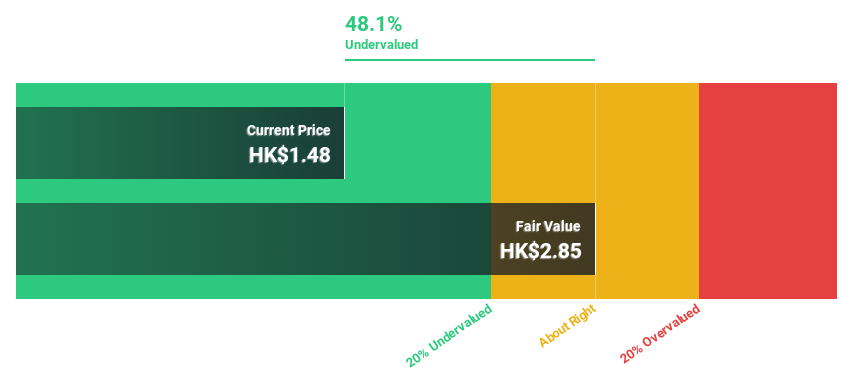

Estimated Discount To Fair Value: 37.1%

Pacific Textiles Holdings, trading at HK$1.74, appears undervalued based on a DCF valuation that suggests a fair value of HK$2.77. Despite recent earnings declines—net income fell to HK$167.12 million from HK$268.57 million—the company's future looks promising with expected earnings growth of 37.67% per year, outpacing the Hong Kong market forecast of 11.4%. However, its dividend sustainability is questionable as it is poorly covered by both earnings and free cash flows.

- Our expertly prepared growth report on Pacific Textiles Holdings implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Pacific Textiles Holdings with our comprehensive financial health report here.

Shanghai INT Medical Instruments (SEHK:1501)

Overview: Shanghai INT Medical Instruments Co., Ltd. operates in the medical equipment industry and has a market capitalization of approximately HK$4.84 billion.

Operations: The company generates CN¥641.32 million from its cardiovascular interventional business.

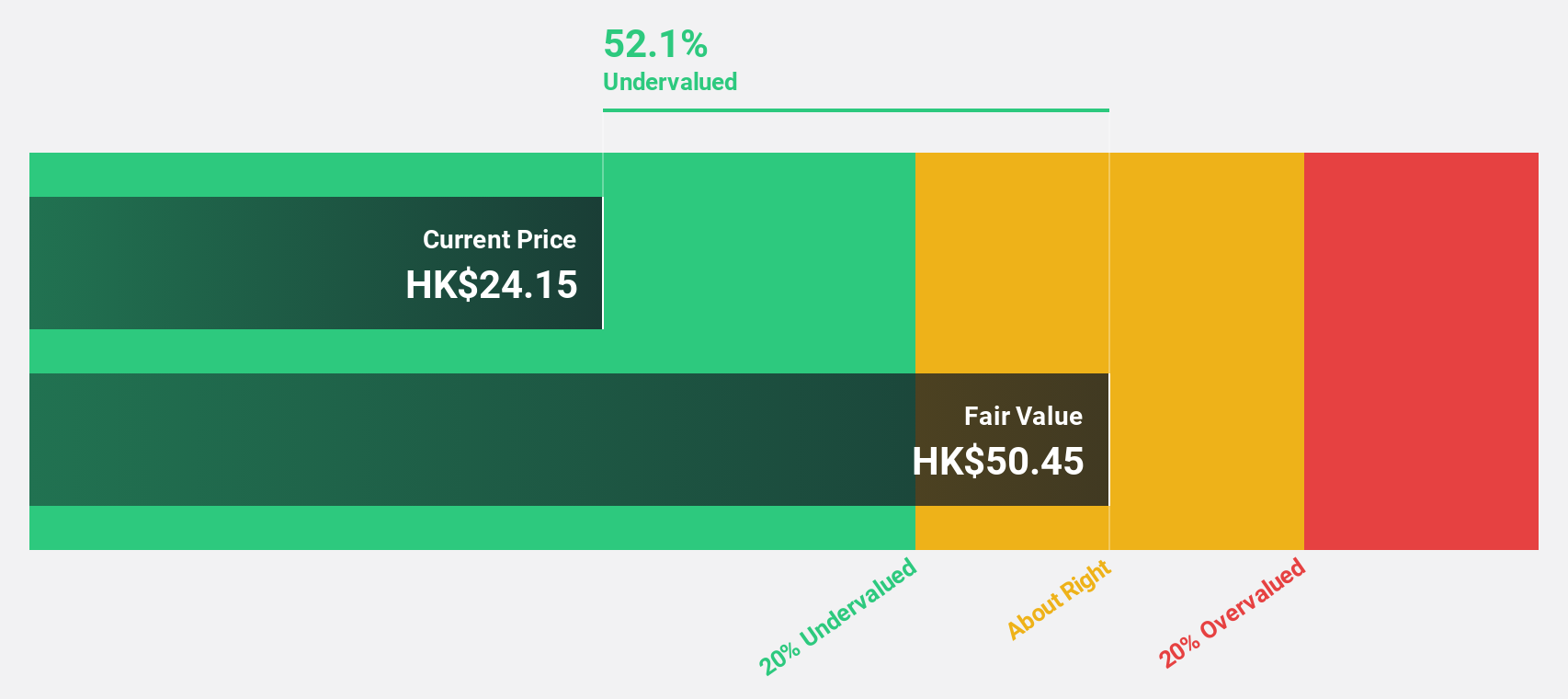

Estimated Discount To Fair Value: 42.7%

Shanghai INT Medical Instruments, priced at HK$27.65, is significantly below its estimated fair value of HK$48.27, indicating strong undervaluation based on cash flows. The company's earnings and revenue are projected to expand by 25.41% and 26% per year respectively, outstripping the broader Hong Kong market growth rates significantly. Despite this robust growth outlook, shareholder dilution occurred last year and the forecasted Return on Equity of 15.8% is considered low for the upcoming three years.

- According our earnings growth report, there's an indication that Shanghai INT Medical Instruments might be ready to expand.

- Get an in-depth perspective on Shanghai INT Medical Instruments' balance sheet by reading our health report here.

Beauty Farm Medical and Health Industry (SEHK:2373)

Overview: Beauty Farm Medical and Health Industry Inc. operates in the healthcare sector with a market capitalization of approximately HK$3.97 billion.

Operations: Beauty Farm Medical and Health Industry Inc. generates revenue primarily from three segments: Aesthetic Medical Services (CN¥850.36 million), Beauty and Wellness Services through direct stores (CN¥1.08 billion), and Subhealth Medical Services (CN¥101.04 million).

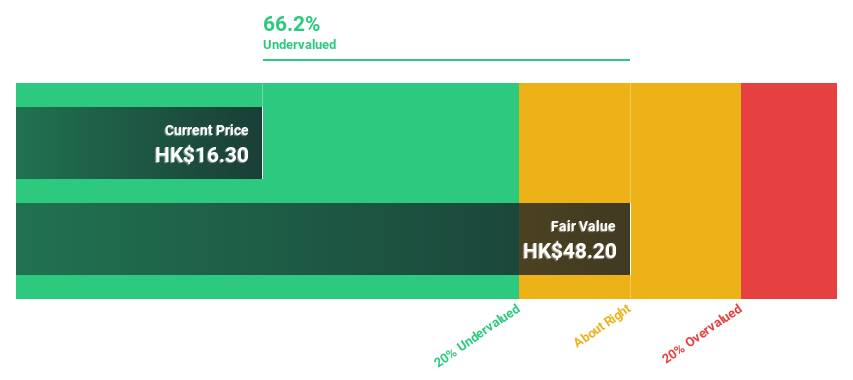

Estimated Discount To Fair Value: 49%

Beauty Farm Medical and Health Industry, currently priced at HK$16.84, is valued well below its estimated fair value of HK$33. This discrepancy suggests a significant undervaluation based on cash flows. The company has demonstrated robust past earnings growth of 109.2% and forecasts suggest continued strong earnings growth at 20.11% annually, outpacing the Hong Kong market's average. Additionally, revenue is expected to grow at 18.3% per year, also above the market trend of 7.8%. Recently, the firm increased its dividend to HK$0.47 per share.

- Our comprehensive growth report raises the possibility that Beauty Farm Medical and Health Industry is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Beauty Farm Medical and Health Industry's balance sheet health report.

Taking Advantage

- Reveal the 42 hidden gems among our Undervalued SEHK Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com