The International Entertainment Corporation (HKG:1009) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term shareholders would now have taken a real hit with the stock declining 7.6% in the last year.

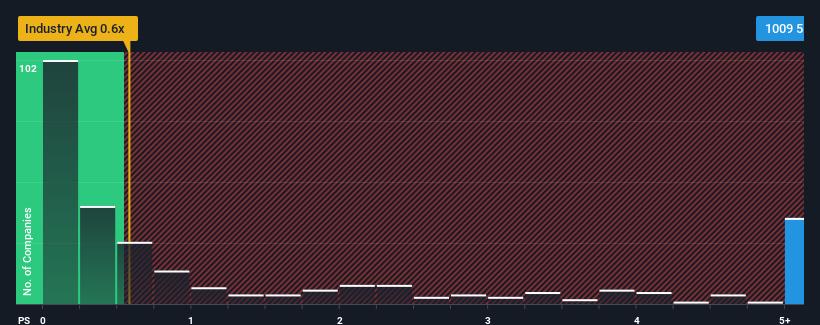

Even after such a large drop in price, you could still be forgiven for thinking International Entertainment is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.4x, considering almost half the companies in Hong Kong's Real Estate industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for International Entertainment

How Has International Entertainment Performed Recently?

International Entertainment certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for International Entertainment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is International Entertainment's Revenue Growth Trending?

In order to justify its P/S ratio, International Entertainment would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. Pleasingly, revenue has also lifted 117% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 3.9%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that International Entertainment's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does International Entertainment's P/S Mean For Investors?

International Entertainment's shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that International Entertainment can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for International Entertainment you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com