Amid a backdrop of fluctuating global indices and economic indicators, the Hong Kong stock market presents an intriguing landscape for investors in July 2024. With small-cap stocks like the Russell 2000 Index recently experiencing notable gains, it's an opportune moment to explore potential undervalued opportunities within this vibrant market. In such a dynamic environment, identifying promising stocks often hinges on recognizing those with solid fundamentals and potential for growth, which may not yet be fully appreciated by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Sundart Holdings | 0.01% | -2.76% | -4.34% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Laopu Gold | 8.43% | 26.56% | 36.28% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

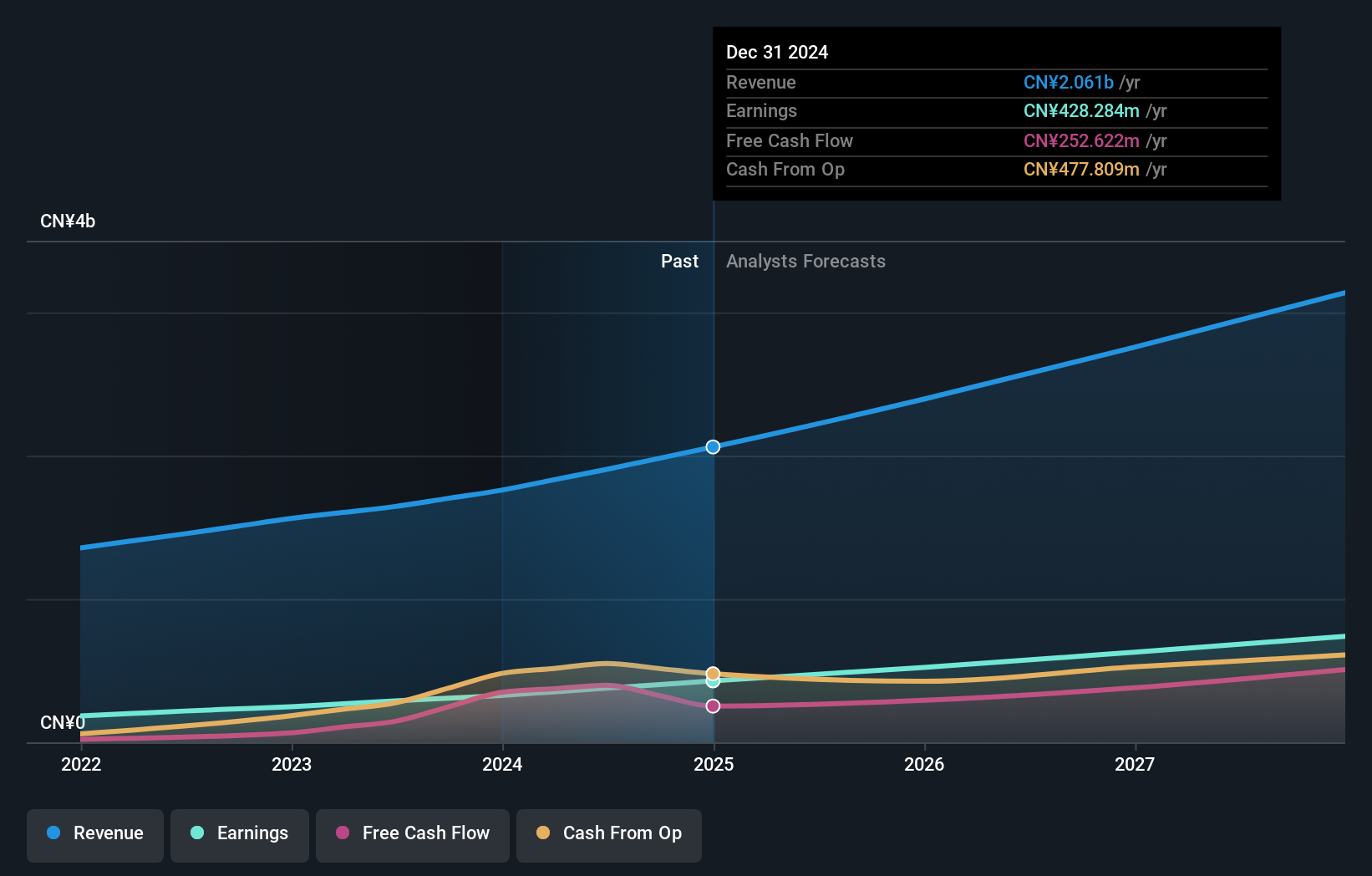

Shanghai Conant Optical (SEHK:2276)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Conant Optical Co., Ltd. is a global manufacturer and distributor of resin spectacle lenses, operating across Mainland China, the Americas, Asia, Europe, Oceania, and Africa with a market capitalization of HK$5.09 billion.

Operations: The company specializes in the manufacturing and sales of resin spectacle lenses, generating CN¥1.76 billion in revenue as of the latest reporting period. It has observed an increasing gross profit margin trend, reaching 37.40% recently, reflecting improved operational efficiency over time.

Shanghai Conant Optical, a lesser-known yet promising entity in Hong Kong's market, has demonstrated robust financial health and growth potential. With earnings growth of 31.6% last year, surpassing the Medical Equipment industry's decline of 8.3%, the company shows strong sector outperformance. Its debt is well-covered by EBIT at 36.1 times, ensuring financial stability. Additionally, the recent approval of a dividend increase to HKD 0.22 per share underscores its commitment to shareholder returns, reflecting confidence in ongoing profitability and cash flow strength.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Conant Optical.

Evaluate Shanghai Conant Optical's historical performance by accessing our past performance report.

Shanghai Conant Optical (SEHK:2276)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Conant Optical Co., Ltd. is a global manufacturer and distributor of resin spectacle lenses, operating across Mainland China, the Americas, Asia, Europe, Oceania, and Africa with a market capitalization of HK$5.09 billion.

Operations: The company specializes in the manufacturing and sales of resin spectacle lenses, generating CN¥1.76 billion in revenue as of the latest reporting period. It has observed an increasing gross profit margin trend, reaching 37.40% recently, reflecting improved operational efficiency over time.

Shanghai Conant Optical, a lesser-known yet promising entity in Hong Kong's market, has demonstrated robust financial health and growth potential. With earnings growth of 31.6% last year, surpassing the Medical Equipment industry's decline of 8.3%, the company shows strong sector outperformance. Its debt is well-covered by EBIT at 36.1 times, ensuring financial stability. Additionally, the recent approval of a dividend increase to HKD 0.22 per share underscores its commitment to shareholder returns, reflecting confidence in ongoing profitability and cash flow strength.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Conant Optical.

Evaluate Shanghai Conant Optical's historical performance by accessing our past performance report.

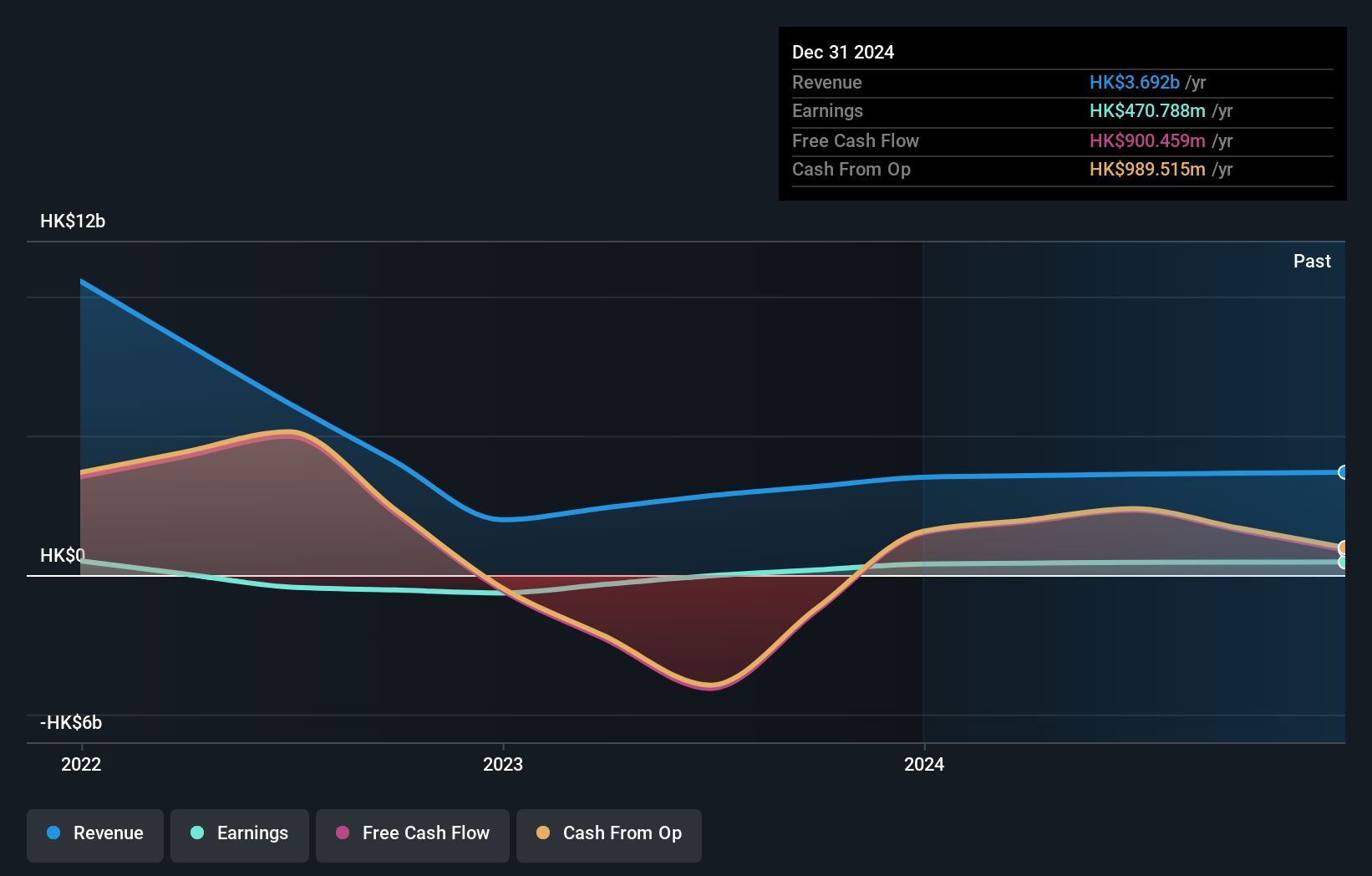

Yunfeng Financial Group (SEHK:376)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yunfeng Financial Group Limited operates as an investment holding company, primarily offering insurance products in Hong Kong and Macau, with a market capitalization of approximately HK$3.33 billion.

Operations: The company primarily generates revenue through its insurance business, contributing HK$3.51 billion, supplemented by a small segment in other financial services and corporate activities. It consistently reports a gross profit margin of 100%, indicating all revenue is recorded as gross profit due to the absence of reported costs of goods sold.

Yunfeng Financial Group, a lesser-known yet promising entity in Hong Kong's financial sector, recently turned profitable, showcasing robust financial health with a Price-To-Earnings ratio of 8.4x—below the market average of 9.5x. The company has more cash than total debt and its interest payments are well covered by EBIT (5.1x coverage). At the recent Annual General Meeting, strategic plans including director re-elections and auditor appointments were affirmed, underscoring stable governance poised to capitalize on its newfound profitability.

Yunfeng Financial Group (SEHK:376)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yunfeng Financial Group Limited operates as an investment holding company, primarily offering insurance products in Hong Kong and Macau, with a market capitalization of approximately HK$3.33 billion.

Operations: The company primarily generates revenue through its insurance business, contributing HK$3.51 billion, supplemented by a small segment in other financial services and corporate activities. It consistently reports a gross profit margin of 100%, indicating all revenue is recorded as gross profit due to the absence of reported costs of goods sold.

Yunfeng Financial Group, a lesser-known yet promising entity in Hong Kong's financial sector, recently turned profitable, showcasing robust financial health with a Price-To-Earnings ratio of 8.4x—below the market average of 9.5x. The company has more cash than total debt and its interest payments are well covered by EBIT (5.1x coverage). At the recent Annual General Meeting, strategic plans including director re-elections and auditor appointments were affirmed, underscoring stable governance poised to capitalize on its newfound profitability.

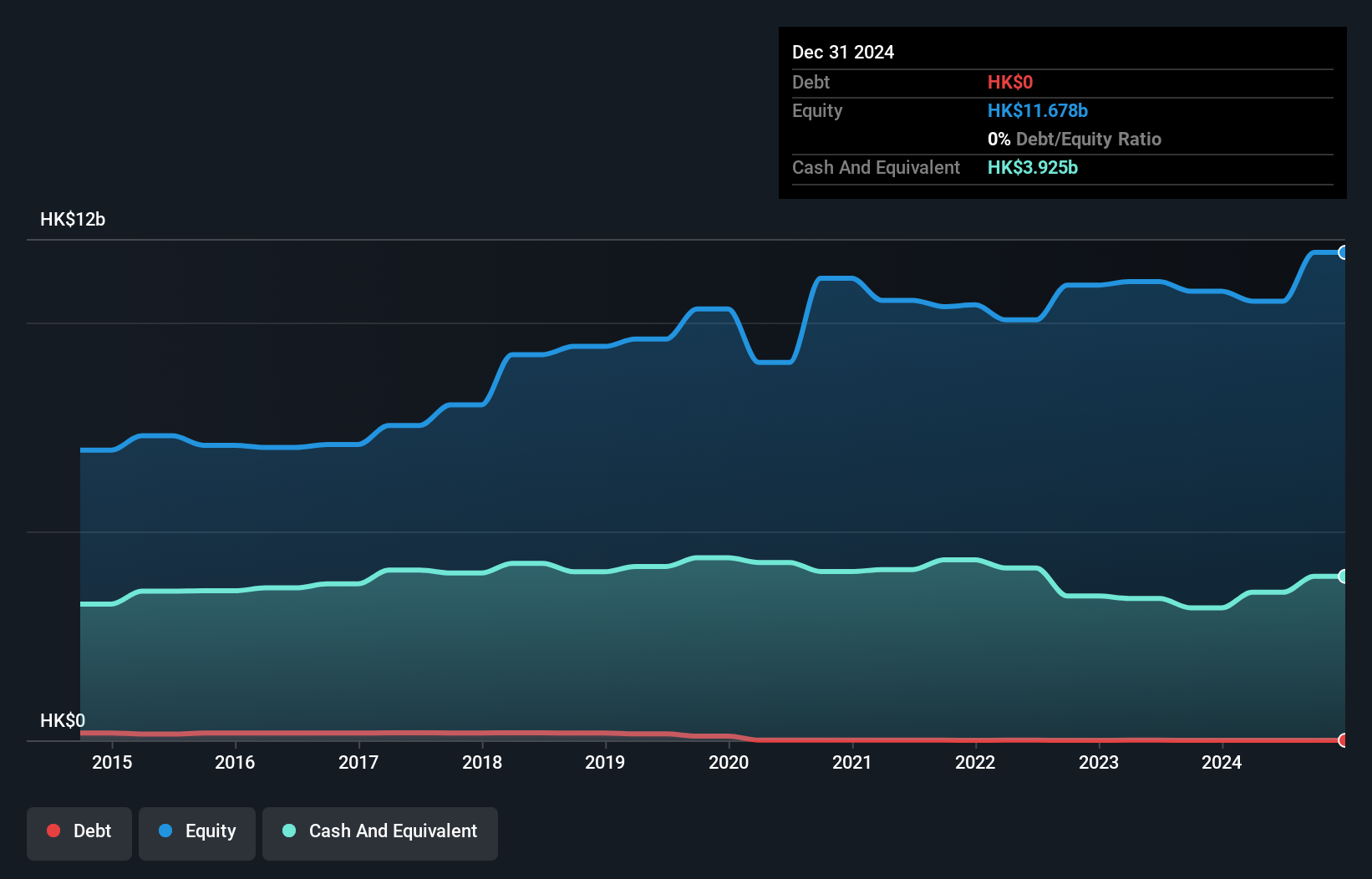

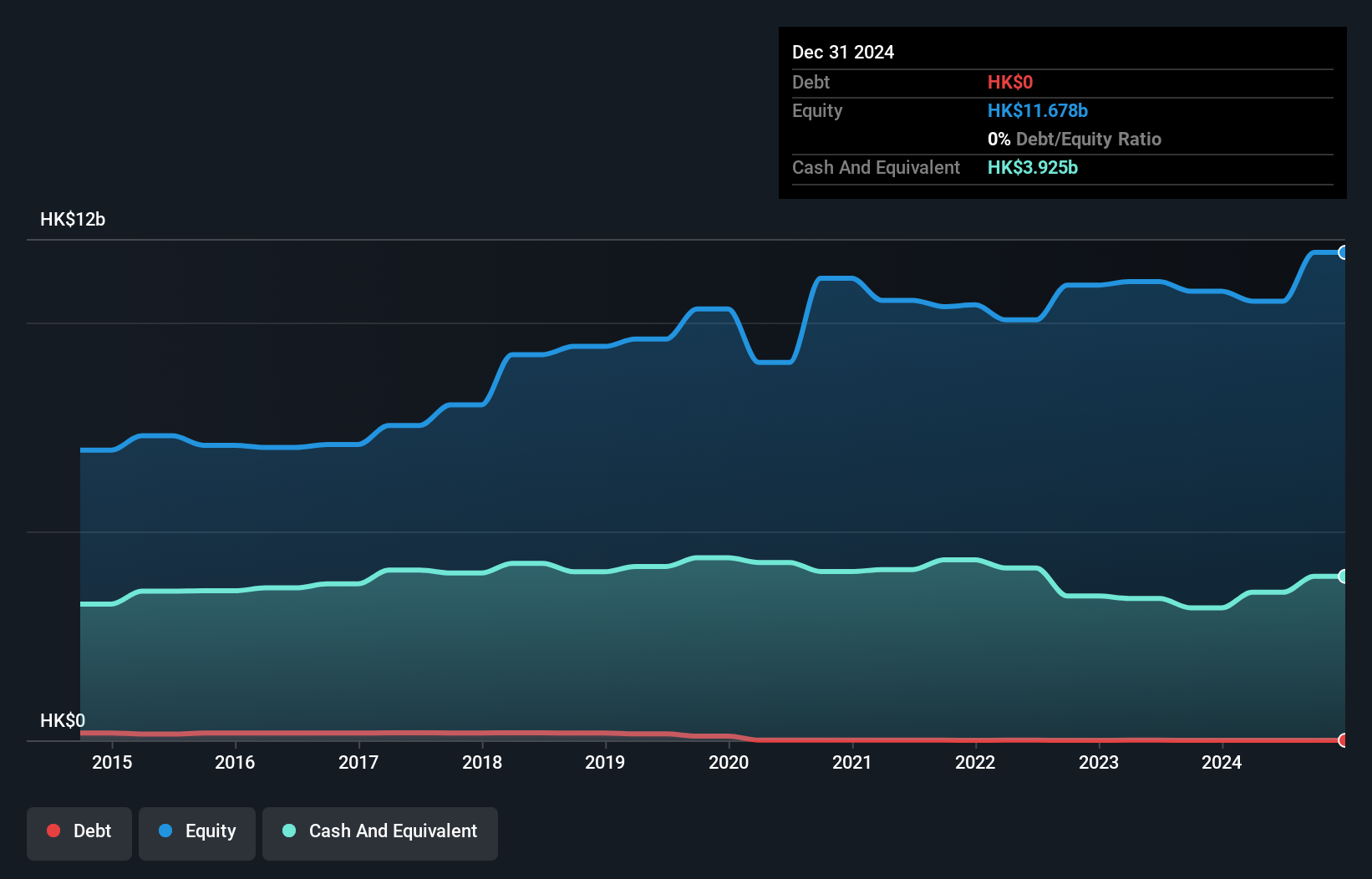

Asia Financial Holdings (SEHK:662)

Simply Wall St Value Rating: ★★★★★★

Overview: Asia Financial Holdings Limited is an investment holding company that specializes in underwriting general and life insurance across Hong Kong, Macau, and Mainland China, with a market capitalization of HK$3.43 billion.

Operations: Asia Financial Holdings primarily generates revenue through its insurance segment, which brought in HK$2.61 billion, complemented by its corporate operations contributing HK$170.36 million. The company's business model emphasizes minimizing operating costs while maximizing gross profit margins, which have shown variability over the periods analyzed.

Asia Financial Holdings, trading 12.8% below its estimated fair value, stands out with a robust earnings growth of 181.5% over the past year, surpassing the insurance industry's decline by 19.6%. The company has effectively eliminated its debt from five years ago when the debt-to-equity ratio was 1.9%, showcasing strong financial health and operational efficiency. With recent shareholder approval for a dividend increase and share repurchases, Asia Financial is poised to enhance shareholder value further.

Asia Financial Holdings (SEHK:662)

Simply Wall St Value Rating: ★★★★★★

Overview: Asia Financial Holdings Limited is an investment holding company that specializes in underwriting general and life insurance across Hong Kong, Macau, and Mainland China, with a market capitalization of HK$3.43 billion.

Operations: Asia Financial Holdings primarily generates revenue through its insurance segment, which brought in HK$2.61 billion, complemented by its corporate operations contributing HK$170.36 million. The company's business model emphasizes minimizing operating costs while maximizing gross profit margins, which have shown variability over the periods analyzed.

Asia Financial Holdings, trading 12.8% below its estimated fair value, stands out with a robust earnings growth of 181.5% over the past year, surpassing the insurance industry's decline by 19.6%. The company has effectively eliminated its debt from five years ago when the debt-to-equity ratio was 1.9%, showcasing strong financial health and operational efficiency. With recent shareholder approval for a dividend increase and share repurchases, Asia Financial is poised to enhance shareholder value further.

Where To Now?

- Discover the full array of 182 SEHK Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com