Despite an already strong run, TL Natural Gas Holdings Limited (HKG:8536) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 236% following the latest surge, making investors sit up and take notice.

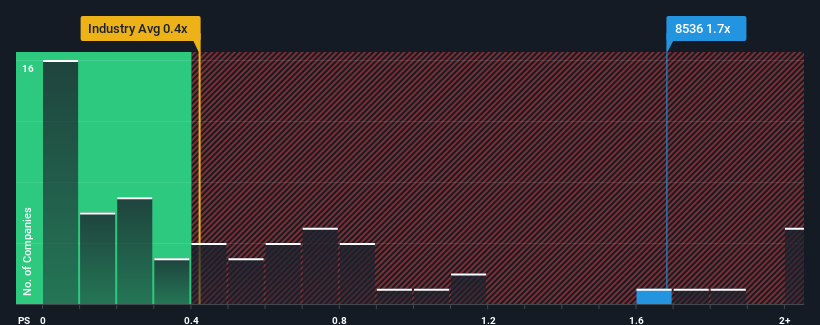

After such a large jump in price, you could be forgiven for thinking TL Natural Gas Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in Hong Kong's Specialty Retail industry have P/S ratios below 0.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for TL Natural Gas Holdings

How Has TL Natural Gas Holdings Performed Recently?

Revenue has risen firmly for TL Natural Gas Holdings recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on TL Natural Gas Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like TL Natural Gas Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. Pleasingly, revenue has also lifted 53% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 9.0% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why TL Natural Gas Holdings' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does TL Natural Gas Holdings' P/S Mean For Investors?

TL Natural Gas Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of TL Natural Gas Holdings revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for TL Natural Gas Holdings (2 shouldn't be ignored!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com