Amidst a backdrop of mixed economic signals from China, where industrial production has slowed and retail sales have seen an uptick, investors might find potential opportunities in undervalued stocks on the SEHK. These market conditions suggest that discerning investors could benefit from examining intrinsic discounts that reflect deeper value than current market prices indicate.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Best Pacific International Holdings (SEHK:2111) | HK$2.09 | HK$3.82 | 45.2% |

| China Resources Mixc Lifestyle Services (SEHK:1209) | HK$25.90 | HK$46.07 | 43.8% |

| China Cinda Asset Management (SEHK:1359) | HK$0.71 | HK$1.29 | 45% |

| Super Hi International Holding (SEHK:9658) | HK$13.48 | HK$25.69 | 47.5% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$9.99 | HK$19.07 | 47.6% |

| Innovent Biologics (SEHK:1801) | HK$37.30 | HK$66.87 | 44.2% |

| REPT BATTERO Energy (SEHK:666) | HK$14.26 | HK$27.24 | 47.7% |

| Zhaojin Mining Industry (SEHK:1818) | HK$13.64 | HK$25.10 | 45.7% |

| CGN Mining (SEHK:1164) | HK$2.66 | HK$4.86 | 45.3% |

| Vobile Group (SEHK:3738) | HK$1.19 | HK$2.11 | 43.6% |

We're going to check out a few of the best picks from our screener tool

Pacific Textiles Holdings (SEHK:1382)

Overview: Pacific Textiles Holdings Limited is engaged in the manufacturing and trading of textile products, with a market capitalization of approximately HK$2.15 billion.

Operations: The company generates its revenue primarily from the production and sale of textiles, totaling approximately HK$4.55 billion.

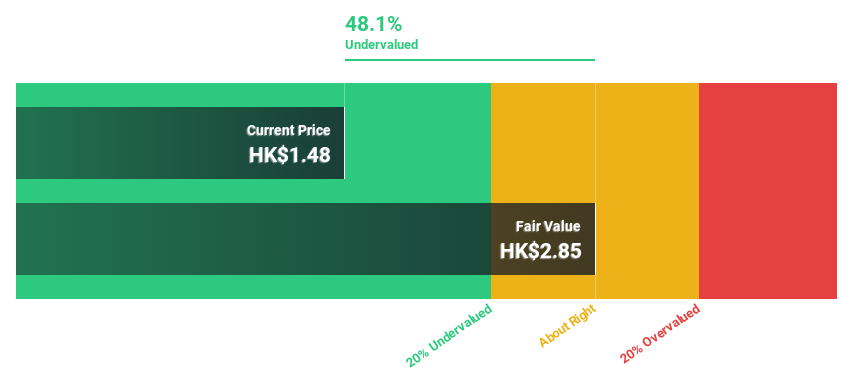

Estimated Discount To Fair Value: 32.2%

Pacific Textiles Holdings, priced at HK$1.56, is trading below its fair value of HK$2.3, reflecting a 32.2% undervaluation based on discounted cash flows. Despite this potential bargain, the company's recent earnings guidance predicts a significant profit drop to HK$105.9 million for FY2024, a decrease of about 60%. Additionally, while earnings are expected to grow by 33.7% annually, this growth is shadowed by low return on equity forecasts and profit margins that have declined from last year's figures.

- Insights from our recent growth report point to a promising forecast for Pacific Textiles Holdings' business outlook.

- Navigate through the intricacies of Pacific Textiles Holdings with our comprehensive financial health report here.

Shanghai INT Medical Instruments (SEHK:1501)

Overview: Shanghai INT Medical Instruments Co., Ltd. is a company that specializes in the production and distribution of medical instruments, with a market capitalization of approximately HK$4.73 billion.

Operations: The primary revenue segment for the company is its Cardiovascular Interventional Business, which generated CN¥641.32 million.

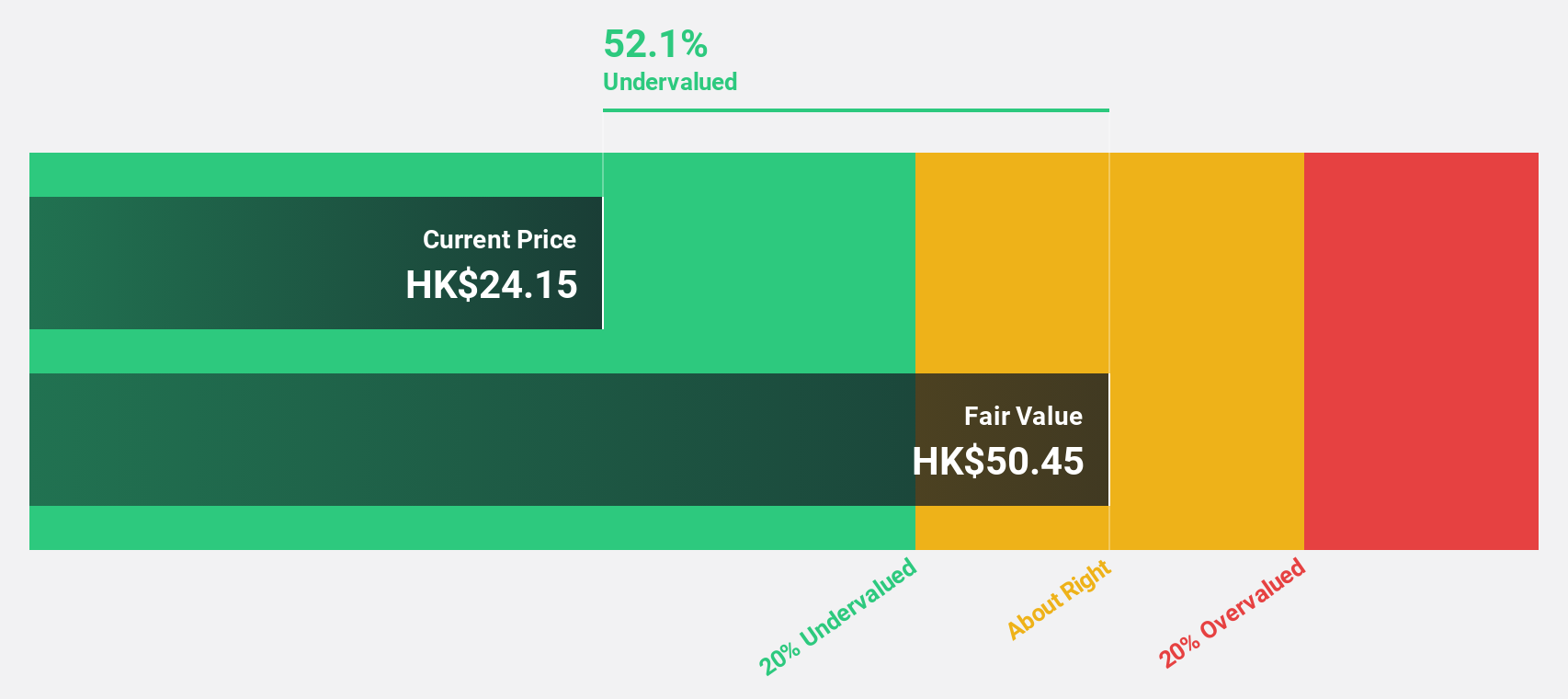

Estimated Discount To Fair Value: 38.8%

Shanghai INT Medical Instruments, trading at HK$27, is significantly undervalued with a fair value estimated at HK$44.15, marking a 38.8% discrepancy. The company's earnings have grown by 16.7% over the past year and are projected to increase by 25.41% annually over the next three years, outpacing the Hong Kong market's expected growth. Despite this robust growth forecast and recent dividend increase to HKD 0.30 per share, its return on equity in three years is anticipated to be modest at 15.8%.

- According our earnings growth report, there's an indication that Shanghai INT Medical Instruments might be ready to expand.

- Click to explore a detailed breakdown of our findings in Shanghai INT Medical Instruments' balance sheet health report.

REPT BATTERO Energy (SEHK:666)

Overview: REPT BATTERO Energy Co., Ltd. specializes in the design, research and development, production, and sale of lithium-ion battery products both domestically in China and internationally, with a market capitalization of HK$32.24 billion.

Operations: The company generates revenue from segments including EV battery products, ESS battery products, and battery components & R&D services, totaling CN¥13.75 billion.

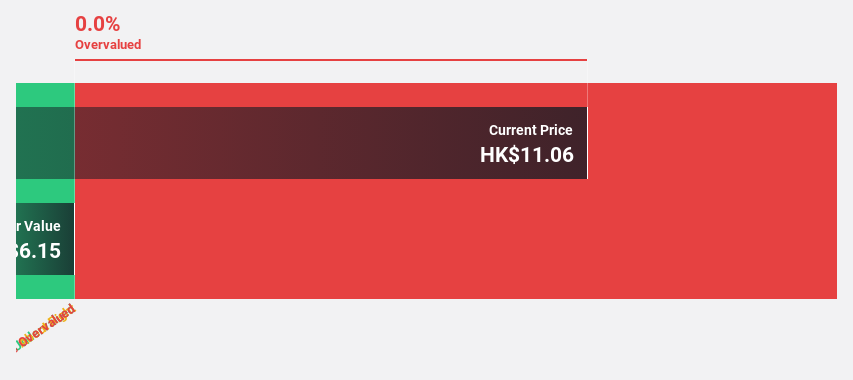

Estimated Discount To Fair Value: 47.7%

REPT BATTERO Energy, currently trading at HK$14.26, is significantly undervalued based on a discounted cash flow analysis with an estimated fair value of HK$27.24, reflecting a substantial undervaluation. Despite recent financial struggles including a net loss of CNY 1,471.8 million in the previous year, the company is expected to see robust revenue growth at 35.5% annually and turn profitable within three years. However, its forecasted return on equity remains low at 9.6%. Recent strategic partnerships in the Americas and enhancements to corporate governance underscore potential operational improvements.

- In light of our recent growth report, it seems possible that REPT BATTERO Energy's financial performance will exceed current levels.

- Dive into the specifics of REPT BATTERO Energy here with our thorough financial health report.

Where To Now?

- Gain an insight into the universe of 41 Undervalued SEHK Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com