Key Insights

- Zhejiang Tengy Environmental Technology will host its Annual General Meeting on 28th of June

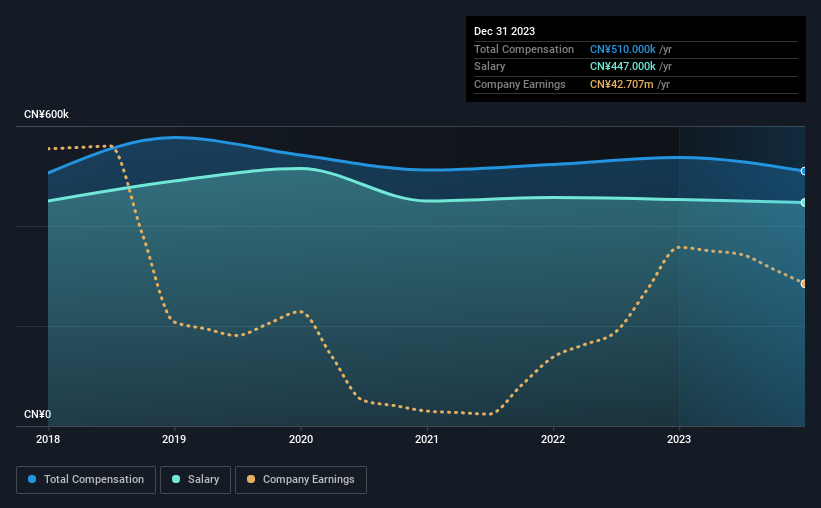

- Total pay for CEO Tianjie Bian includes CN¥447.0k salary

- The total compensation is 72% less than the average for the industry

- Zhejiang Tengy Environmental Technology's EPS grew by 112% over the past three years while total shareholder return over the past three years was 11%

Shareholders will probably not be disappointed by the robust results at Zhejiang Tengy Environmental Technology Co., Ltd (HKG:1527) recently and they will be keeping this in mind as they go into the AGM on 28th of June. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

See our latest analysis for Zhejiang Tengy Environmental Technology

How Does Total Compensation For Tianjie Bian Compare With Other Companies In The Industry?

According to our data, Zhejiang Tengy Environmental Technology Co., Ltd has a market capitalization of HK$149m, and paid its CEO total annual compensation worth CN¥510k over the year to December 2023. That's a slight decrease of 5.0% on the prior year. We note that the salary portion, which stands at CN¥447.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong Machinery industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥1.8m. This suggests that Tianjie Bian is paid below the industry median. What's more, Tianjie Bian holds HK$8.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥447k | CN¥453k | 88% |

| Other | CN¥63k | CN¥84k | 12% |

| Total Compensation | CN¥510k | CN¥537k | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. It's interesting to note that Zhejiang Tengy Environmental Technology pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Zhejiang Tengy Environmental Technology Co., Ltd's Growth

Over the past three years, Zhejiang Tengy Environmental Technology Co., Ltd has seen its earnings per share (EPS) grow by 112% per year. In the last year, its revenue is up 31%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Zhejiang Tengy Environmental Technology Co., Ltd Been A Good Investment?

Zhejiang Tengy Environmental Technology Co., Ltd has generated a total shareholder return of 11% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

The company's overall performance, while not bad, could be better. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Zhejiang Tengy Environmental Technology that investors should look into moving forward.

Switching gears from Zhejiang Tengy Environmental Technology, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com