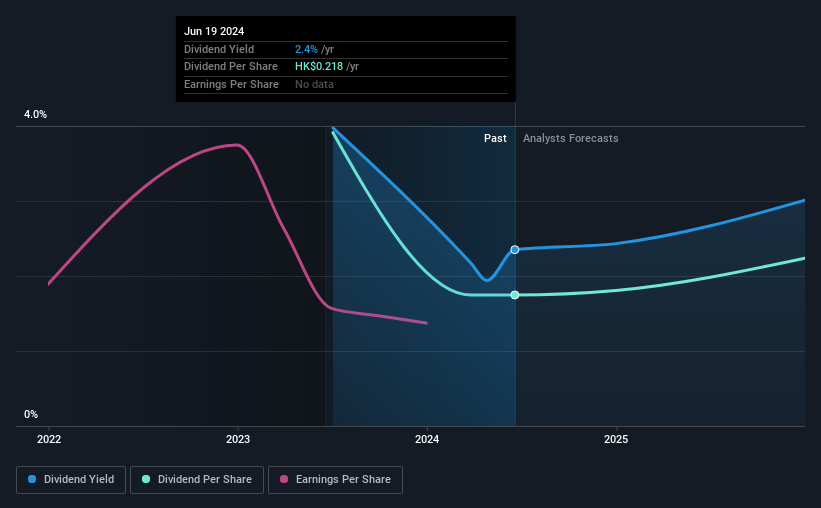

JF Wealth Holdings Ltd's (HKG:9636) dividend is being reduced from last year's payment covering the same period to CN¥0.22 on the 10th of July. This payment takes the dividend yield to 2.4%, which only provides a modest boost to overall returns.

Check out our latest analysis for JF Wealth Holdings

JF Wealth Holdings' Earnings Easily Cover The Distributions

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Based on the last payment, JF Wealth Holdings was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

The next year is set to see EPS grow by 25.1%. Assuming the dividend continues along recent trends, we think the payout ratio could be 41% by next year, which is in a pretty sustainable range.

JF Wealth Holdings Doesn't Have A Long Payment History

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Over the last year, JF Wealth Holdings' EPS has fallen by 63%. Decreases in earnings as large as this could start to put some pressure on the dividend if they are sustained for several years. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for JF Wealth Holdings that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com