EuroEyes International Eye Clinic Limited (HKG:1846) has announced that on 28th of June, it will be paying a dividend ofHK$0.0489, which a reduction from last year's comparable dividend. This means that the annual payment is 2.0% of the current stock price, which is lower than what the rest of the industry is paying.

Check out our latest analysis for EuroEyes International Eye Clinic

EuroEyes International Eye Clinic's Earnings Easily Cover The Distributions

If it is predictable over a long period, even low dividend yields can be attractive. However, EuroEyes International Eye Clinic's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

Looking forward, earnings per share could rise by 21.7% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 21%, which is in the range that makes us comfortable with the sustainability of the dividend.

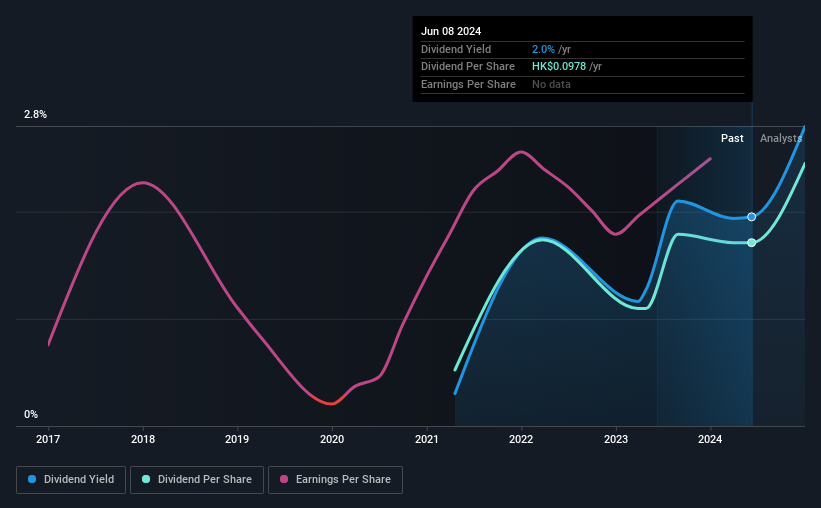

EuroEyes International Eye Clinic's Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. The dividend has gone from an annual total of HK$0.0299 in 2021 to the most recent total annual payment of HK$0.0978. This works out to be a compound annual growth rate (CAGR) of approximately 48% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. EuroEyes International Eye Clinic has seen EPS rising for the last five years, at 22% per annum. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

We Really Like EuroEyes International Eye Clinic's Dividend

Overall, we think that EuroEyes International Eye Clinic could be a great option for a dividend investment, although we would have preferred if the dividend wasn't cut this year. Reducing the amount it is paying as a dividend can protect the company's balance sheet, keeping the dividend sustainable for longer. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in EuroEyes International Eye Clinic stock. Is EuroEyes International Eye Clinic not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.