Renrui Human Resources Technology Holdings Limited (HKG:6919) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

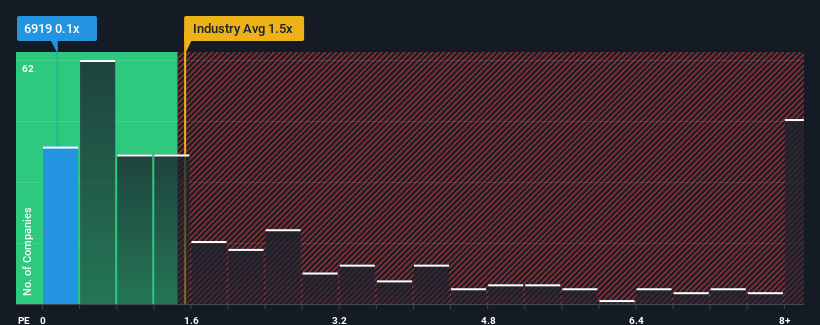

In spite of the firm bounce in price, it's still not a stretch to say that Renrui Human Resources Technology Holdings' price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Professional Services industry in Hong Kong, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Renrui Human Resources Technology Holdings

What Does Renrui Human Resources Technology Holdings' Recent Performance Look Like?

Recent times haven't been great for Renrui Human Resources Technology Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Renrui Human Resources Technology Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Renrui Human Resources Technology Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. The latest three year period has also seen an excellent 58% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 18% per annum as estimated by the one analyst watching the company. With the industry only predicted to deliver 7.6% each year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Renrui Human Resources Technology Holdings is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Renrui Human Resources Technology Holdings' P/S

Renrui Human Resources Technology Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Renrui Human Resources Technology Holdings' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for Renrui Human Resources Technology Holdings that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.