Key Insights

- Add New Energy Investment Holdings Group's Annual General Meeting to take place on 6th of June

- Salary of CN¥703.0k is part of CEO Guohua Geng's total remuneration

- The total compensation is similar to the average for the industry

- Add New Energy Investment Holdings Group's EPS declined by 14% over the past three years while total shareholder loss over the past three years was 85%

Add New Energy Investment Holdings Group Limited (HKG:2623) has not performed well recently and CEO Guohua Geng will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 6th of June. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Add New Energy Investment Holdings Group

Comparing Add New Energy Investment Holdings Group Limited's CEO Compensation With The Industry

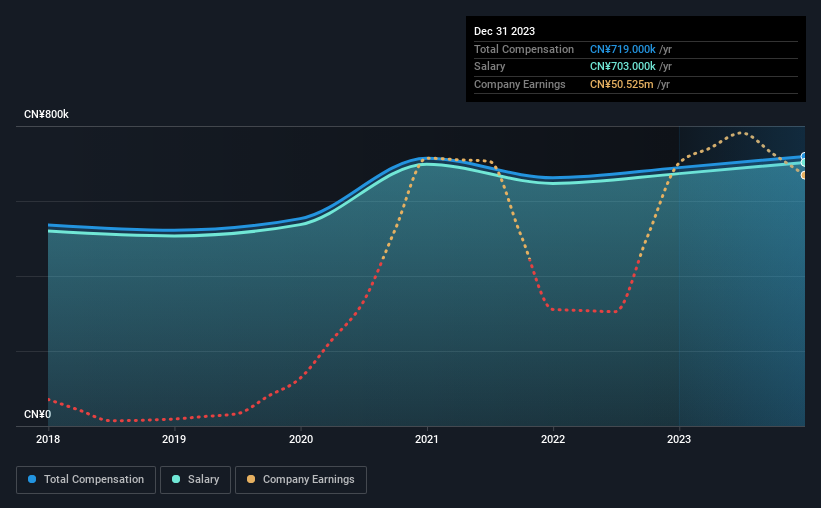

Our data indicates that Add New Energy Investment Holdings Group Limited has a market capitalization of HK$280m, and total annual CEO compensation was reported as CN¥719k for the year to December 2023. That's a fairly small increase of 4.4% over the previous year. In particular, the salary of CN¥703.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Hong Kong Metals and Mining industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was CN¥883k. This suggests that Add New Energy Investment Holdings Group remunerates its CEO largely in line with the industry average. Furthermore, Guohua Geng directly owns HK$1.0m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥703k | CN¥673k | 98% |

| Other | CN¥16k | CN¥16k | 2% |

| Total Compensation | CN¥719k | CN¥689k | 100% |

Speaking on an industry level, nearly 89% of total compensation represents salary, while the remainder of 11% is other remuneration. Add New Energy Investment Holdings Group has gone down a largely traditional route, paying Guohua Geng a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Add New Energy Investment Holdings Group Limited's Growth

Over the last three years, Add New Energy Investment Holdings Group Limited has shrunk its earnings per share by 14% per year. Its revenue is down 32% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Add New Energy Investment Holdings Group Limited Been A Good Investment?

The return of -85% over three years would not have pleased Add New Energy Investment Holdings Group Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Guohua receives almost all of their compensation through a salary. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which shouldn't be ignored) in Add New Energy Investment Holdings Group we think you should know about.

Switching gears from Add New Energy Investment Holdings Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.