Hidili Industry International Development Limited (HKG:1393) shares have had a really impressive month, gaining 32% after a shaky period beforehand. But the last month did very little to improve the 69% share price decline over the last year.

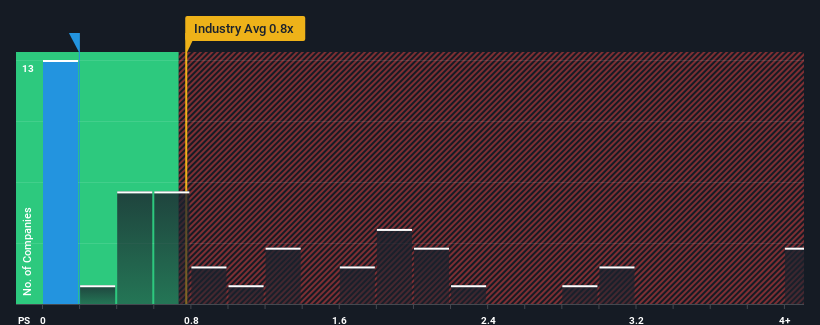

Although its price has surged higher, given about half the companies operating in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Hidili Industry International Development as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Hidili Industry International Development

How Hidili Industry International Development Has Been Performing

For example, consider that Hidili Industry International Development's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hidili Industry International Development will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Hidili Industry International Development would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 82% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 1.7% shows it's noticeably more attractive.

With this information, we find it odd that Hidili Industry International Development is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Hidili Industry International Development's P/S?

Hidili Industry International Development's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Hidili Industry International Development currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 2 warning signs for Hidili Industry International Development that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.