The Ins and Outs of Cash Management

Key Takeaways:

- What is Cash Management and how does it work?

- Can I still trade when my funds are in Cash Management?

- Are there any costs to use Cash Management?

- How do I activate Cash Management?

What is Cash Management and how does it work?

Cash Management strives to empowers investors like you to earn a competitive return on your AUD and USD deposits (on any residual funds you may have) within the money market. With its intuitive auto-sweep feature, this idle cash is automatically channelled into money market trust funds, helping to ensure an enhanced yield.

When trading, the total amount in Cash Management factors in your total cash balance, preserving your buying power as if you held the equivalent amount in cash. This makes it an ideal solution for your share trading settlements.

To be eligible for the Cash Management feature, you will need to have an account with Webull and complete the Cash Management activation process.

Can I trade Stocks, ETFs, and Options with my funds in Cash Management?

You can continue trading even when your funds are in Cash Management.

99% of the market value of your Cash Management position will be added to your Buying Power for trading purposes.

The funds from your Cash Management position will be auto-redeemed*when you do not have sufficient cash to settle your trades.

*Auto-redeemed means that when you lack sufficient cash to settle your trades, the system will automatically redeem or sell some or all of your Cash Management position to generate the necessary funds to cover the trade settlement. This process helps ensure that you have enough funds to meet your financial obligations within the trading system.

If I wish to withdraw my funds what is the process and how long does it take?

If you need more funds from Cash Management for the exchange and withdrawal, you will need to redeem first and the monies will be available to exchange and withdraw within 2 trading days. During peak holiday seasons in the US, Hong Kong and Australia, processing times for manual redemption, auto-subscription or auto redemption may be extended.

After your funds hit your brokerage account, you can withdraw by following the process in the link. Click to learn Withdrawal Process>>> Your withdrawal request will take 1 to 3 business days to complete. The exact settlement time may vary between banks.

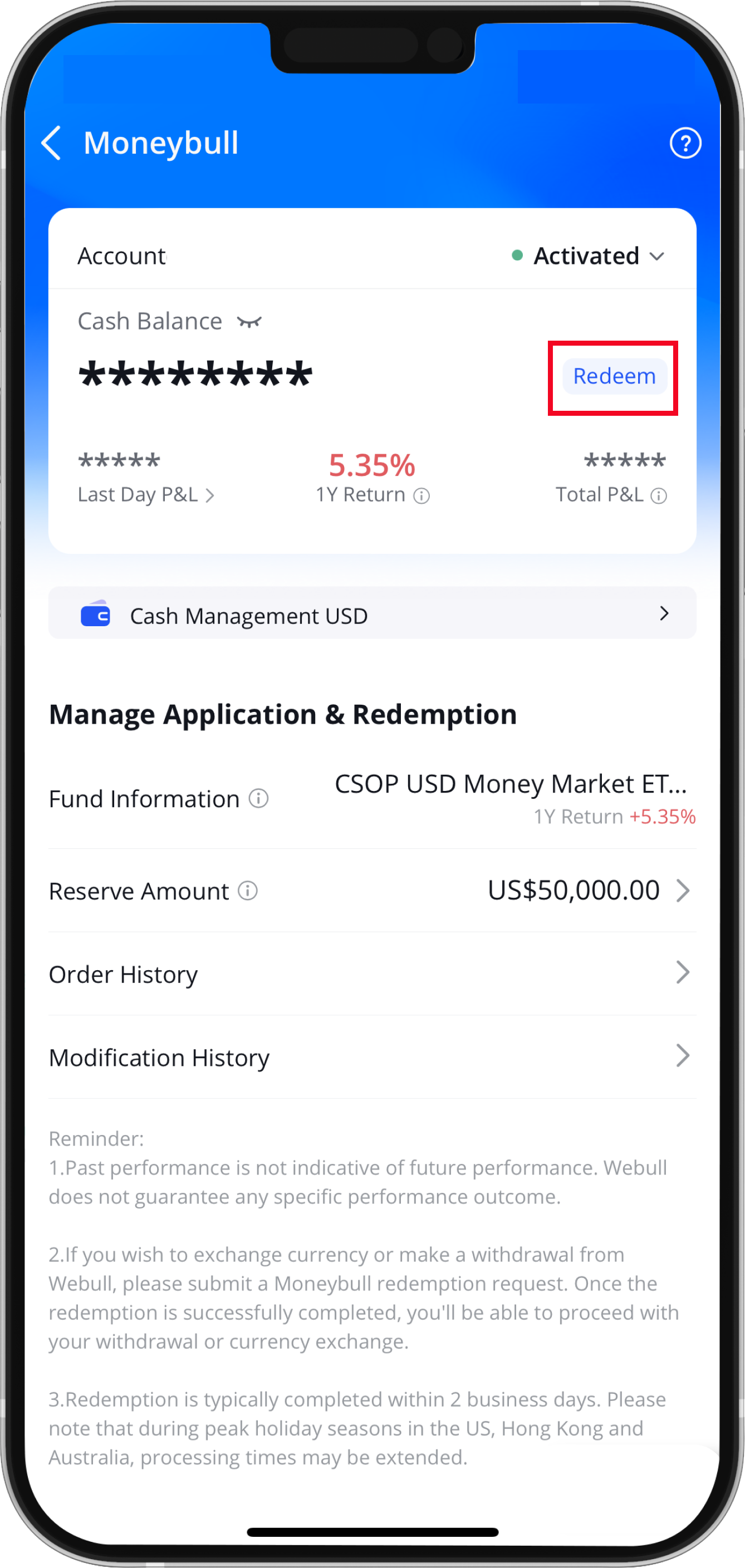

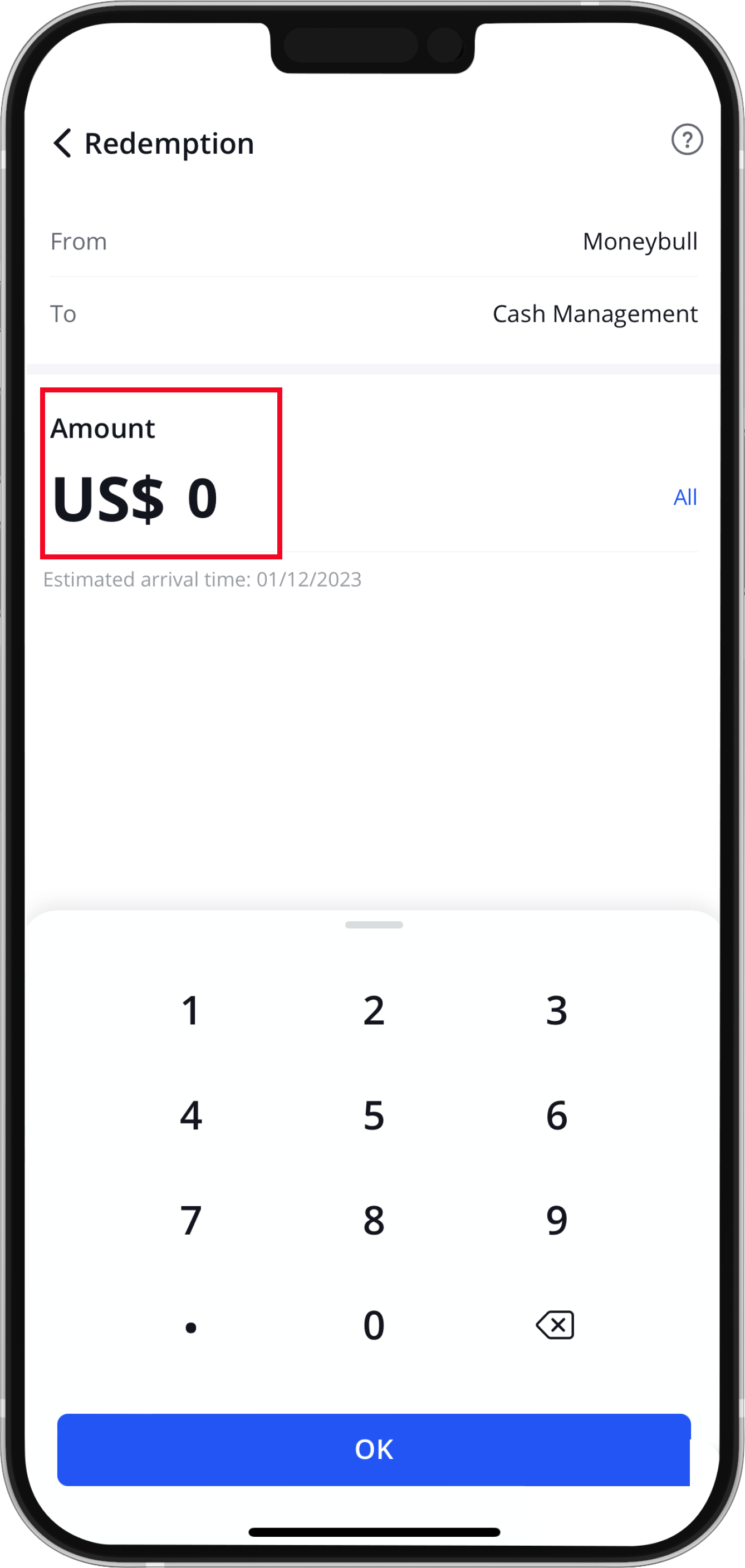

The process for redeeming money in Cash Management:

Go to the detailed page of Cash Management> Click Redeem button>Enter the amount you want to redeem>Click OK to confirm.

Are there any costs to use Cash Management?

No, there are no charges or hidden fees to start using the Cash Management feature.

The designated money market fund may contain a management fee, which is factored into the net account value of the fund. This may reduce overall earnings slightly but will not add any additional costs. The currency conversion may incur an additional FX transfer fee.

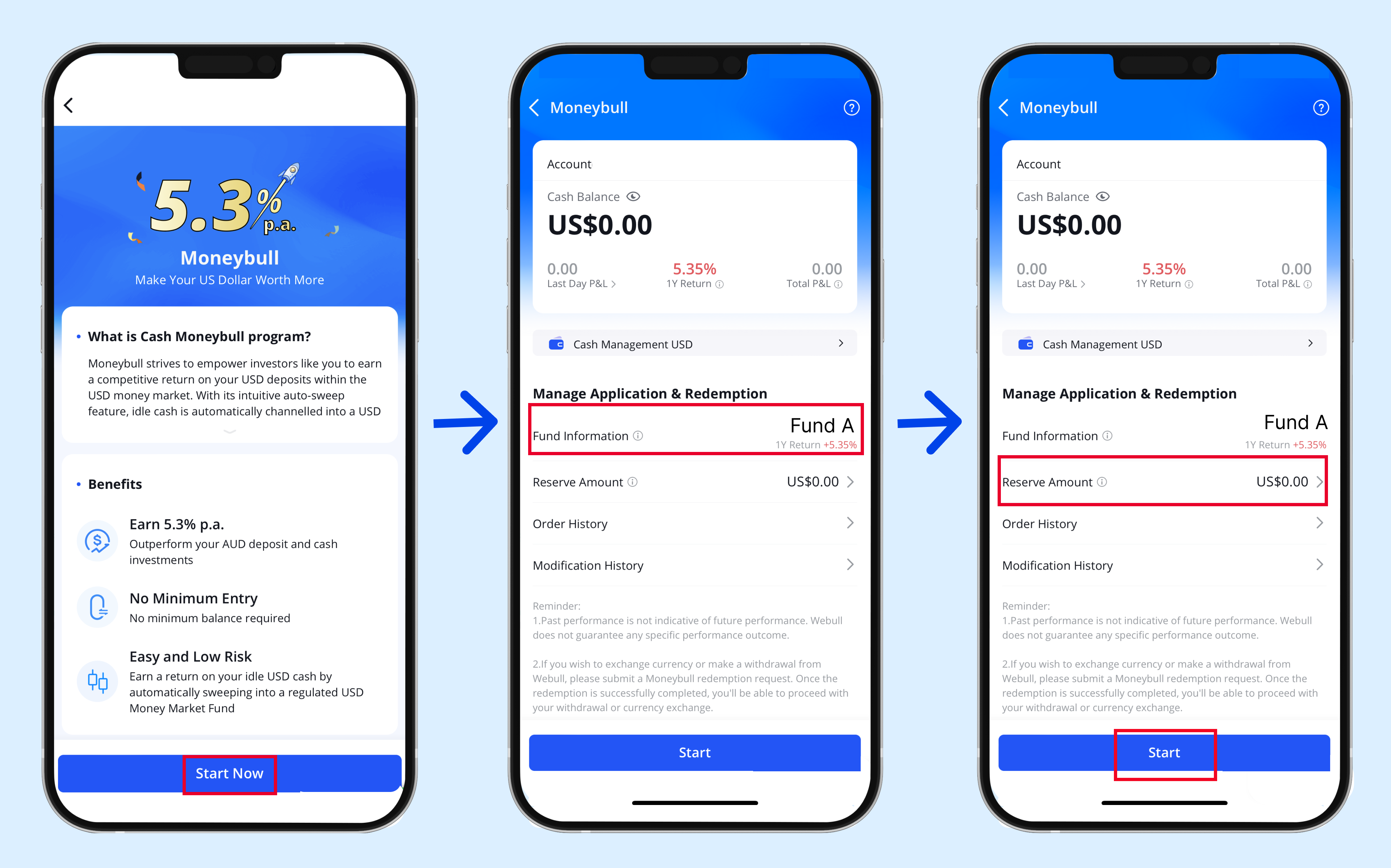

How to activate Cash Management?

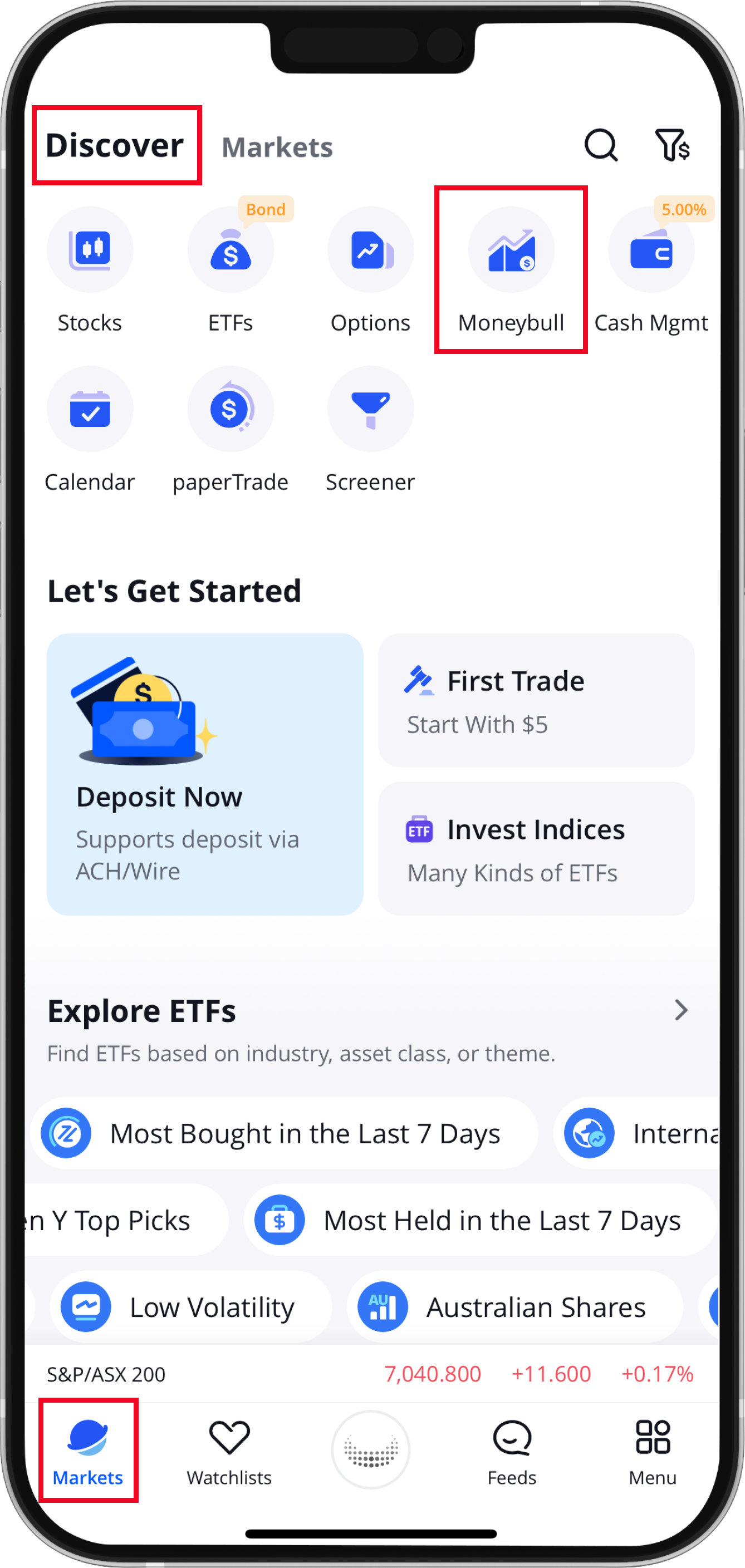

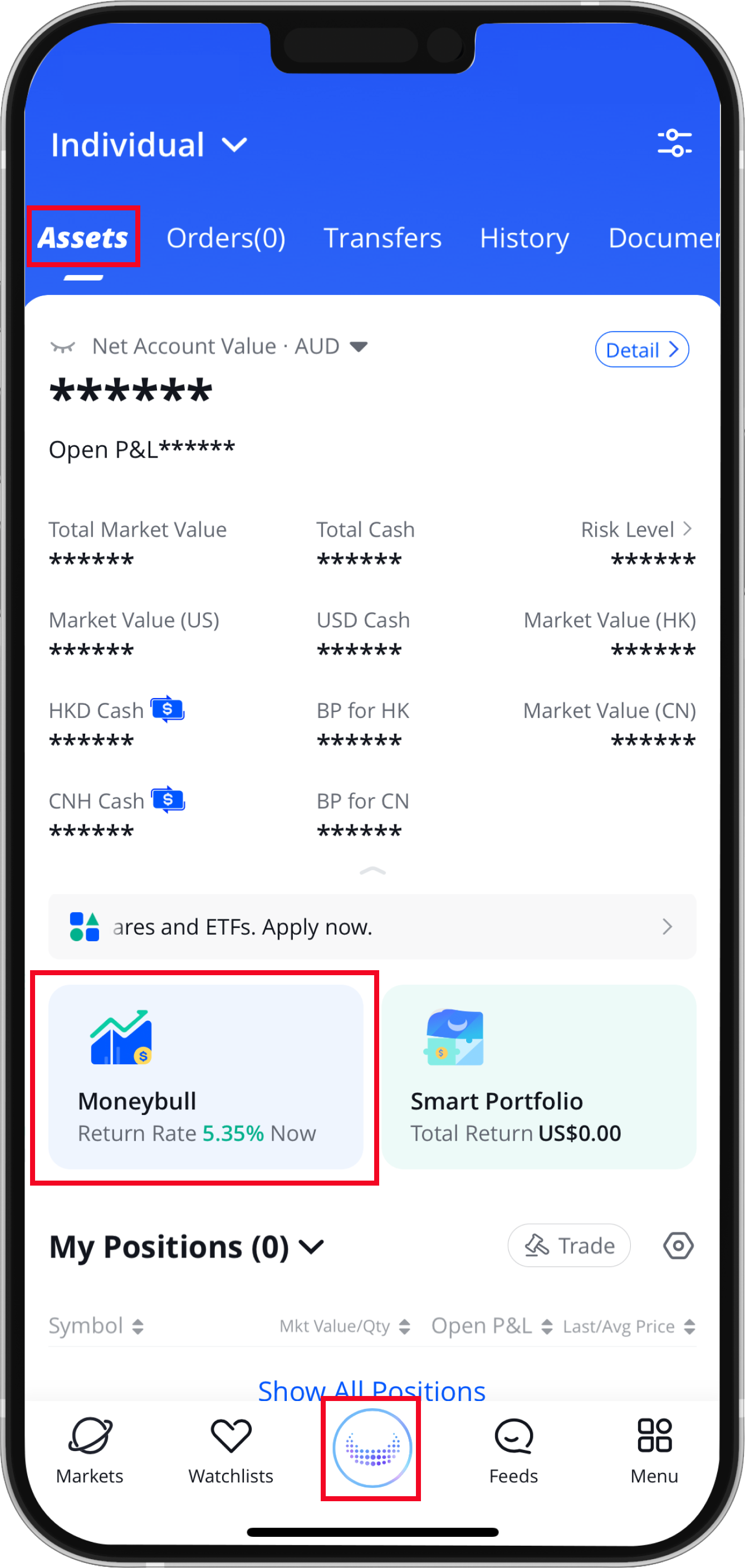

Step 1: Access the Cash Management Page in-app (there are 2 ways to do so)

Entrance 1. Update your Webull app to version 9.2.6 and head to Markets > Discover > Cash Management Icon

Entrance 2. Update your Webull app to version 9.2.6 and go to Account Page > Assets >Cash Management Banner

Step 1: Click ‘Start Now’ to access the introduction/detailed page of Cash Management.

Step 2: Set Reserve Amount.

*The reserve amount for your USD balance that does not participate in Auto-Sweep.

Step 3: Read Cash Management Product Information Statement and Cash Management Terms of Business, and confirm you understand the associated risks of Cash Management.

Step 4: Enter your trading password.

Step 5: Activate successfully.

*The figures shown are based on the 1-year return of the money market fund. Past performance is not indicative of future performance. Webull does not guarantee any specific performance outcome.