Investing with Sector ETFs

In addition to the role of investor, you likely have another profession as well. For example, if you’re a programmer, you must know something and care about technology development. No matter what your day job is, there’s a sector out there with an ETF you may be interested in. Why not try investing in a familiar sector ETF to get started?

Industry Selection

The greatest value of sector ETFs is that you can trade entire sectors as easily as individual stocks, allowing you to achieve low-cost, diversified sector portfolio investment.

- Select an industry that interests you

If you are interested in an industry, you might be more sensitive to industry disruptions. The more you understand the industry, the more informed you are before investing.

- Consider the economic situation before selecting

The international market is often in turmoil because of unexpected events, like Covid-19. For example, skilled investors are good at adjusting their investment portfolios under different market conditions. Therefore, you must consider the current market and economic situation before selecting an industry.

ETF Selection

- Know what kind of companies are included

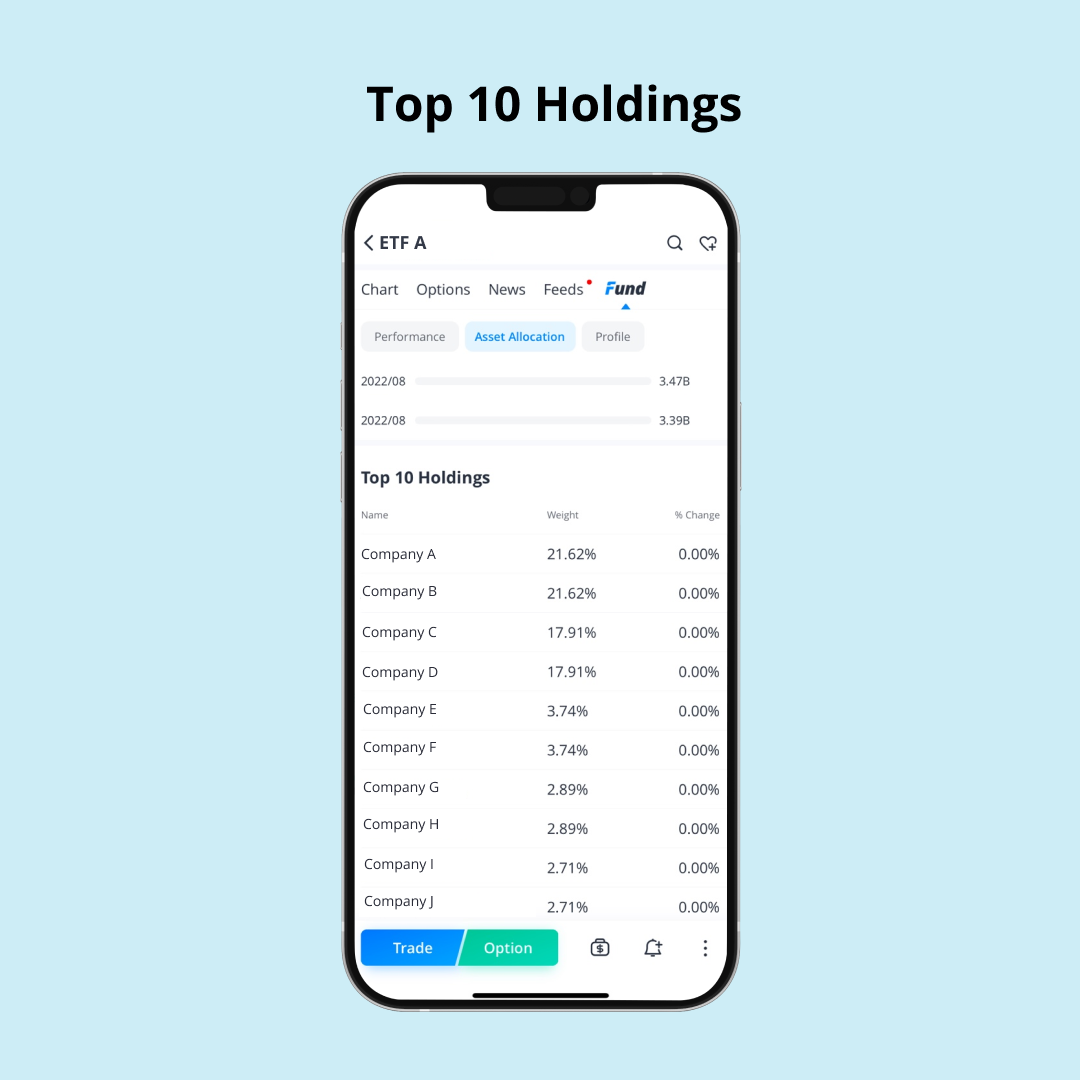

Top holdings

It is essential to understand the specific position of an ETF, and the Top 10 holdings list is a powerful tool for this purpose. For example, if you want to invest in a technology sector ETF, how do you know what companies are included?

The picture below shows the top holdings of an ETF A. With the help of the top holdings list, you can see the company allocation easily, which is crucial when selecting ETFs.

How Do You Get Started with Webull?

Webull offers a list that shows all available ETFs. Choose an industry that you want to trade. Filter the long/short ETFs out according to your expectations of the market.