Considering Inverse ETFs in a Bear Market

Inverse ETFs Can Be a Good Option in a Bear Market

Inverse ETFs, also called short ETFs, are exchange-traded funds designed to generate returns opposite of their underlying index. Investors who believe the markets will go lower might consider using inverse ETFs as a way to hedge risk.

Two examples of inverse ETFs:

*Inverse ETFs like SQQQ, which achieve multiples (-2X to -3X) of an index’s opposite return, are called leveraged Inverse ETFs.

Inverse ETFs and similar products are risky and may not be appropriate for all investors.

Pros and Cons of Inverse ETFs

Pros

- Less risk: Put options, shorting or inverse ETFs are common bearish strategies. The put options have a finite lifespan and can expire worthlessly. Inverse ETFs don't expire like put options. Shorting requires buying the stock back later, resulting in the potential for unlimited losses if the stock moves higher. Inverse ETFs’ maximum loss is the principal capital invested.

- Accessibility: All accounts support trading inverse ETFs, including retirement accounts. Unlike shorting, which is limited to margin accounts.

Cons

- Leverage risk: Leveraged inverse ETFs can magnify your losses exponentially when you miss your market predictions.

- Compounding risk: Inverse ETFs reset their leverage daily—there is a risk that leverage resets can significantly undercut returns in volatile markets in the long term, or even the principal could lose entirely. So, Inverse ETFs are meant to be short-term products.

- Higher fees: Inverse ETFs rebalance their portfolios on a daily basis typically, which results in higher fees and transaction costs versus traditional ETFs.

Traders cannot ignore the fact that there are risks associated with inverse ETFs and they do not suit everyone. Due diligence is required before investing.

What Can Be Achieved with Inverse ETFs

- Hedging against risk: Let’s say an investor is currently holding an ETF that matches long exposure of the S&P 500 and declines 1% on a given day. That investor may hedge their long exposure with a 1x inverse S&P ETF, which by design, might gain 1% as the S&P declines.

- Trading: Suppose that after looking at certain earning reports, you anticipate that the price of an index or sector will fall in the coming period and buy an inverse ETF. As the price of the corresponding index falls, the price of the inverse ETF should rise. At this time, you can sell the inverse ETF to take profits.

Factors to Help Identify Quality Inverse ETFs

- The expense ratio: The expense ratio is subtracted from the total return of the inverse ETF and paid to the fund manager. A lower expense ratio means lower costs.

- The liquidity: Inverse ETFs with higher liquidity tend to have more volume and smaller spreads, which can make it easier and cheaper for investors to trade them.

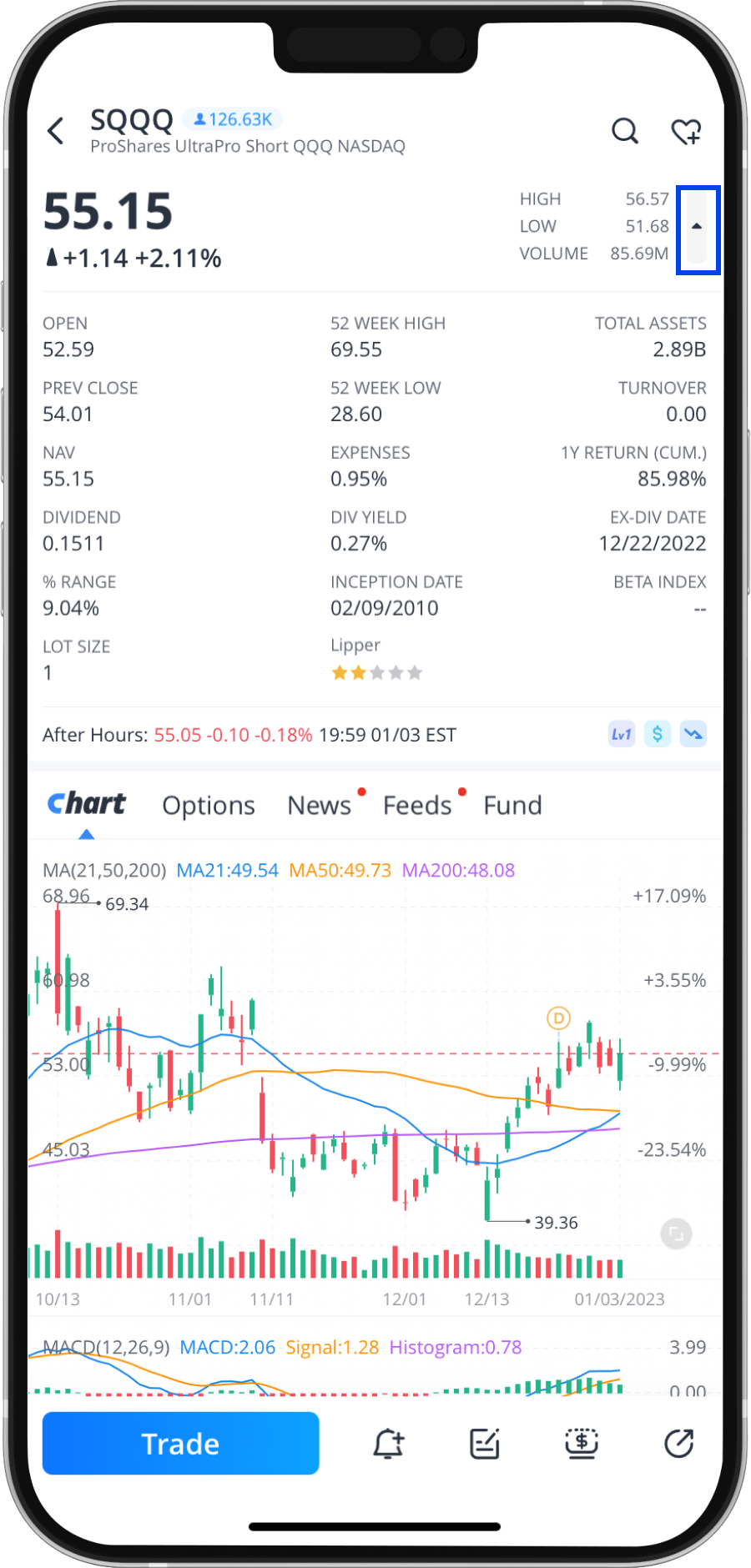

You can click on the triangle icon in the upper right corner of the individual symbol details page to view the key data for this inverse ETF. ↓

Disclaimer: All companies and symbols provided are for educational and informational purposes only and do not constitute an investment recommendation or advice.

How to Trade Inverse ETFs on Webull

You can trade inverse ETFs by hitting the buy button with any account. Refer to the GIF below for specific instructions.

- Go to the "ETFs Top Movers" list on Webull.

- Choose the index you want to trade.

- Select the short side to filter the inverse ETFs.

The Bottom Line

Investors who are confident in their predictions of a downturn and have a higher risk tolerance can consider using inverse ETFs to hedge against risk, and potentially profit. Leveraged inverse ETFs are riskier than regular inverse ETFs because the potential return and loss risk are both multiplied.

Disclaimer: ETFs are subject to similar risk to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. An ETF prospectus contains its investment objectives, risks, charges, expenses, and other important information, and should be read and carefully considered before investing. Inverse, leveraged, volatility-linked, and other types of ETFs are considered complex products and involve greater risk and typically have higher carrying costs. It is important that investors understand the unique characteristics and risks associated with these securities. These products may not be suitable for buy-and-hold investors. In general, these types of ETFs reset daily and are not designed to track the underlying index or benchmark over a longer period of time.